Top 5 made in USA altcoins tackle uncertainty on Trump’s return: XRP, Solana, Cardano, Chainlink, Avalanche

- Crypto market capitalization of tokens made in the U.S. climbs 15% in the past 24 hours, crossing $544.15 billion.

- XRP, Solana, Cardano, Chainlink and Avalanche are the top 5 altcoins, wading the uncertainty of Trump’s return to the Oval office.

- Experts are optimistic of pro-crypto policy and update in regulation within the first 100 days of President Donald Trump’s new administration.

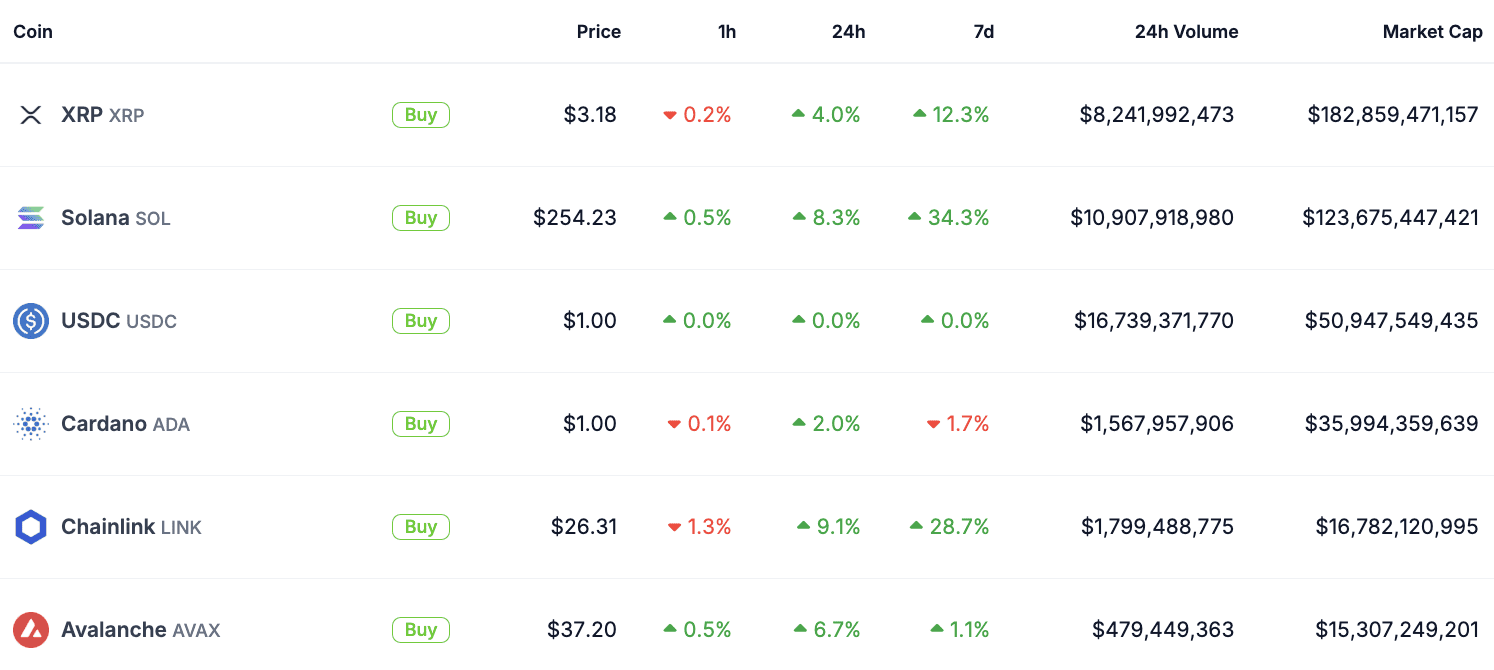

Crypto market capitalization of altcoins developed in the U.S. crossed $544.15 billion on Wednesday, January 22. Among cryptocurrencies trending in the U.S., XRP, Solana (SOL), Cardano (ADA), Chainlink (LINK), and Avalanche (AVAX) have gained in the past 24 hours, per CoinGecko data.

President Donald Trump’s return to the Oval office comes with a slew of executive orders and traders are wading through the uncertainty that follows the volatility in crypto and foreign exchange markets.

Top 5 made in USA altcoins rally

CoinGecko data lists the top altcoins rallying in the past 24 hours. As Bitcoin held steady above

$105,000, altcoins gained between 2% and 9% in the 24-hour timeframe.

Top 5 altcoins made in the USA | Source: CoinGecko

XRP, SOL, LINK and AVAX built on their weekly gains, the tokens are holding on to their rally early on Wednesday. The trade volume of made in USA altcoins crossed $64 billion, according to CoinGecko. Nearly 25 altcoins in the category rallied, riding on the optimism of positive crypto regulation and the expectation of pro-crypto policies in the U.S.

USD may be overvalued and could fuel crypto gains

President Trump’s executive orders, and remarks on tariffs have fueled the uncertainty in global markets. Bitcoin’s consolidation around the $105,000 level is a reminder of how the crypto market is wading unchartered territory and traders come to grips with uncertainty for the coming weeks and months of 2025.

The USD looks stretched on valuation metrics, Citi analysts believe it is overvalued by 3%, however this doesn’t mean the fiat currency wouldn’t climb higher. Following through on fiscal policies promised by President Trump could continue to jolt global markets and the outlook for cryptocurrencies remains a cautiously optimistic one, mid January.

Typically, devaluation of the USD offers an opportunity for Bitcoin and cryptocurrencies to emerge as a hedge against inflation, a safe haven for investors.

Experts maintain optimistic outlook

Mr. Pankaj Balani, Co – Founder & CEO, Delta Exchange told FXStreet in an exclusive interview:

“Trump's pro-crypto stance has created significant momentum in the markets, with the global crypto market growing by $1.8 trillion in 2024, including $1 trillion since his victory. Post inauguration, investors are anticipating executive orders that would facilitate US banks' to participate in cryptocurrency markets, including allowing banks to own, trade and custody crypto and offer these services to their wealthy clients.

A more favourable US stance on crypto could encourage India to adopt a progressive approach, fostering innovation and growth in the domestic market.”

Michael Egorov, Founder of decentralised exchange Curve Finance told FXStreet,

“I expect that the stablecoin space, in particular, is going to see advancements in 2025, including the growing role of stablecoins that are pegged not to the USD, but to other local currencies.

They are the future of global payments and that means that they will have to start interacting more closely with other fiat currencies. So whatever the results of Trump’s administration will be for the U.S. specifically, on the global scale, we will see other factors shaping this market.”

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.