Uniswap price aims for a significant bounce to $33 with no resistance ahead

- Uniswap price is right above a key support level on the 4-hour chart.

- Several metrics show that UNI faces barely any resistance above $30.

- The TD Sequential indicator is on the verge of presenting a buy signal for Uniswap.

Uniswap has been trading above a key support level at around $30 on the 4-hour chart since March 7. Another successful defense of this critical point and UNI could quickly see a massive rebound as it faces almost no resistance ahead.

Uniswap price must hold above this level to see a nice bounce

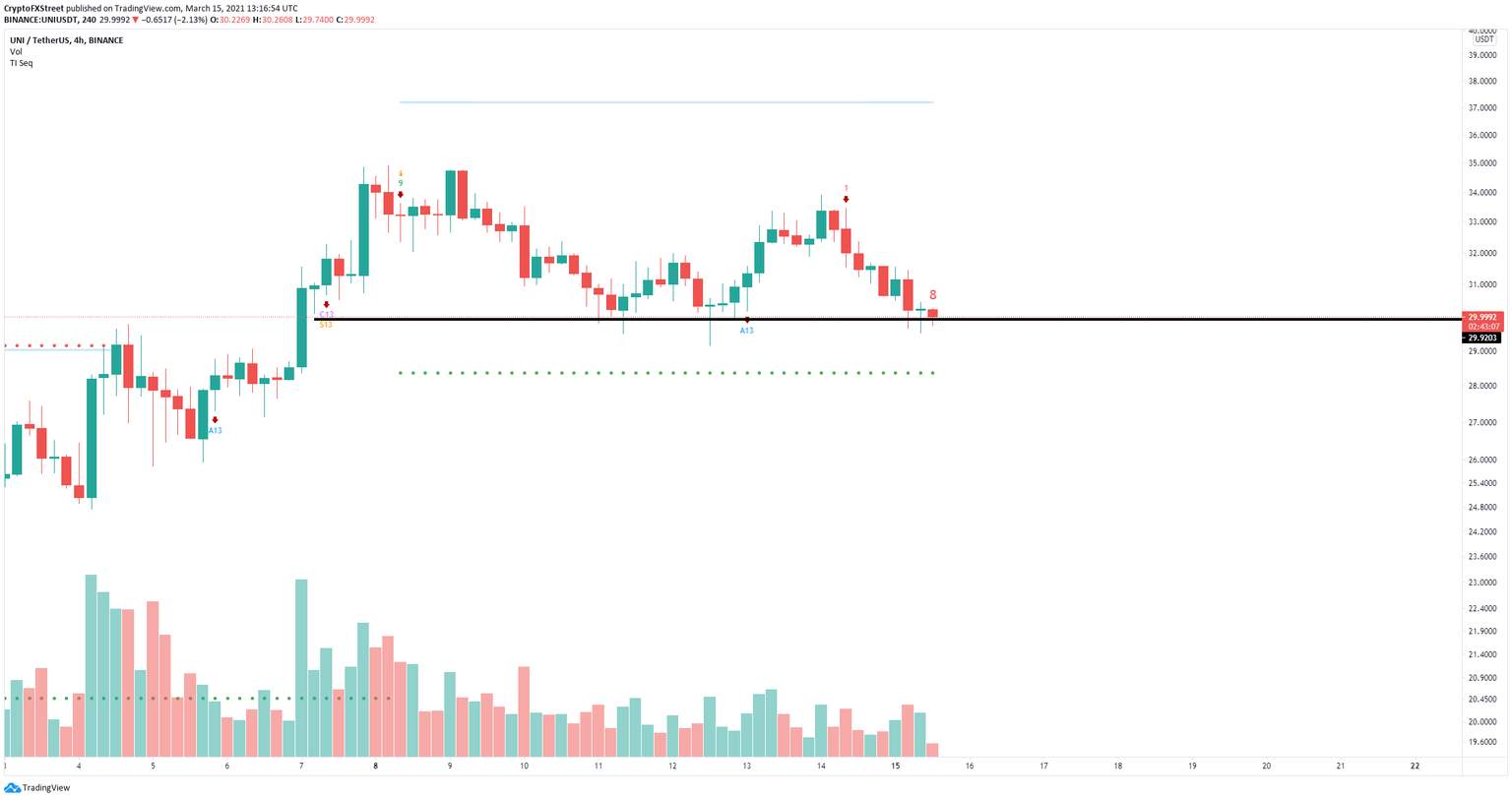

On the 4-hour chart, Uniswap has created a robust support trendline at $30 which has held the price several times in the past week. Additionally, the TD Sequential indicator has just presented a red ‘8’ candlestick which is usually followed by a buy signal.

UNI/USD 4-hour chart

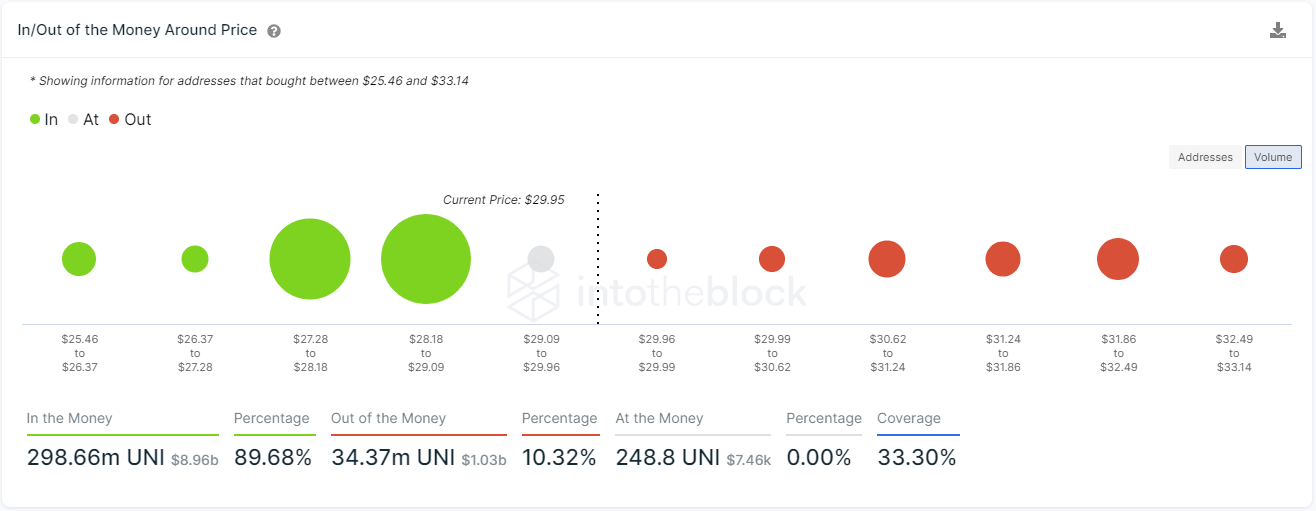

Another successful defense of the key support level should push Uniswap price towards the last high at around $34. The In/Out of the Money Around Price (IOMAP) chart also indicates that UNI bulls face low resistance ahead.

UNI IOMAP chart

The most significant resistance area is located between $31.8 and $32.4 where Uniswap price could pause briefly before resuming its bounce towards $34. Additionally, it seems that large holders have been accumulating a lot of UNI tokens in the past week.

UNI Holders Distribution chart

Since March 10, the number of holders with 10,000 to 100,000 UNI increased by 56. Similarly, the number of whales with 100,000 to 1,000,000 coins increased by 10. This adds even more credence to the bullish outlook.

To invalidate the upcoming rebound, bears will need to push Uniswap price below $30, with a 4-hour candlestick close. However, the IOMAP chart still shows a lot of support between $29 and $27.2 which means bears could push Uniswap down to $27.2 with a breakdown below $30 but probably not further.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B14.18.16%2C%252015%2520Mar%2C%25202021%5D-637514118084236146.png&w=1536&q=95)