Cryptocurrencies Price Prediction: Bitcoin, Uniswap and Dogecoin – European Wrap 16 February

Bitcoin price rally fails to turn derivatives traders bullish, here’s what to expect

Uniswap price provides a buying opportunity for UNI bulls before exponential break out towards $10

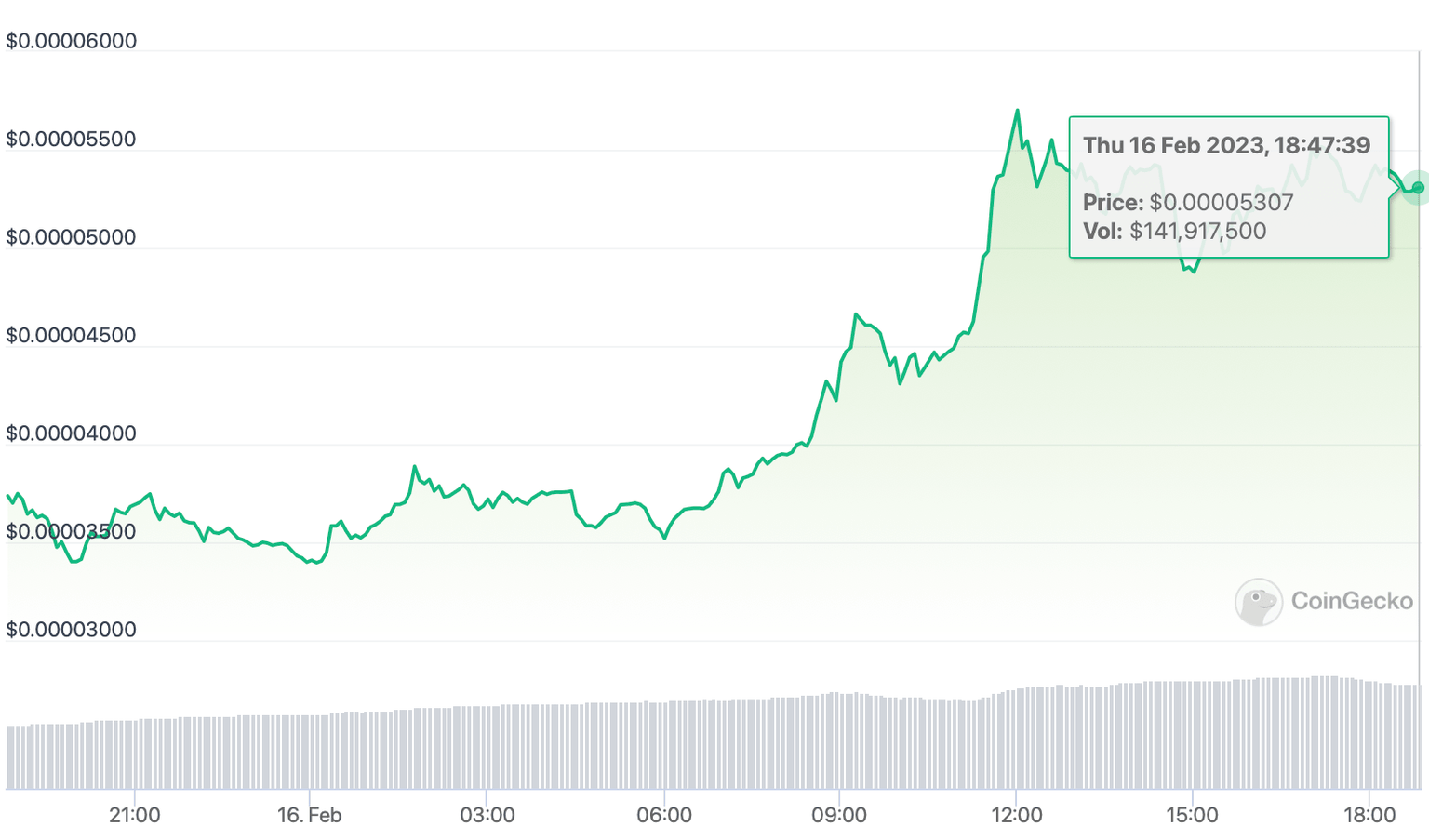

Uniswap (UNI) price has witnessed a staggering move to the upside after Tuesday's US Consumer Price Index (CPI) numbers. With a further decline in inflation, markets are focusing on a full recovery story as other countries are also reporting lower inflation numbers. Although inflation remains elevated globally, the consecutive decline points to hopes that market conditions will soon return to normal.

Dogecoin and Shiba Inu lead the wave of meme coin price rallies, here’s what to expect

Shiba-Inu-themed meme coins are leading a recovery rally in crypto. The two largest meme coins Dogecoin and Shiba Inu recovered from their recent price drops. This is not the first time Musk’s comments have triggered price rallies in meme coins.

Author

FXStreet Team

FXStreet