- Tron could be seen following the bearish trend as it fell back down to $0.058 after recovering to $0.071.

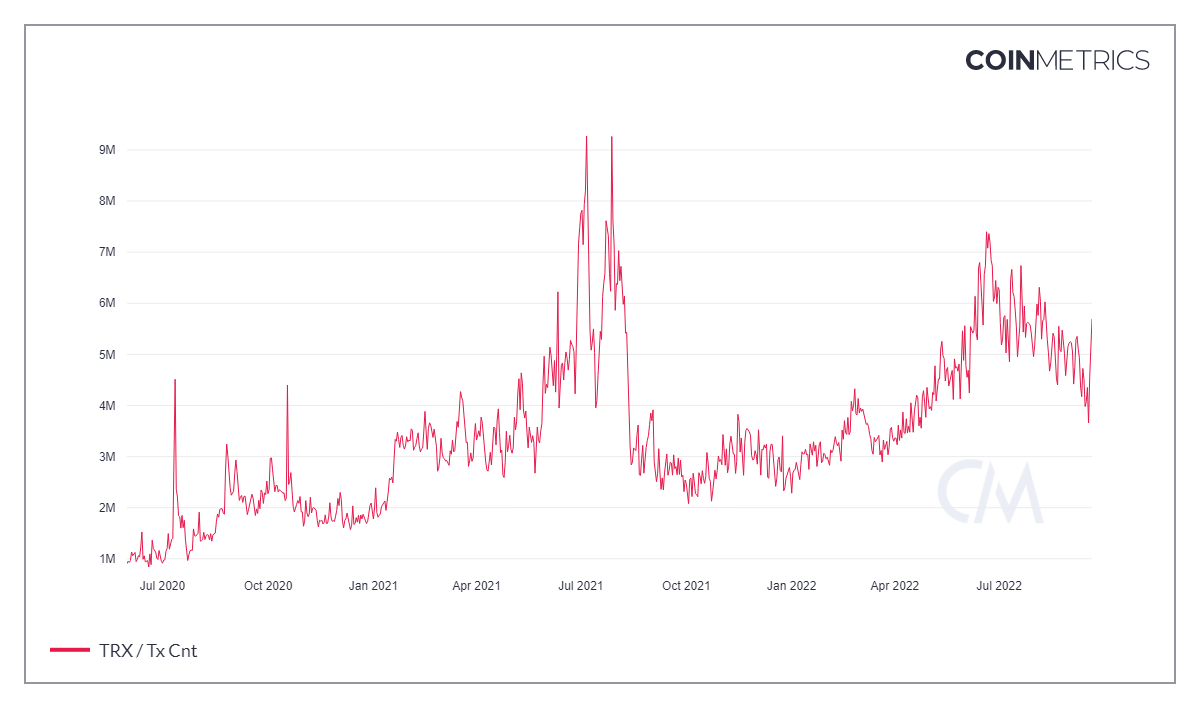

- This week noted that the overall transactions recorded on-chain increased from 3.65 million to 5.69 million.

- The lack of buying pressure in the market is keeping Tron from flipping the broader market trend.

The Justin Sun cryptocurrency can be seen adhering to the bearishness persisting in the market generated due to the recent crashes. Tron investors, however, do not seem to be pulling away from the crypto network, as their recent behavior points to them taking a more bullish stance.

Tron investors bump it up

On-chain data shows that, over the last week, the entire crypto market and international markets were holding back, anticipating a 0.75% interest rate hike from the Fed. However, it did not affect Tron investors as they continued making their presence felt in the space. Within this week, their average daily transactions shot up from 3.65 million to 5.69 million.

Tron daily transactions

But a similar growth was not observed on the charts since TRX fell to a three-month low after failing to breach a 17-month-old downtrend that has been in place since April 2021. However, the price drawdown has not been as significant, with TRX only falling by 16% in the span of a month.

Tron can turn this around once buying pressure returns to the market. As observed on the Relative Strength Index (RSI), selling pressure has not dissipated despite the increased activity, which is why the recovery has been difficult on the charts.

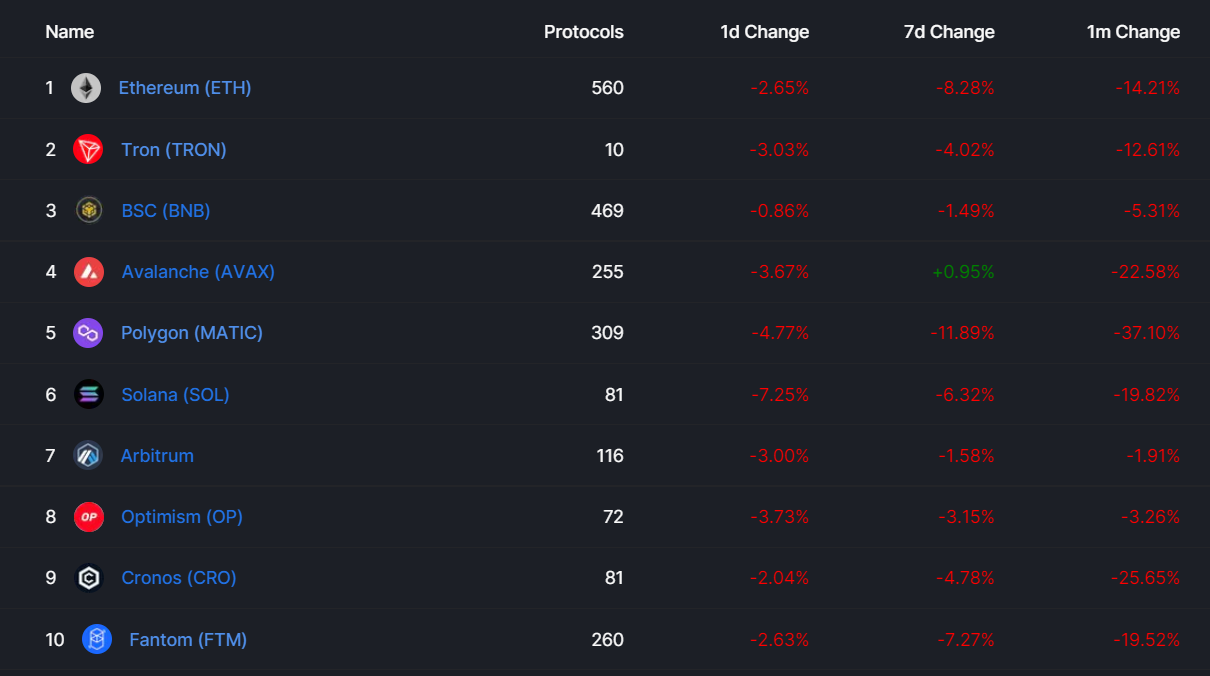

Backup from the DeFi market

Even though on the spot front, TRX’s performance has not been outstanding, it still is the second biggest DeFi network in the world. In comparison to the rest of the top 10 DeFi chains, Tron has been one of the better performers. It lost only 12% of its TVL over the month, while the likes of Polygon fell by 35%.

DeFi chains’ TVL

If that bullishness can be channeled into the spot market as well, Tron might have a shot going forward in breaching the long-standing downtrend.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto traders brace for short-term volatility with $2.4 billion options expiry on Friday

Bitcoin and Ethereum options market looks bullish on Friday, according to data from intelligence tracker Greeks.live. The firm said it has identified two Bitcoin calls that show an underlying bullish sentiment among market participants.

XRP recovers from week-long decline following Ripple’s response to SEC motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

Lido adds 4% gains as protocol rolls out first step towards decentralization

Lido takes the first batch of simple DVT validators to live, a step taken to decentralize the protocol. Lido leveraged technology to expand the protocol to multiple node operators, inviting both solo and community stakers.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Bitcoin: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.