USDC supply falls to a 10-month low while FDIC head suggests more restrictions on stablecoin issuance

- The Acting Chair of the Federal Deposit Insurance Corporation (FDIC) calls for the limitation of stablecoin issuance to permissioned blockchains.

- The FDIC head also suggested a KYC for nodes and validators in order to ensure AML/CTF compliance.

- Over the last three and a half months, USDC’s supply has been reduced by $11.3 billion.

Since no regulations for crypto and other digital assets have been set in stone, every now and then, severalgovernment agencies have taken initiative to offer their suggestions. The latest in this list is the Acting Chair of FDIC, Martin Gruenberg, who had pointers concerning stablecoin issuance.

Stablecoins should be secured further

During a speech at the Brookings Institution on Thursday, Gruenberg shared his opinion on how stablecoin issuance can go about in the U.S. Since FDIC is a regulatory authority for the banks in the country, the agency suggested limiting stablecoin issuance. However, this rule wouldn’t be limited to a bank or other government-controlled organization but also to permissioned blockchains.

In his reasoning, Gruenberg stated,

“Payment stablecoins would be safer if they were transacted on permissioned ledger systems with a robust governance and compliance mechanisms.”

He believes that the governance should also expand to validators as well as nodes. This would allow the assurance of compliance with the anti-money laundering and counter-terrorism financing rules.

However, Gruenberg’s concern went back to the banks, as he said,

“We will continue to work with our supervised banks to ensure that any crypto-asset-related activities that they engage in are permissible banking activities that can be conducted in a safe and sound manner and in compliance with existing laws and regulations.”

What impact this could have on stablecoins is currently unknown since the landscape of the market has changed considerably.

USDC loses more ground

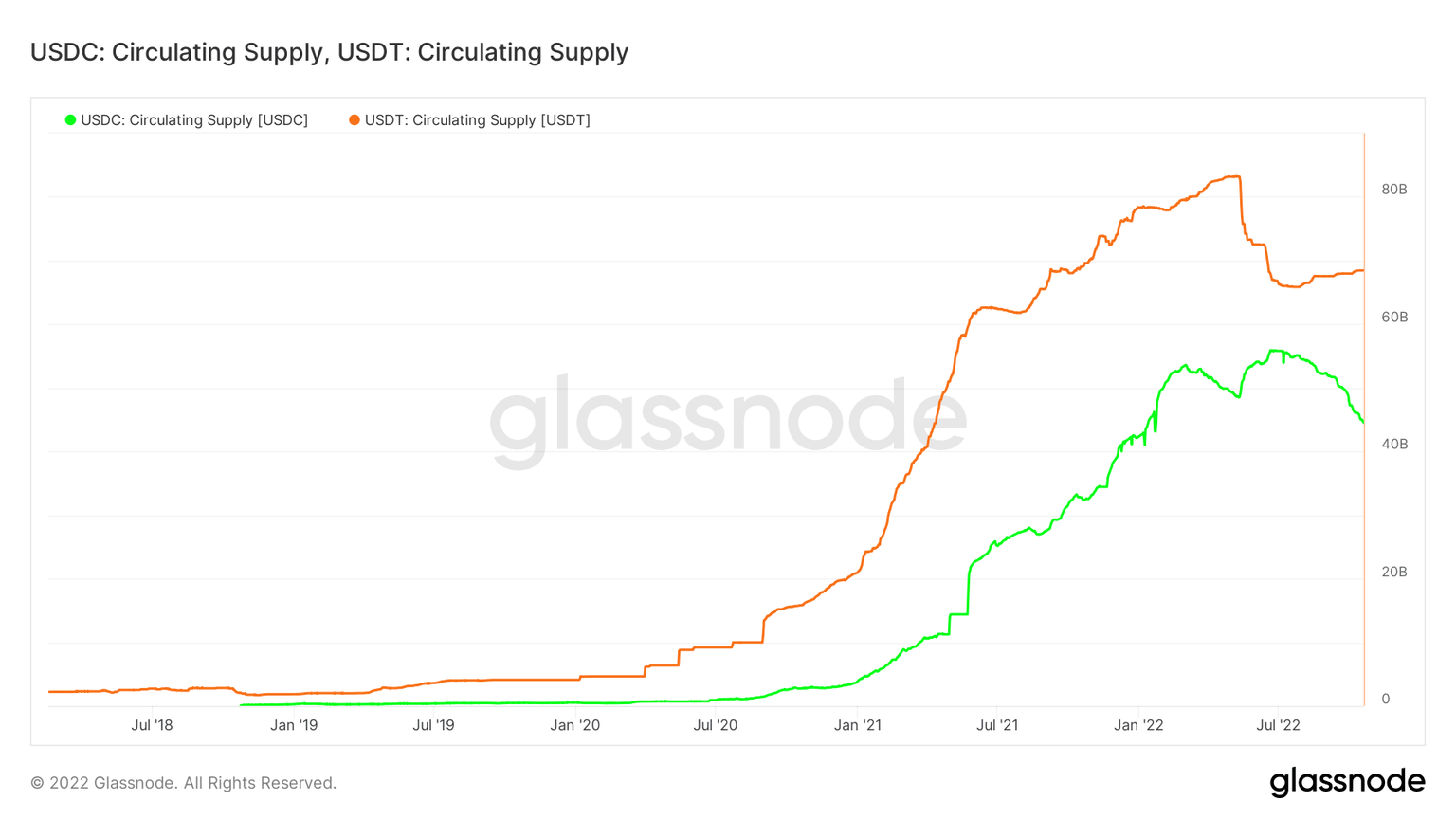

In the last couple of months, the stablecoin market has noted some severe fluctuations and continues to do so. The first instance was the sudden drop in Tether (USDT) supply and the spike in USD Coin (USDC) supply around May.

With the latter only standing $10 billion below the former, it seemed like, eventually, USDC might become the bigger stablecoin taking over USDT.

However, between July and October, USDC’s supply fell by $11.3 billion, whereas USDT’s noted mild changes, rising to $68.4 billion. With this shift in circulation, USDC and USDT’s difference increased by 140% to $24 billion, ensuring Tether’s persistence in the top spot.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.