- Cryptocurrencies are giving up gains earned on Tuesday.

- Bitcoin is doing relatively well as compared to altcoins.

- Here are the levels to watch according to the Confluence Detector.

Cryptocurrency market shifted back into the red zone as Binance news weighted on the market sentiments. The world’s largest cryptocurrency exchange experienced a severe security breach that cost it over $40 million. The head of the exchange Zhao said that only the hot wallet was compromised, though the case is another reminder of the vulnerabilities of the nascent industry.

The total capitalization of all digital assets in circulation dropped to $184 billion from the recent peak of $189. Bitcoin, the most popular digital asset, is hovering around $5,800, mostly unchanged on a day-on-day basis. Meanwhile, major altcoins experience much deeper drawdowns, which is consistent with the theory of Bitcoin divergence form the rest of the pack.

So, what levels should we watch?

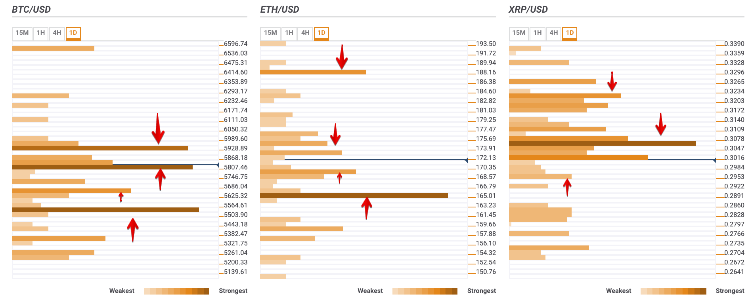

This is what the Crypto Confluence Detector shows in its latest update:

BTC/USD dances around $5,800

A strong support located right below the current price consists of SMA50 1-hour, SMA200 15-min and 61.8% Fibo retracement daily. Once it is out of the way, the sell-off ma be extended towards $5,630 (April’s high and Pivot Point 1-day Support 1).

The key support awaits us on approach to $5,550, created by 161.8% Fibo projection daily, and 38.2% Fibo retracement weekly.

On the upside, 23.6% Fibo retracement daily and the upper boundary of 4-hour Bollinger Band create a formidable resistance on approach to $5,930. It separates us from psychological $6,000 with Pivot Point Week R1, the previous daily high and Pivot Point day R3 located below this barrier.

ETH/USD gives back gains

Ethereum is hovering above $170.00, which is a strong local support created by SMA100 1-hour, 38.2% Fibo retracement daily and the middle line of 4-hour Bollinger Band. However, the critical barrier is seen on approach to $165.00, strengthened byy a confluence of SMA100 4-hour, DMA10 and 38.2% Fibo retracement weekly.

There are few strong hurdles above the current price, though $172.50 may create a local barrier strengthened by previous 4-hour high and 23.6% Fibo retracement daily. The ultimate resistance is seen on approach to $188.00 (previous month high and Pilot Point 1-day R1).

XRP/USD is about to break below $0.30

Ripple, currently at $0.2997, is vulnerable to further losses as there are no strong support levels below the current price. Once the breakthrough is confirmed, the sell-off may be extended towards $0.2930 (Pivot Point 1-day Support 2 and the previous week low).

On the upside, a strong resistance is created on approach to the psychological $0.3100 with several technical levels clustered there. They include SMA100 and SMA50 4-hour, 61.8% Fibo retracement daily, DMA5 and DMA10.

Once it is out of the way, the recovery may be extended towards the next upside barrier on approach to $0.3200. It is protected by the previous week high and the Pivot Point 1-week R3.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin is showing rising correlation with the S&P 500

Bitcoin and the crypto market have been in an uptrend since Wednesday following the Federal Reserve's decision to cut interest rates by 50 basis points. Bitcoin is up nearly 3% in the past 24 hours, rising briefly above the $63,000 level for the first time in three weeks.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Consensys case against SEC over Ethereum dismissed by Texas court

Consensys announced dismissal of a case it filed against the SEC in April about the agency's alleged actions against Ethereum. Judge Reed O'Connor of the Northern District of Texas dismissed the case on Thursday. Consensys claims that the court failed to examine the "merits" of its claim against the SEC.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Bitcoin: On the road to $60,000

Bitcoin price retested and bounced off from the daily support level of $56,000 this week. US spot Bitcoin ETFs posted $140.7 million in inflows until Thursday and on-chain data supports a bullish outlook.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.