- BTC/USD attracts new money and is close to a new upside segment.

- ETH/USD follows Bitcoin up but shows a lack of strength.

- XRP/USD takes it easy and awaits events.

It dawns in Europe with key Crypto players on the verge of breaking key resistance levels. A consistent closure above these caps would open the door to a new bullish segment of the sector.

The strong rise made by the BCH/USD in the last few hours is significant news for other cryptos as well. Bitcoin Cash is also tackling key resistance levels.

Bitcoin and the Ethereum technically stand out as both showed more degraded indicators are behaving better than Ripple. In turn, the XRP presented a perfect configuration to take advantage of any bullish impulse.

The key resistance levels to watch are $6.764 in BTC/USD, $247.75 in ETH/USD, and the relative maximum in $0.60 for the XRP/USD.

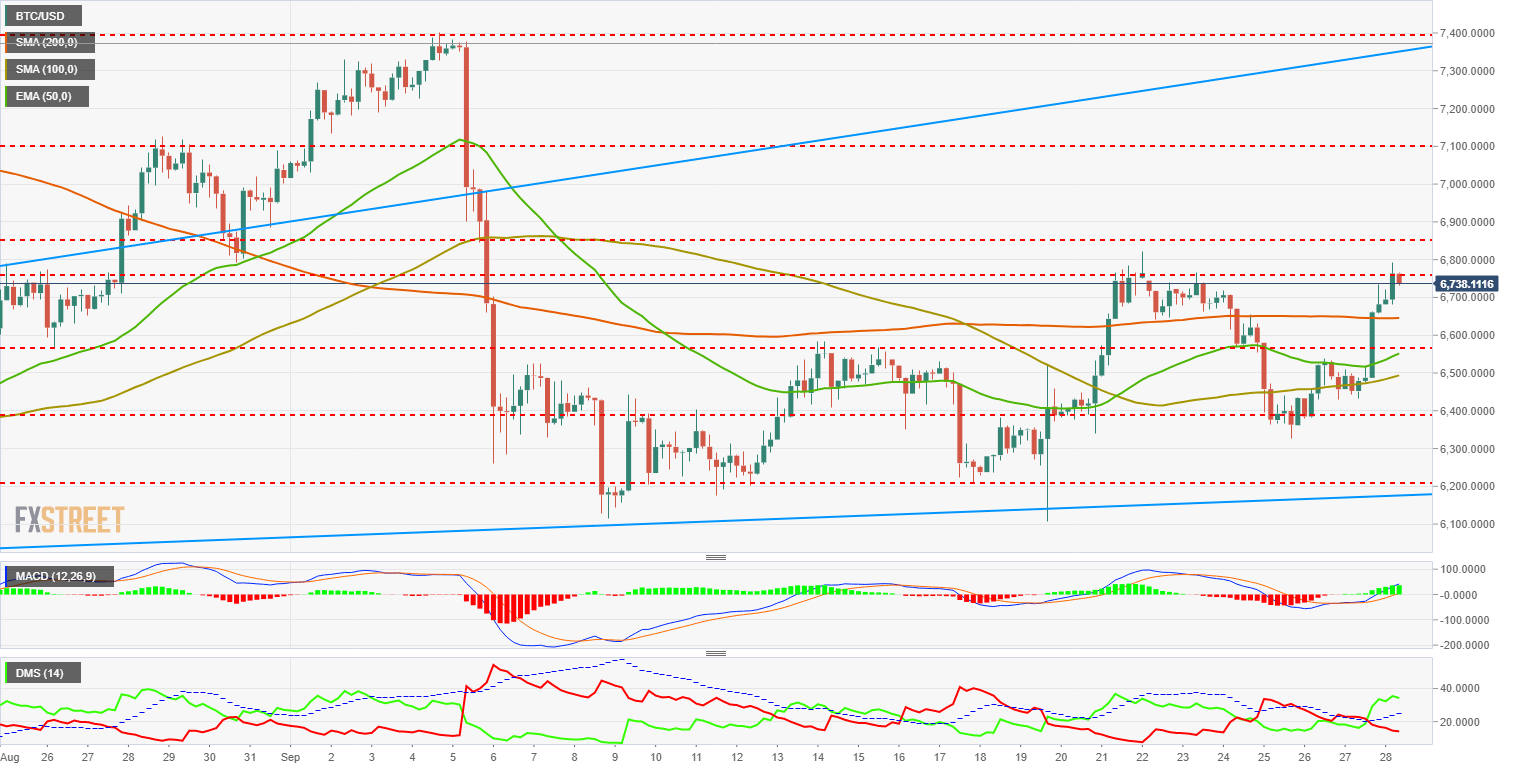

BTC/USD 240-Min.

The BTC/USD is currently trading at the price level of $6.766. A close at this level would give us a signal, as it exceeds the short term relative maximum close although by a small margin the signal loses strength.

Above the current price, the first resistance level is at $6,850 (price congestion resistance), the second one at $7,100 (price congestion resistance) and finally, we eye the very important resistance level at $7,384 (medium-term relative maximum). To reach this level, it will be necessary for the BTC/USD to recover the trend line from the annual lows, which is one more obstacle to add.

Below the current price, the first support is on the SMA200 at the price level of $6.645. Below this support level, the next support is at $6.566 (price congestion support), then at $6.552 (EMA50) and as a third support we look at $6.493 (SMA100).

The MACD at 240-Min reflects a rise above the zero level and is on the bullish side of the indicator. It acquires a good bullish inclination and the distance between lines provides potential in the short term.

The DMI at 240-Min confirms the movement and the bulls take absolute control of the situation. The bears withdraw quickly and go clearly below level 20. This configuration also gives room for bullish continuity.

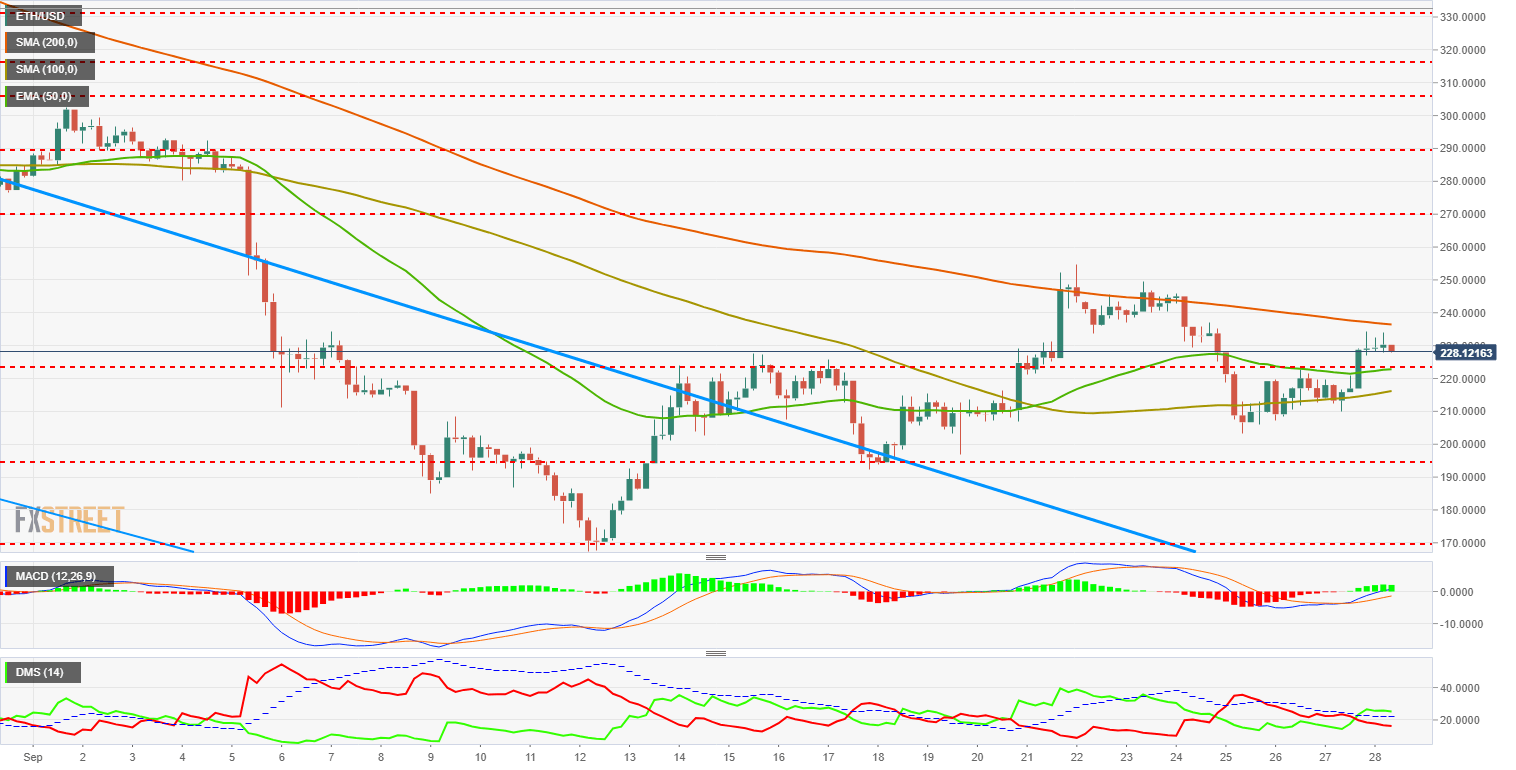

ETH/USD 240-Min

The ETH/USD is currently quoted on the $228 price level. It moves between moving averages and its main challenge apart from the relative maximum is to outperform the SMA200 and gain upside free space.

Above the current price, the resistance is at $236 (SMA200). If this level is exceeded, the ETH/USD will have some clean space until the next resistance level at $270 (price congestion resistance). The third resistance level is found at $290 (price congestion resistance) and already at the gates of the important $300 level.

Below the current price, the first support is $220 price level (EMA50 and price congestion support). The second support is at $216 (SMA100) and as a cut-off point within the current support scenario, we see $195 (price congestion support).

The MACD at 240-Min shows a good bullish reaction, but in the case of the ETH/USD, it does not manage to get above the zero line. This means that Ether will find it hard to take advantage of the money that enters the Crypto sector.

The DMI to 240-Min shows us that bulls are taking control but not in a very forceful way. Its horizontal profile lets us see that there is not much conviction in the climbs. Luckily for the bulls, the bears do not have a clear sight either and continue decreasing in intensity.

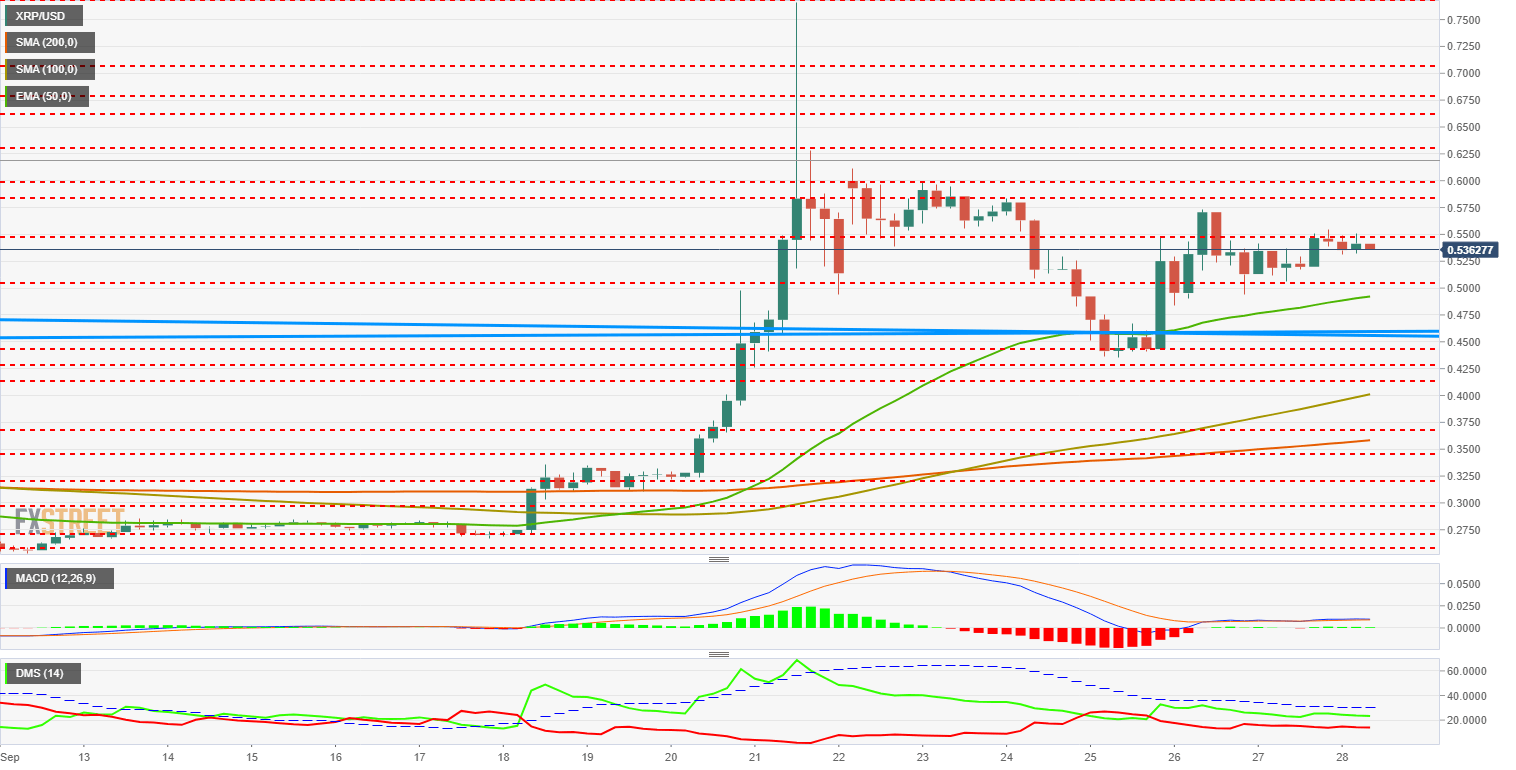

XRP/USD 240-Min

The XRP/USD is currently trading at the $0.537 price level. Of the three main Cryptos in the market, today it is the Ripple's turn to be the laggard. However, Ripple remains ahead thanks to last week's strong gains but for now, it loses the opportunity to continue improving.

Above current price, the first resistance is at $0.55 (price congestion resistance). So, a second resistance line is at $0.583 (price congestion resistance) and the third resistance level at $0.60, a key support level that did not manage to close above on the 4H chart in the recent rise.

Below the current price, the first support is at $0.505 price level (price congestion support), the second support is at $0.492 (EMA50) and as a key level the XRP/USD should not lose, the third support is at $0.46 (medium and long-term trend line support).

The MACD at 240-Min has not changed its profile since yesterday. The lack of price reaction leaves a very horizontal indicator and gives us very little information beyond highlighting that it moves on the bullish side of the indicator.

The DMI at 240-Min continues to show bulls are in control of the situation and it still remains above the 20 level. The downside is that bullish traders are not convinced on their side of the market. On the other hand, bears remain at a low but sustained level.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

TRON gains 10% in 2024, supply of stablecoins reaches over $50 billion in Q1

TRON, a blockchain-based digital platform, has seen positive growth in the first quarter of 2024, as seen in a Messari report. TRON noted gains across several metrics like market capitalization, revenue and total value locked.

XRP hovers near $0.50 as Ripple CTO addresses concerns related to stablecoin launch

XRP is hovering near $0.53 on Friday, spending nearly all week below $0.55. Ripple CTO David Schwartz addressed concerns on stablecoin and XRP utility on Thursday.

Terraform Labs set to restrict access for users in the US after recent ruling in SEC lawsuit

Blockchain company Terraform Labs said Thursday that it will restrict access to some of its products and services for US-based users as it expects to receive a court order soon in light of its legal battle against the US Securities and Exchange Commission (SEC).

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.