- The price drop in Bitcoin is intended to gain space to attack resistance levels.

- Ethereum continues to outperform Bitcoin and ensures upward continuity.

- XRP is being sold to capitalize profits above 20%.

The ruthless crypto market purges the weakest hands of the market – or perhaps the fastest – and positions are liquidated to take profits after good gains in the short term.

The excuse for Bitcoin’s fall is that it ceases in its effort to stay stuck to resistance lines and probably moves in search of volatility – allowing it to break barriers easily.

The first Bitcoin drop has gone straight to support at $9,800 and then bounced back up. In my opinion, the bearish movement has a further downward trajectory.

The most affected among the Top 3 is XRP, which falls more than 7% in honor of its history of high volatility and uncomplicated lurches.

The technical structures continue to be bullish, but in the logical turning process, there are phases. Once the first moving averages have been surpassed, the movement slows down and markets wait for these fast averages to cross the slow ones upwards. This process is slow and is likely to take a few days.

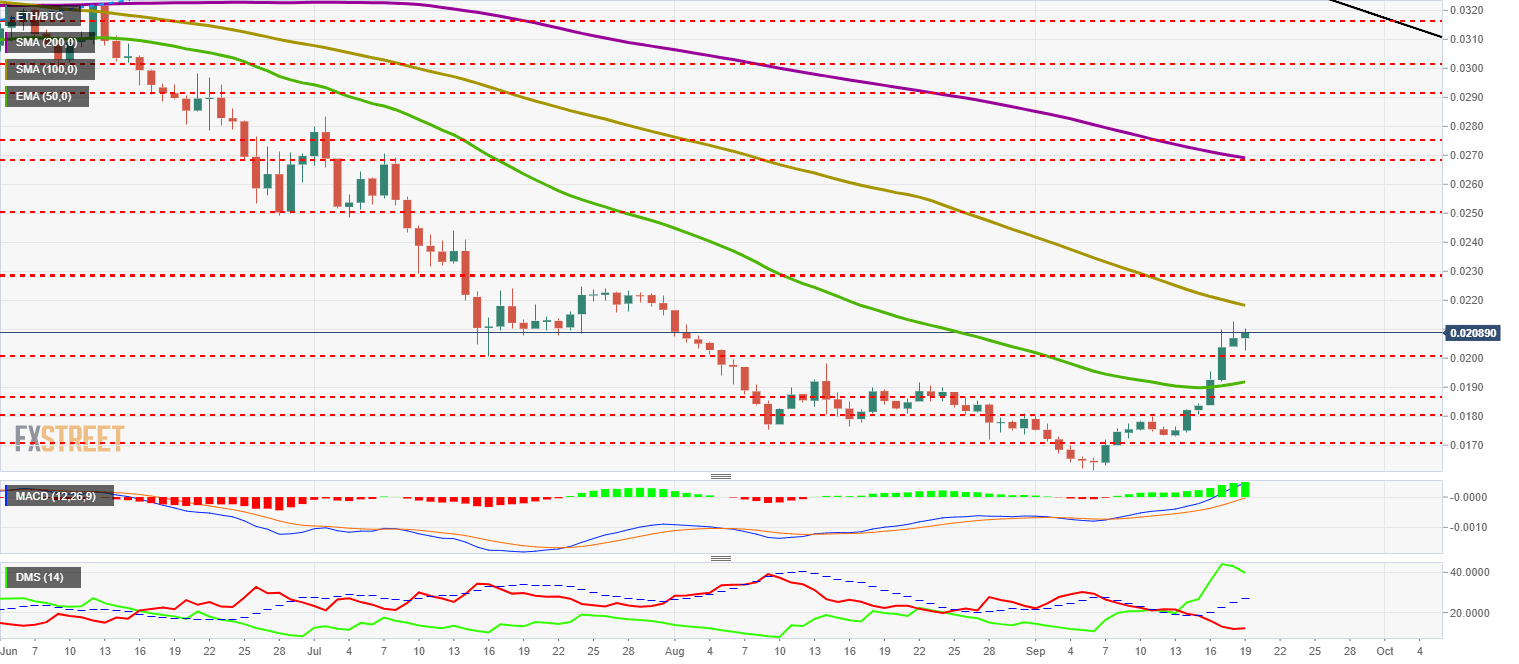

ETH/BTC Daily Chart

The ETHBTC cross is trading at 0.0208 and remains in the green as it has been in the past few days.

Above the current price, the first resistance level is at 0.0219, then the second at 0.0229 and the third one at 0.025.

Below the current price, the first support level is at 0.022, then the second at 0.0192 and the third one at 0.0186.

The MACD on the daily chart shows that the bullish momentum continues to increase and is already clearly penetrating the positive side of the indicator. The arrival of the slow average at the zero levels may imply a slowdown of the upward movement.

The DMI on the daily chart shows the bulls receding from yesterday's levels. Despite the loss of strength, it remains above the 40 levels. The bears increase their strength slightly but far from endangering the bulls' dominance.

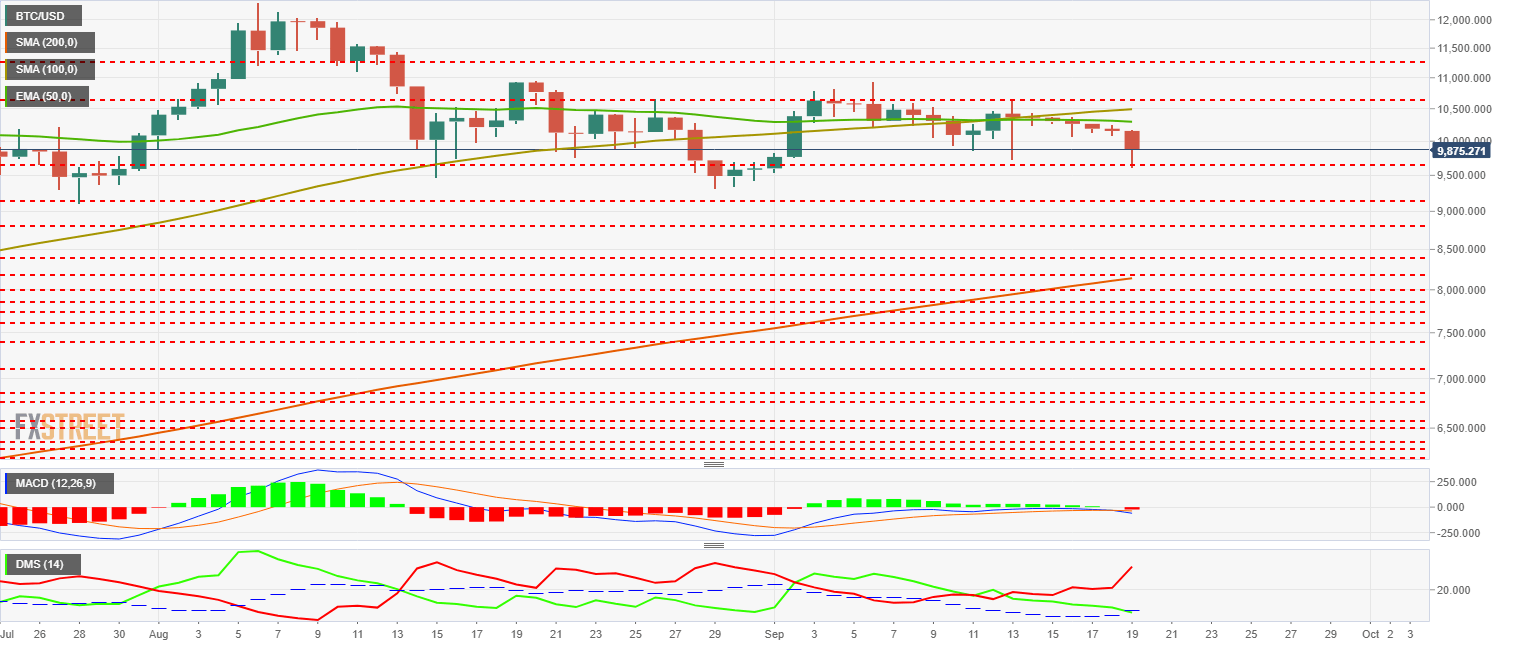

BTC/USD Daily Chart

BTC/USD is currently trading at the $9,875 price level after touching Asian time support at $9,800. Resistances at the $10,000 level have been too heavy for the Bitcoin, which comes down for fresh money and volatility.

Above the current price, the first resistance level is at $10,350, then the second at $10,700 and the third one at $11,275.

Below the current price, the first support level is at $9,800, then the second at $9,150 and the third one at $8,800.

The MACD on the daily chart crosses downward and moves away from the zero levels after ten days of unsuccessful attempts to drill upward. The bearish cross may unravel in a few days.

The DMI on the daily chart clearly shows how the bears take absolute control of the pair and quickly drag the ADX line upward. This technical profile augurs a few days of price drops.

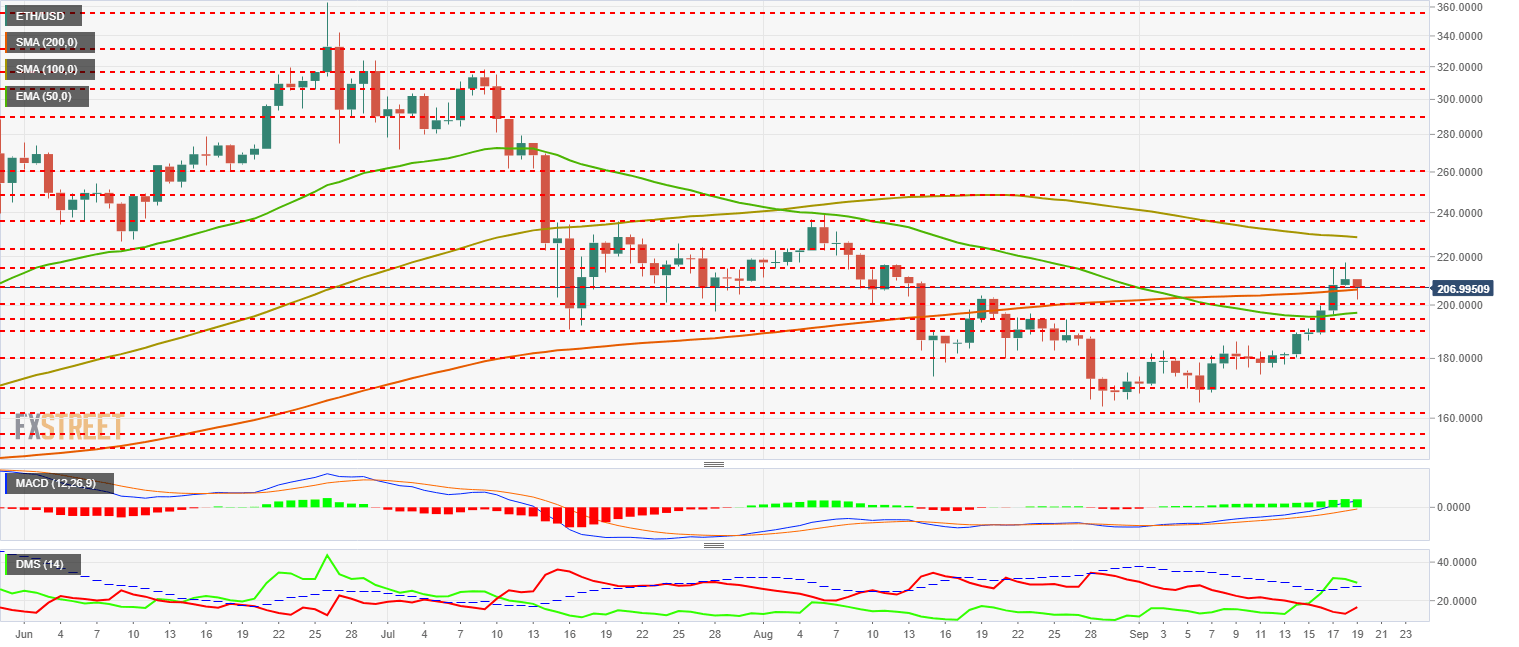

ETH/USD Daily Chart

ETH/USD is traded at the $206.99 price level and is once again above the 100 simple moving average.

Above the current price, the first resistance level is at $207, then the second at $215 and the third one at $225.

Below the current price, the first support level is at $200, then the second at $195 and the third one at $190.

The MACD on the daily chart retains its bullish profile and is not affected by today's sales at the moment. Exponential averages are already moving through the bullish zone of the indicator and reinforce the idea of bullish continuity.

The DMI on the daily chart shows the bulls losing trend strength and looking for support on the ADX line. On the other hand, the bears gain trend strength but do not manage to overcome level 20 or endanger the leadership of the bulls.

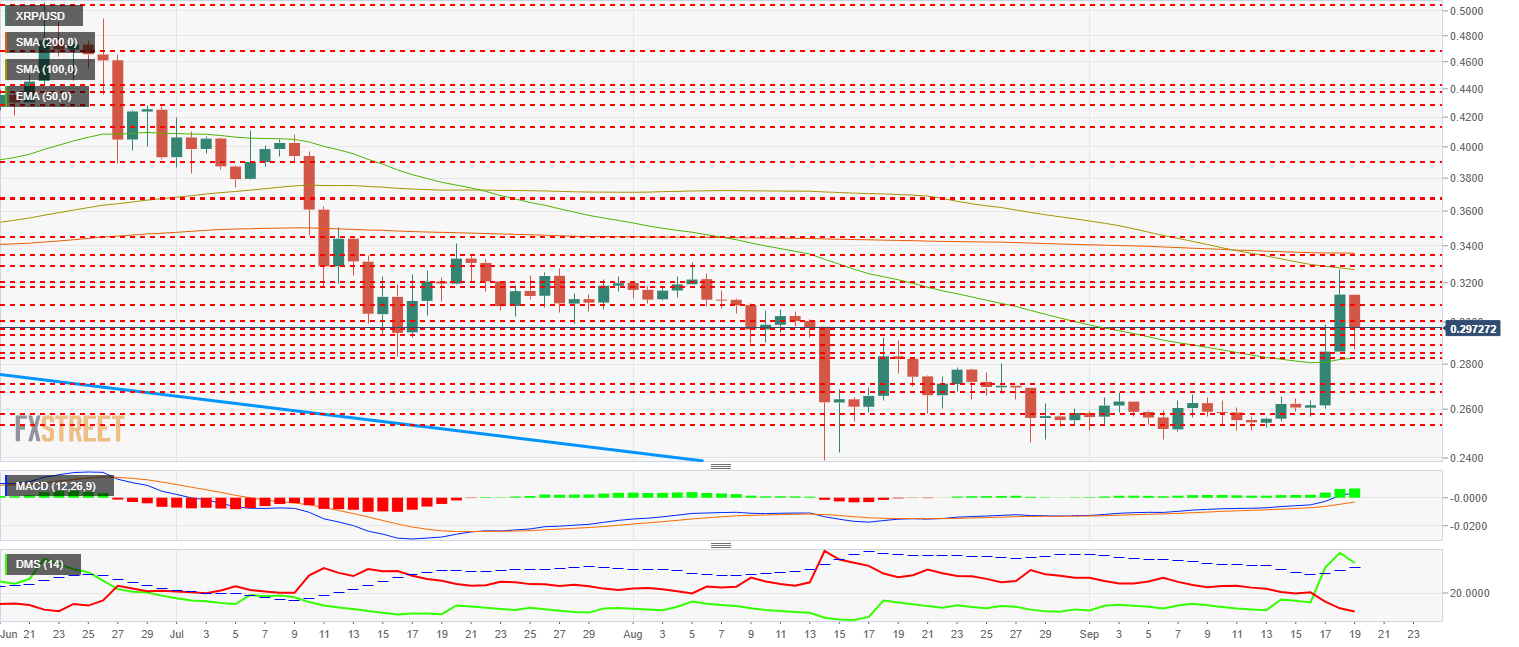

XRP/USD Daily Chart

XRP/USD is currently trading at $0.2972 and is recovering from the day's low of $0.286. XRP was accumulating a profit above 20% in two days, so profit-taking was predictable, as I commented on Wednesday.

Above the current price, the first resistance level is at $0.30, then the second at $0.308 and the third one at $0.32.

Below the current price, the first support level is at $0.29, then the second at $0.285 and the third one at $0.271.

The MACD on the daily chart loses both slope and openness between the lines. Exponential averages are between the bullish and bearish sides of the indicator. This scenario may increase the difficulty of moving higher for XRP in the next few days.

The DMI on the daily chart shows bulls controlling the XRP/USD pair. Bears do not increase strength despite falls, a decisive point in the short term.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

TRON gains 10% in 2024, supply of stablecoins reaches over $50 billion in Q1

TRON, a blockchain-based digital platform, has seen positive growth in the first quarter of 2024, as seen in a Messari report. TRON noted gains across several metrics like market capitalization, revenue and total value locked.

XRP hovers near $0.50 as Ripple CTO addresses concerns related to stablecoin launch

XRP is hovering near $0.53 on Friday, spending nearly all week below $0.55. Ripple CTO David Schwartz addressed concerns on stablecoin and XRP utility on Thursday.

Terraform Labs set to restrict access for users in the US after recent ruling in SEC lawsuit

Blockchain company Terraform Labs said Thursday that it will restrict access to some of its products and services for US-based users as it expects to receive a court order soon in light of its legal battle against the US Securities and Exchange Commission (SEC).

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.