Financial analysts say a growing number of retail investors are betting on Bitcoin (BTC) as a hedge against macroeconomic turbulence during the protracted United States-China trade war.

The London Economic reported the news on Aug. 29, citing data from eToro, a United Kingdom-based multi-asset investment platform and social network.

Correlated uptick in Bitcoin, gold positions

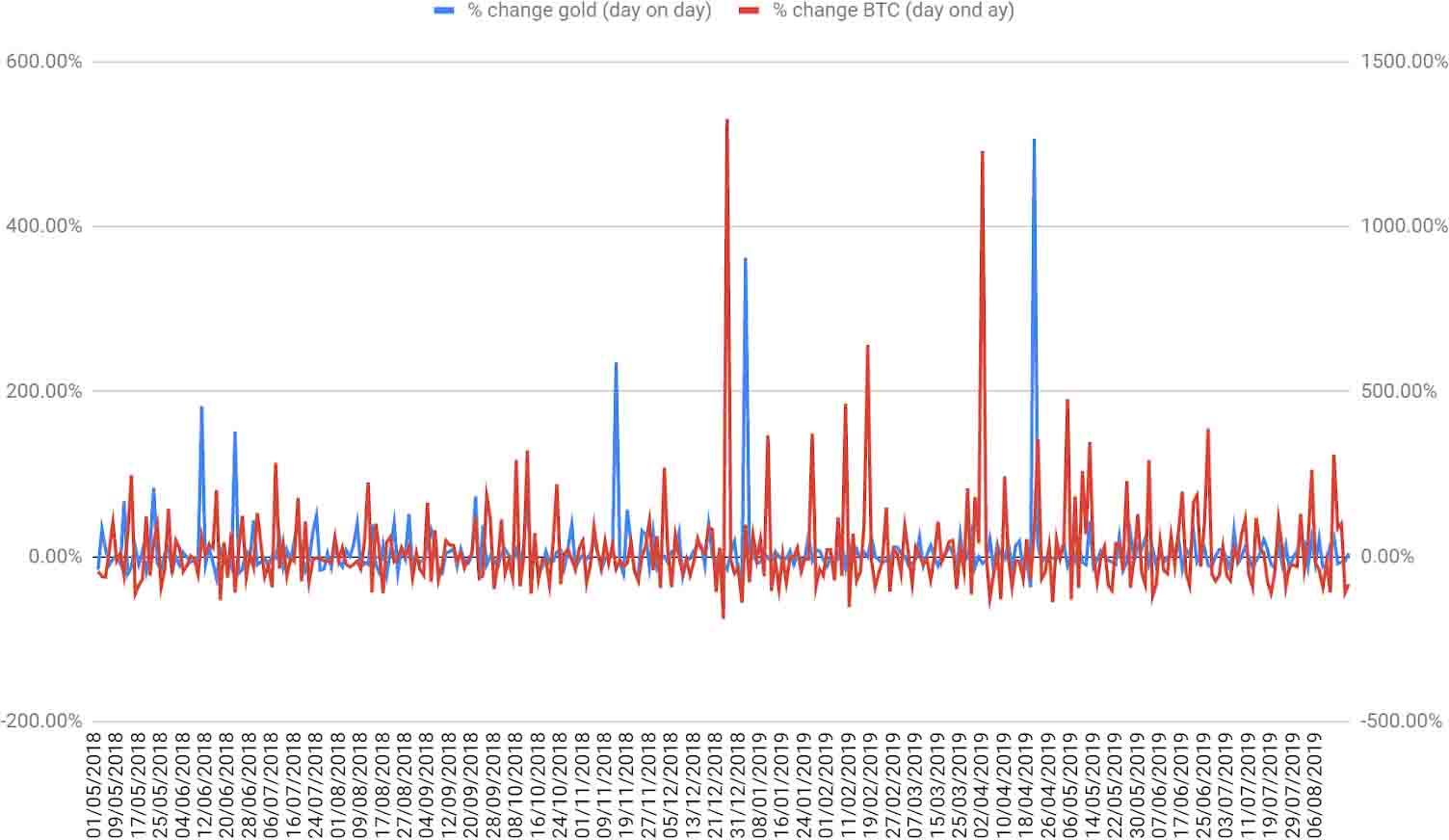

EToro’s data reveals a correlated uptick of positions in both Bitcoin and gold on its platform following news announcements of escalating trade tensions between the U.S. and China.

While gold has long been regarded as a safe haven asset during periods of macroeconomic or geopolitical instability, eToro’s data points to a growing perception among investors of Bitcoin as a form of “digital gold” and store of value in an uncertain global climate.

% change in daily gold and Bitcoin positions on eToro, Jan. 2018 - Aug. 2019. Source: eToro via The London Economic

EToro UK analyst Simon Peters has analyzed the data, noting that Bitcoin:

“Shares similar characteristics to gold in that there will only ever be a finite amount in existence (21 million), it’s decentralised, its price is not affected by inflation and it has the added benefit over gold of lower storage costs.”

Peters conceded that several factors still impede mainstream acceptance of Bitcoin as a sure-fire hedge, noting that its reputation continues to be marred by perceived price volatility, alleged market manipulation and the prevalence of hacks in the cryptocurrency sector.

World markets are reeling

EToro’s data corroborates a narrative that has been gaining increasing traction at a time when global financial markets are reeling from unpredictable — and arguably unprecedented — upheavals in the trade relationship between the two largest economies in the world.

Not only the Washington-Beijing showdown, but a host of political risks across the globe — from Hong Kong to the United Kingdom and the Middle East — are putting investors on a knife-edge. As one Japan-based trading adviser told a CNBC reporter earlier today:

“The talking point is still the U.S. yield curve inversion and whether the U.S. economy heads into a recession [...] In short, the atmosphere is not so good.”

Earlier this month, Cointelegraph reported on fresh data from Bloomberg revealing that the correlation between Bitcoin and gold had almost doubled in the past three months.

Recognition of Bitcoin as a non-sovereign and secure store of value in uncertain times has been voiced across the investment landscape; analysts are consistently citing macro factors — including central banks’ dovish policy turn — in relation to Bitcoin’s bullish trade volumes and price performance this year.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink social dominance surged to a six-month peak on Friday as LINK holders increased their activity. LINK traders started taking profits, on-chain data trackers show. LINK price added 6% on Friday, extending its gains from mid-week.

Binance helps Taiwan crack a virtual asset money laundering case, BNB sustains above $570

Binance’s Financial Crimes Compliance (FCC) department joined forces with Taiwan’s Ministry of Justice and helped resolve a case of money laundering worth NT$200 million, or $6.2 million.

Bitcoin Weekly Forecast: Is BTC out of the woods? Premium

Bitcoin price shows signs of continuing its uptrend, providing a buying opportunity between $64,580 to $63,095. On-chain metrics forecast a bullish outlook for BTC ahead. If BTC clears $70,000, the chances of resuming the uptrend would skyrocket.

XRP trades steady at $0.50 as Ripple shares plan to expand services in Africa

Ripple hovers close to $0.51 on Friday, above the psychologically important $0.50 level, as traders await the court ruling of the lawsuit against the US Securities and Exchange Commission and amid new commitments from the firm to expand its services in Africa.

Bitcoin: Is BTC out of the woods? Premium

Bitcoin (BTC) price action in the past two days has confirmed the resumption of the bull run. However, BTC needs to clear a few key hurdles before investors can go all-in.