Trending altcoins: Hedera, VeChain and Algorand extend rally by posting double-digit gains

- Hedera, VeChain and Algorand extend gains by more than 10% on Tuesday after surging last week.

- HBAR, VET and ALGO hover around key levels, signaling the possibility of further gains ahead.

- The RSI is well within overbought levels for these three altcoins, increasing the odds of a corrective pullback.

Three trending altcoins – Hedera (HBAR), VeChain (VET), and Algorand (ALGO) – post double-digit gains on Tuesday after surging last week, benefiting from the recent consolidation of Bitcoin prices. Historically, altcoins outperform whenever Bitcoin takes a breather after a significant rally as profits rotate into smaller-cap coins, which can be seen in the recent surge in these altcoins. The technical outlook suggests that the bulls still have steam to push these three meme coins for extra double-digit gains, although momentum indicators are in overbought levels.

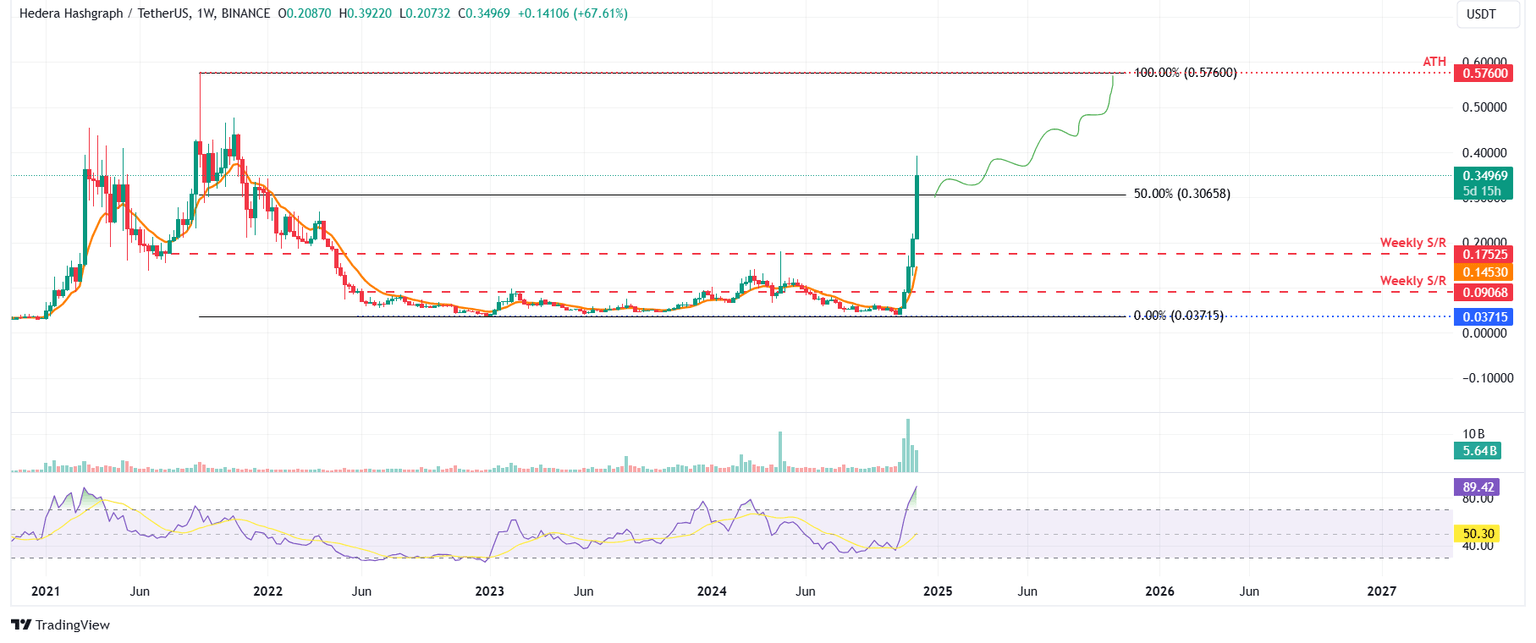

Hedera bulls aim for all-time high of $0.57

Hedera price more than tripled in November. As of the start of this week, it has extended its gains by more than 67% until Tuesday, trading around $0.349.

If HBAR continues its upward momentum, it could rally to retest its all-time high (ATH) at $0.576, seen in November 2022.

The weekly chart’s Relative Strength Index (RSI) stands at 89, trading above its overbought level of 70. Traders should be cautious because the chances of a price pullback are increasing. Still, the RSI is still pointing upwards, so there is the possibility that the rally continues and the indicator remains above the overbought level.

HBAR/USDT weekly chart

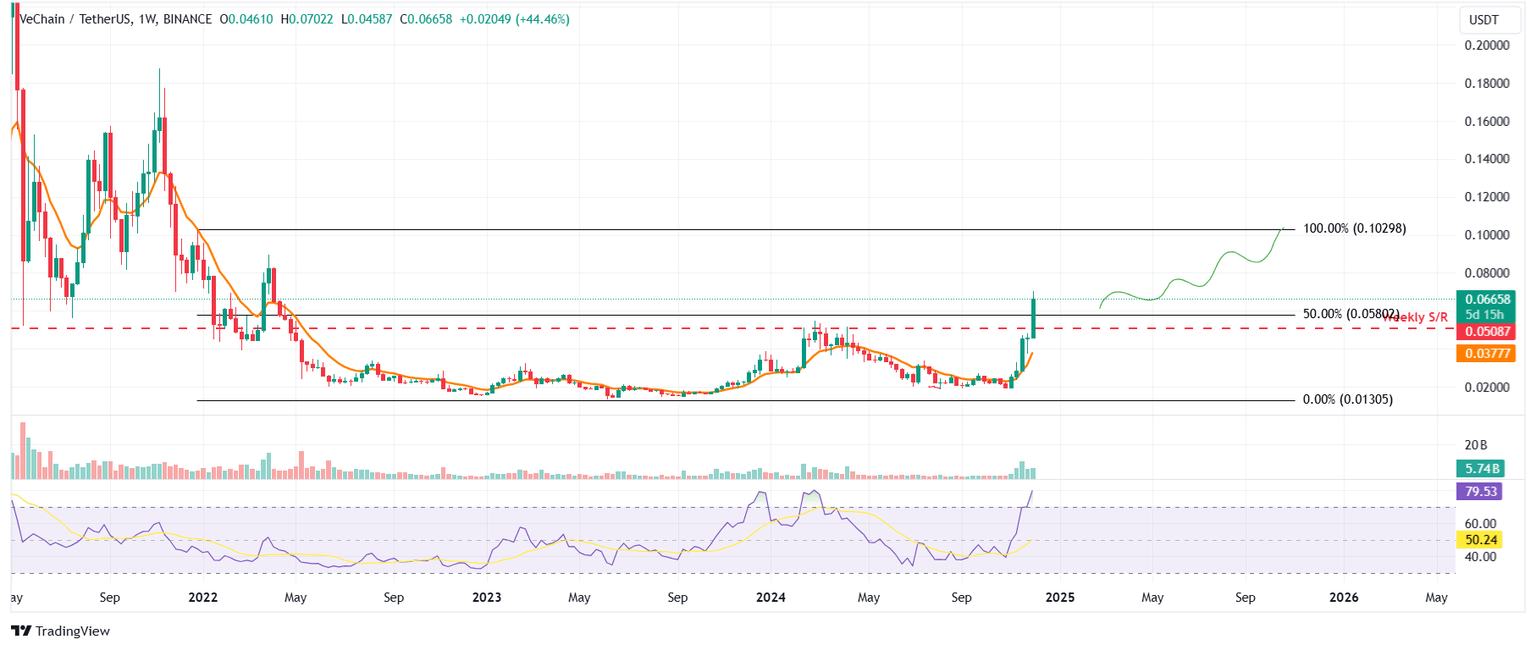

Vechain price looks at three-year high

Vechain price rallied more than 40% until Tuesday, breaking above the weekly resistance level of $0.508 and trading around $0.066. If the upward trend continues, VET could retest its December 2021 high of $0.102. This would represent a further 50% increase from the current price level.

VET’s weekly RSI reads 79, well above its overbought level like HBAR, so chances of a pullback are increasing.

VET/USDT weekly chart

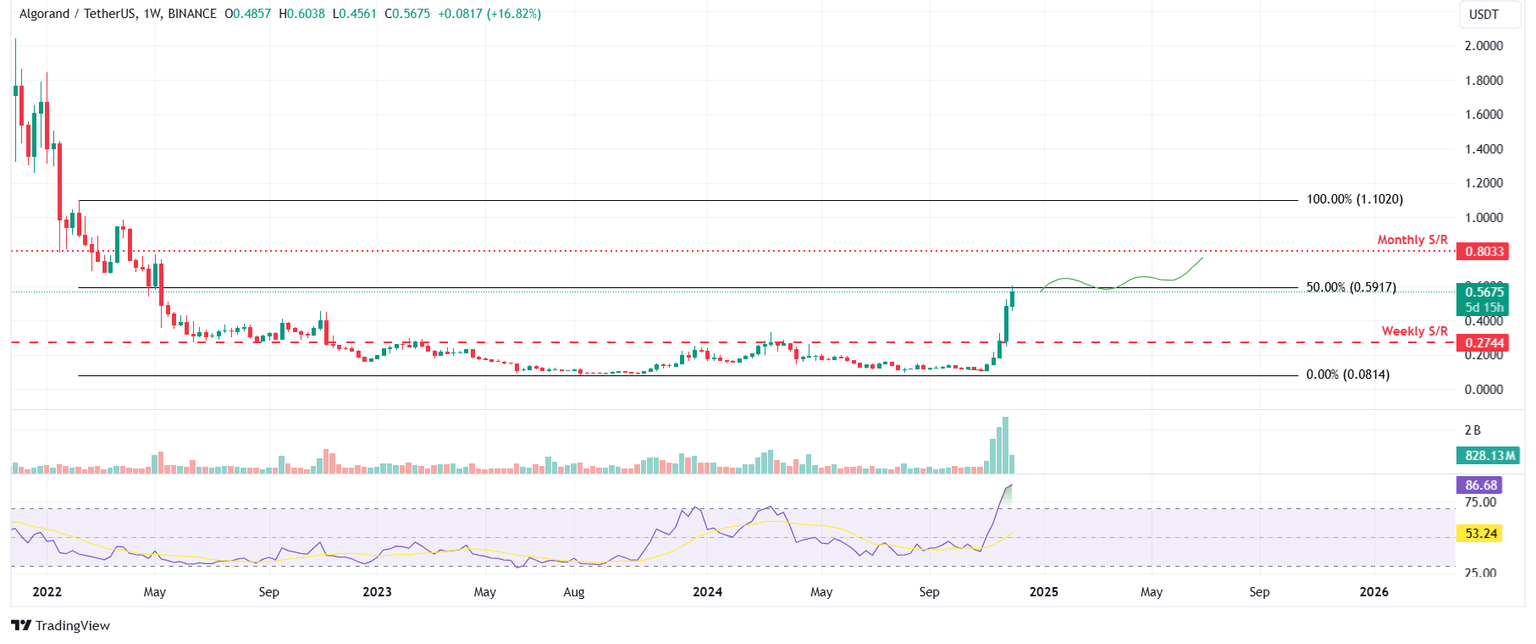

Algorand price poised for more gains if it closes above $0.59

Algorand price rallied more than 70% last week after closing above the weekly resistance at $0.274 on November 18. As of this week, it extended its gains, rising by 17.5% until Tuesday. The altcoin’s price is approaching a key technical resistance at $0.591, the 50% price retracement level drawn from February’s high of $1.10 to August’s low of $0.081.

If ALGO breaks above this level and closes above it, it could extend the rally by 35% to retest its monthly resistance level at $0.803.

Like HBAR and VET, ALGO’s weekly RSI indicator trades well above its overbought levels. Traders should be cautious when adding to their long positions because the chances of a price pullback are increasing.

ALGO/USDT weekly chart

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.