Bitcoin Price Forecast: BTC retreats as $90,000 rejection, ETF outflows weigh on sentiment

- Bitcoin continues to trade lower on Tuesday after failing to break the key $90,000 resistance level the previous day.

- US-listed spot ETFs record an outflow of $142.90 on Monday, while Strategy Inc. boosts its cash reserves to $2.19 billion.

- Ghana’s parliament approves bill to legalize cryptocurrency, addressing concerns about the rapid, unregulated adoption of digital assets.

Bitcoin (BTC) continues to trade under pressure, slipping below $87,500 at the time of writing on Tuesday after failing to reclaim a key psychological level. Institutional demand continues to weaken, as spot Bitcoin Exchange Traded Funds (ETFs) recorded an outflow of over $142 million on Monday. At the same time, Strategy’s (MSTR) growing cash pile suggests a more defensive stance. Regulatory developments, such as Ghana’s move to legalize cryptocurrency, add a longer-term structural positive for the largest cryptocurrency by market capitalization.

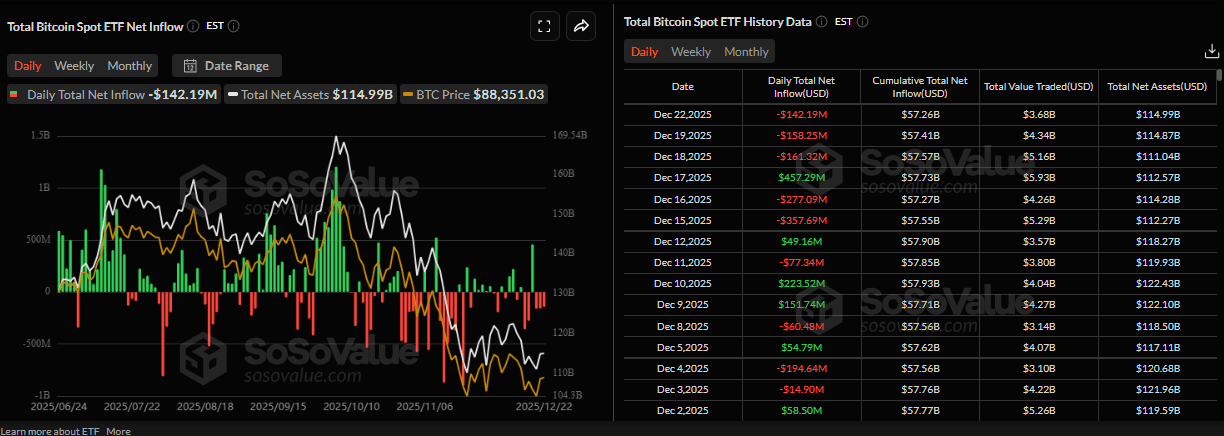

Spot ETFs’ outflow weighs on the Bitcoin price

Institutional demand started the week on a negative note. SoSoValue data show that Spot Bitcoin ETFs recorded an outflow of $142.19 million on Monday, marking the third consecutive day of withdrawals since December 18. If these outflows continue and intensify, the Bitcoin price could see further correction.

On the corporate side, Michael Saylor’s Strategy Inc. announced on Monday that it has increased its USD Reserve by $748 million, bringing the total to $2.19 billion. This move signals a more defensive stance after recent Bitcoin purchases and amid a roughly 30% decline from October’s all-time high. The company currently holds 671,269 BTC valued at $60 billion.

Regulatory developments

Ghana’s parliament passed the Virtual Asset Service Providers Bill on Monday, which formally legalizes and regulates the use of cryptocurrencies in the country, Bloomberg reports.

The new law authorizes the Bank of Ghana to license and supervise crypto platforms and their activities, Bank of Ghana Governor Johnson Asiama said at the weekend in the capital, Accra.

The regulatory developments are bullish for cryptocurrency in the long term, as they aim to improve transparency and address concerns about the rapid, largely unregulated adoption of digital assets, estimated to involve around 3 million Ghanaians, or 17% of the adult population.

Thinning liquidity across crypto markets

QCP Capital’s Tuesday report highlighted that liquidity is thinning meaningfully as traders close out positions ahead of the holidays.

Meanwhile, BTC perpetual open interest across major exchanges fell by approximately $3 billion overnight, a reminder that risk is being taken off rather than redeployed.

The analyst concluded, “Historically, BTC has tended to experience 5 to 7% swings during the Christmas period, a pattern often linked to year-end option expirations rather than fresh fundamental catalysts. This Friday’s record expiry is no exception. Roughly 300,000 BTC option contracts, equivalent to $23.7 billion, alongside 446,000 IBIT option contracts, are set to expire.”

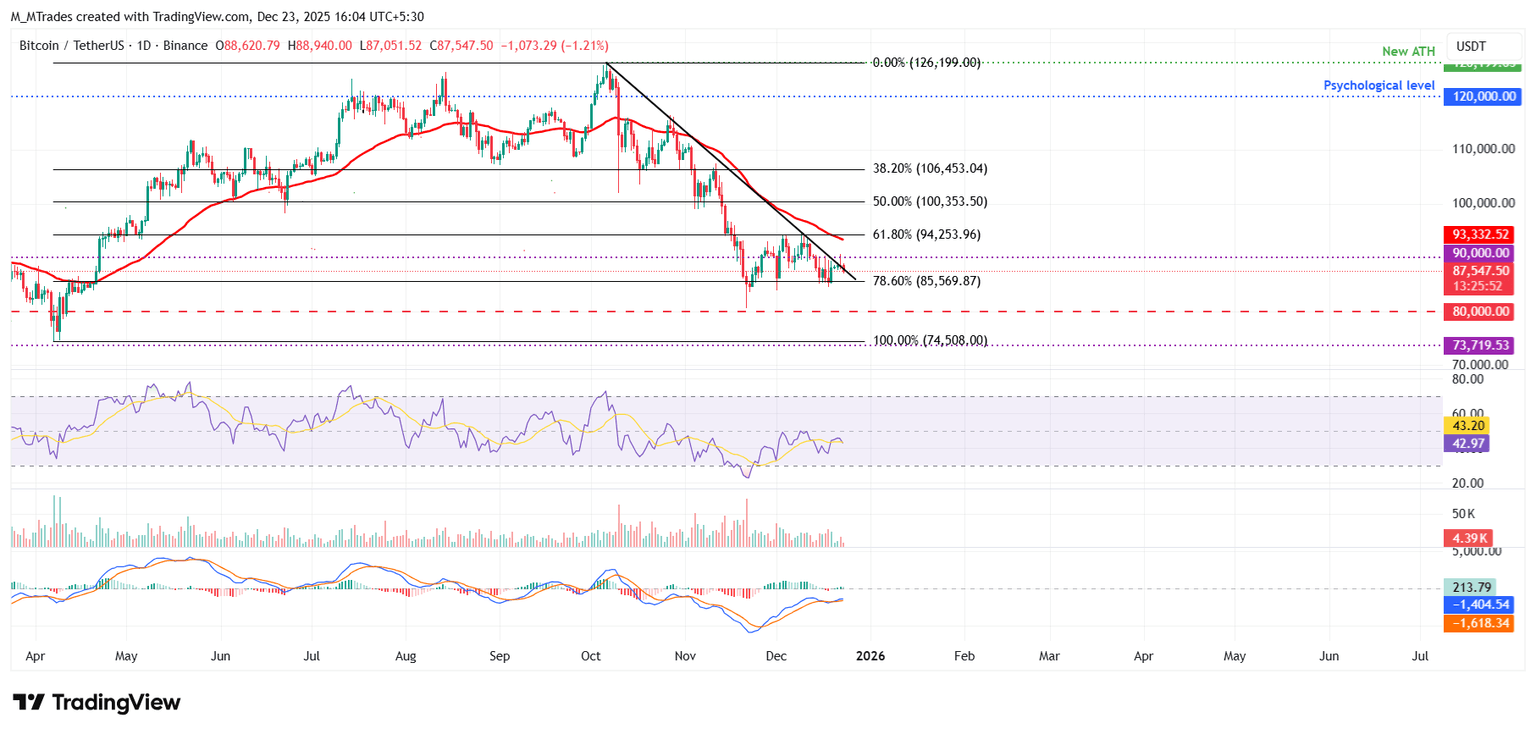

Bitcoin Price Forecast: BTC fails to close above the $90,000 mark

Bitcoin price was retested and found support at the 78.60% Fibonacci retracement level at $85,869 on Thursday, and it recovered 3.67% over the next three days. However, on Monday, BTC declined slightly, failing to close above the $90,000 psychological level. As of Tuesday, BTC trades at around $87,500.

If BTC closes above the $90,000, it could extend the recovery toward the next resistance at $94,253.

The Relative Strength Index (RSI) is 42, near the neutral 50 level, suggesting early signs of fading bearish momentum. For the bullish momentum to be sustained, the RSI must move above the neutral level. Moreover, the Moving Average Convergence Divergence (MACD) indicator showed a bullish crossover on Saturday, further supporting the recovery thesis.

On the other hand, if BTC continues its correction, it could extend the decline toward the key support at $85,569.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.