Tron network revenue exceeds Bitcoin, Ethereum and Solana in Q3

- Tron’s total revenue for Q3 is $577 million, the highest since the protocol’s inception.

- Token terminal data shows TRX generated $567 million in fees, outpacing other blockchains.

- Tron has performed better than Bitcoin and Ethereum in daily active addresses, daily transactions, stablecoin transfer volume, and DEX trading volume.

The Tron network (TRX) generated the highest revenue in the third quarter since its inception, outperforming leading cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

Tron posts highest quarterly revenue ever

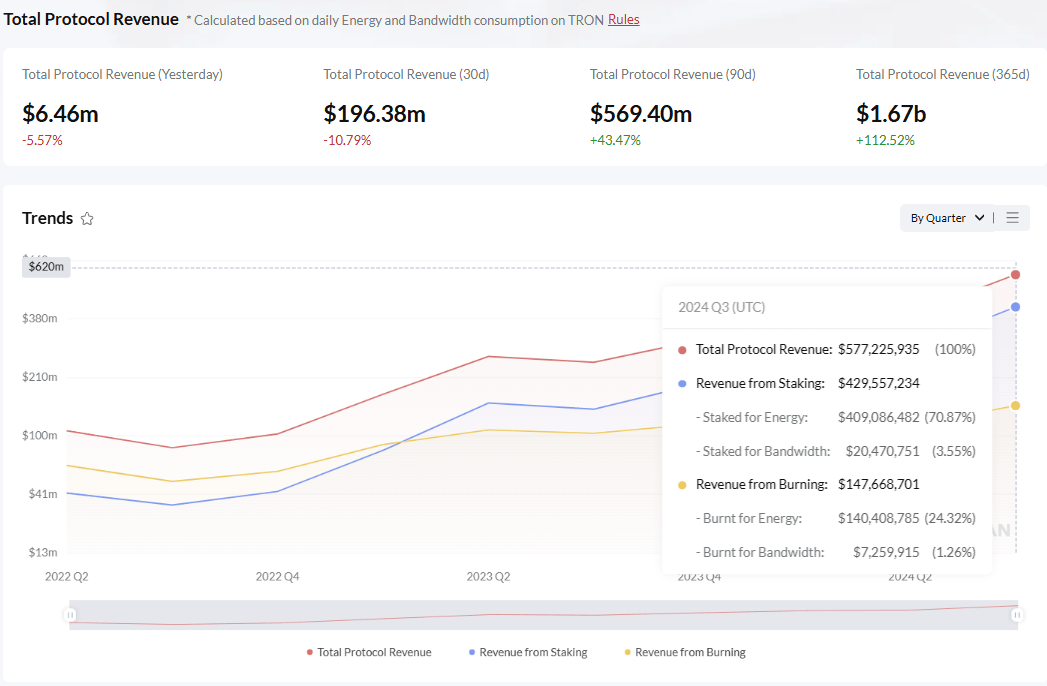

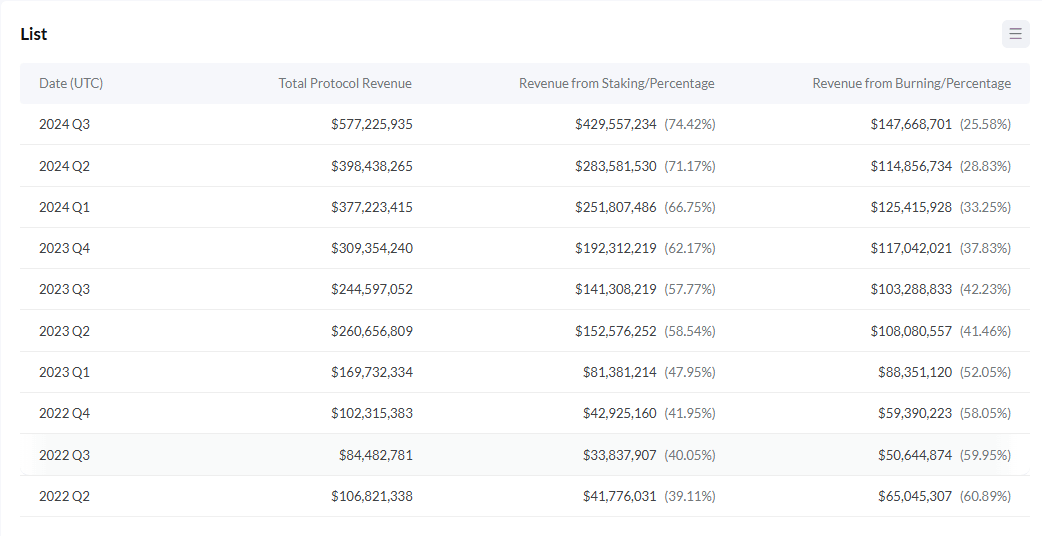

TronScan data shows that Tron generated a total revenue of $577.25 million in the third quarter, the highest since the protocol’s inception. This represents a 43% increase compared to Q2.

The 74% of the revenue was derived from staking, while the remaining 26% came from burn mechanisms. The success of TRON’s memecoin platform, Sun pump meme, has also contributed to this performance, adding $8.4 million since its launch.

Growth in revenue and fees has also been attributed primarily to the booming activity in stablecoins, with TRON now commanding over 34% of the stablecoin market, which amounts to $60 billion, according to DefiLlama.

Justin Sun, the founder of TRON, tweeted, “We are confident that Q4 will see even more growth compared to Q3!”

Tron Revenue chart

Quarterly revenue chart

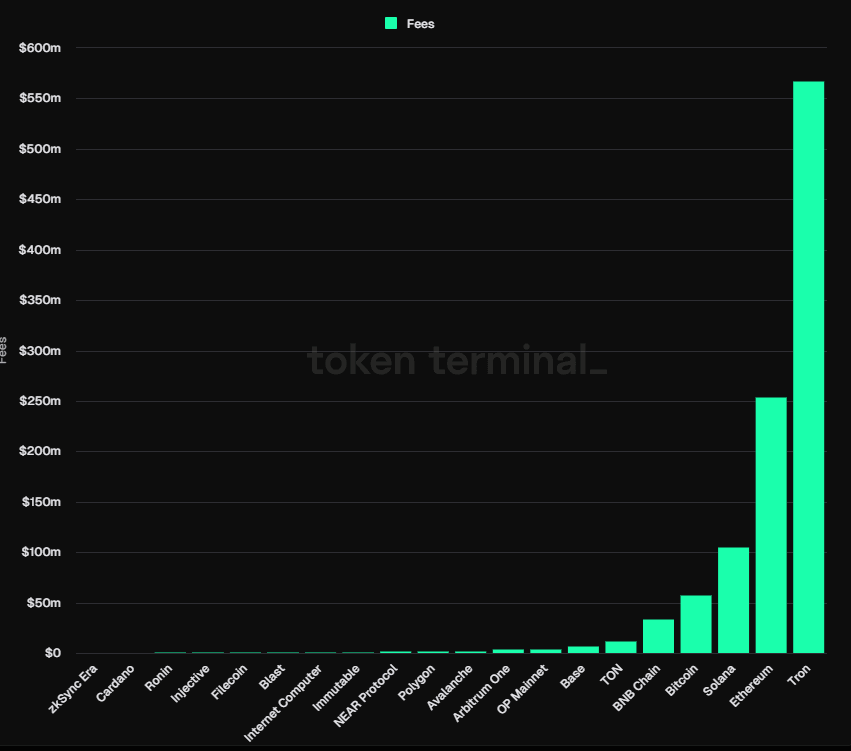

Crypto aggregator platform Token Terminal data shows that Tron’s fee generation over the past three months outpaced other blockchains. During this period, Tron generated $567 million in fees, more than double than Ethereum ($253 million), five times morex more than Solana ($105 million) and 9x more than Bitcoin ($57 million), suggesting that Tron’s blockchain gains more traction than other blockchains.

Fee chart

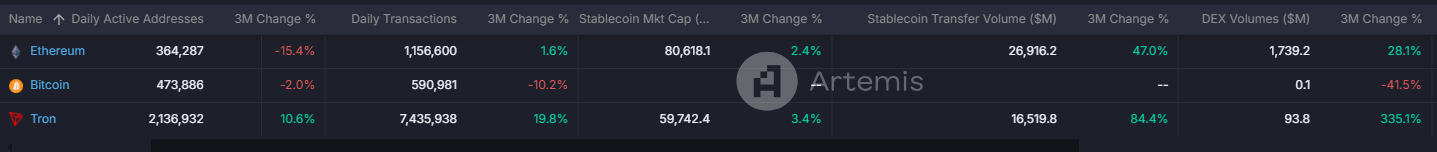

Comparing Tron’s on-chain metrics with those of Bitcoin and Ethereum over the last three months shows that Tron outperforms in daily active addresses, daily transactions, stablecoin transfer volume, and DEX trading volume.

Comparison chart

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.