Uniswap Price Prediction: UNI bulls hold trenches to defend rally, but is 17% gain inevitable?

- Uniswap price sees bulls defending key levels this week in a make-or-break moment.

- UNI could break through the important trend line.

- Medium-term Uniswap price could slide 17% lower before crucial support comes to its rescue.

Uniswap (UNI) is showing signs of fatigue over a longer and broader term. Overall, cryptocurrencies are taking a step back, and unfortunately alt-currencies are even outpacing cryptocurrencies in that same decline. The decline comes at a very bad moment as price action resides at a crucial point that could confirm the future of the rally for 2023.

Uniswap price sees traders having issues with current conditions

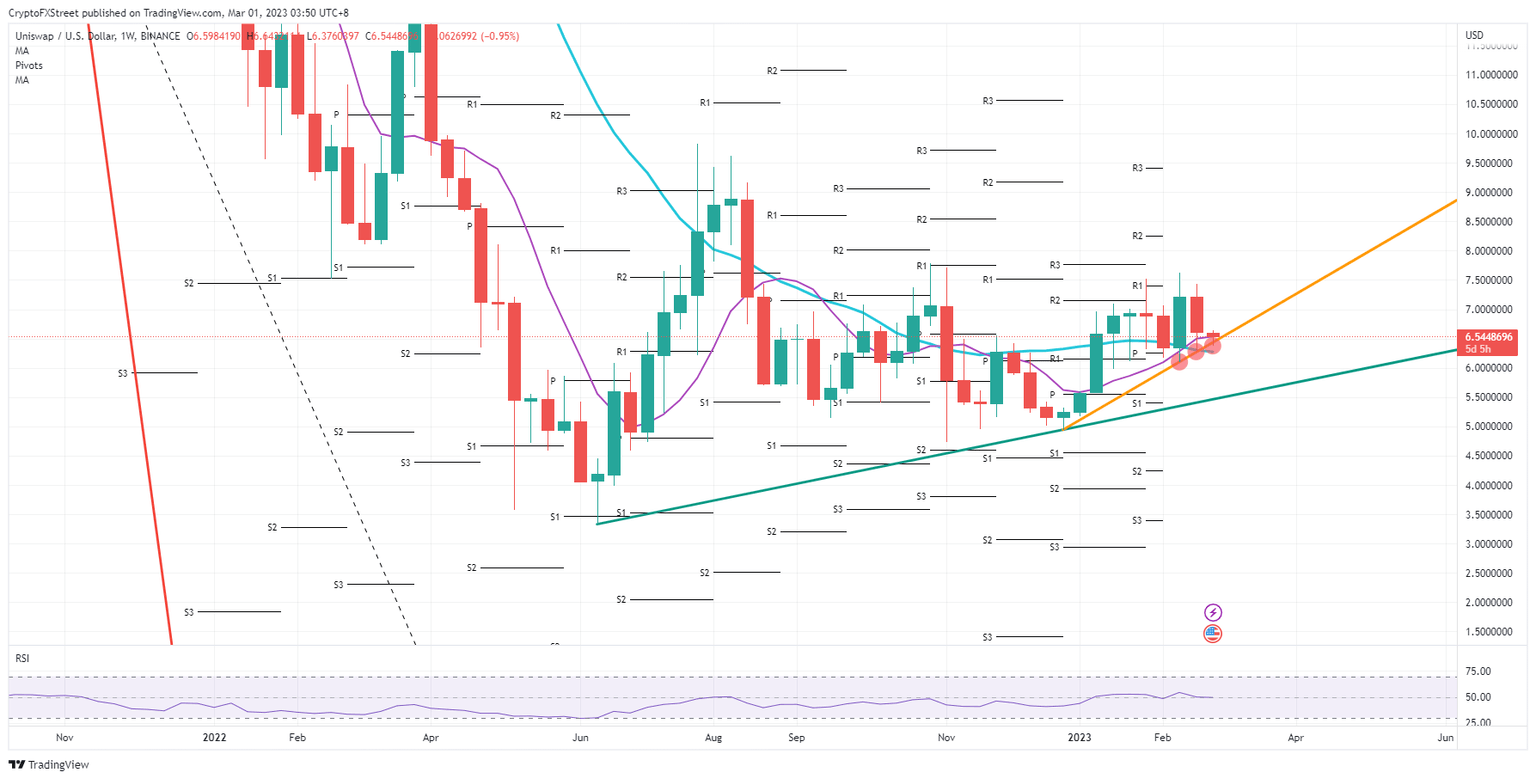

Uniswap price is having an identity crisis as the first big challenge for 2023 is taking place this week as March begins. UNI resides near $6.50 and is flirting with a break of the 55-day and the 200-day Simple Moving Averages (SMAs). Additionally at risk, the orange ascending trend line is up for grabs for either a bounce or a breakthrough lower.

UNI bulls are flipping a coin and will be determining if they want to stay, add or reduce their position in Uniswap. Traders need to remember that if the orange ascending trend line breaks, the formation of the Golden Cross could be aborted prematurely. Not only will there be a 17% decline nearby, but in the longer term the rally could get fully unwound in case the lower green ascending trendline breaks.

UNI/USD weekly chart

Investors could choose to sit this decline out and simply keep or even add to their positions. With the Relative Strength Index (RSI) not tanking lower, it appears that the move is not driven by bulls selling off. Expect a bounce with price action quickly trading higher to back up near $7.50.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.