Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto markets to favor bears soon

- Bitcoin price has more room for upside, but the threat of a downside risk keeps growing.

- Ethereum price shows signs of rejection around the $2,789 to $3,167 supply zone.

- Ripple price continues to consolidate around the $0.604 support level.

Bitcoin price has been on a steady uptrend since its crash on January 24. The uptrend is approaching a vital resistance barrier, where it could face rejection and a potential downswing. Investors need to exercise caution with Ethereum, Ripple, therefore, and other altcoins since they might follow suit.

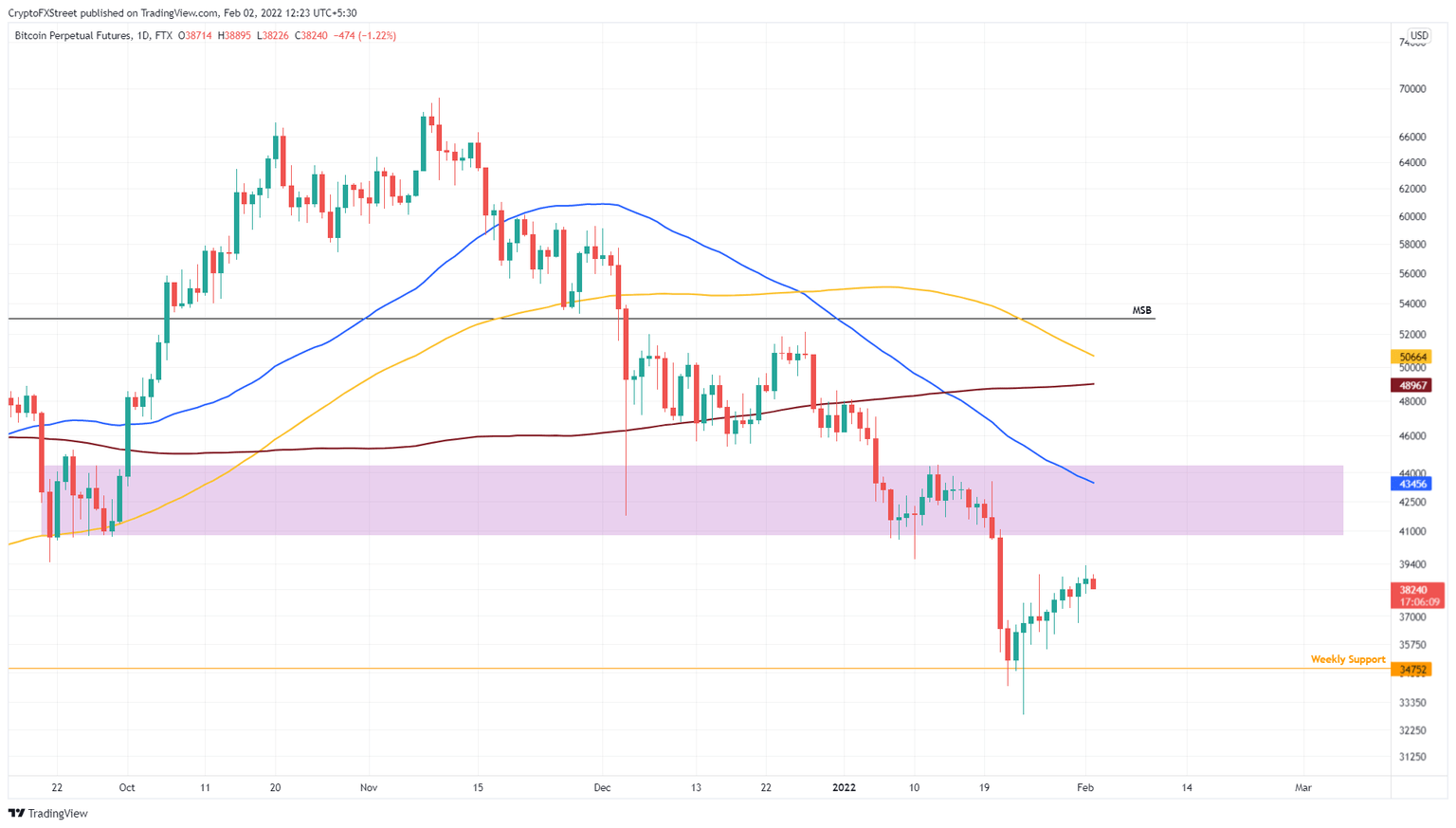

Bitcoin price upside limited

Bitcoin price crashed on January 20 and January 22 and then seemed to stabilize around the weekly support level at $34,752. Since then, BTC has rallied 18% and is currently hovering at $38,349. The up move may be capped by the supply zone, extending from $40,794 and $44,387.

The lower limit of the zone coincides with the fair value gap’s upper limit. A move beyond this confluence, therefore, seems unlikely and investors can expect a retracement from there to the weekly support level at $34,752.

From the current position, Bitcoin price has room for a 7% upside.

BTC/USD 1-day chart

On the other hand, if Bitcoin price produces a higher high above $44,387, the uptrend will continue, however, a daily candlestick close below $34,752 will invalidate the bullish thesis.

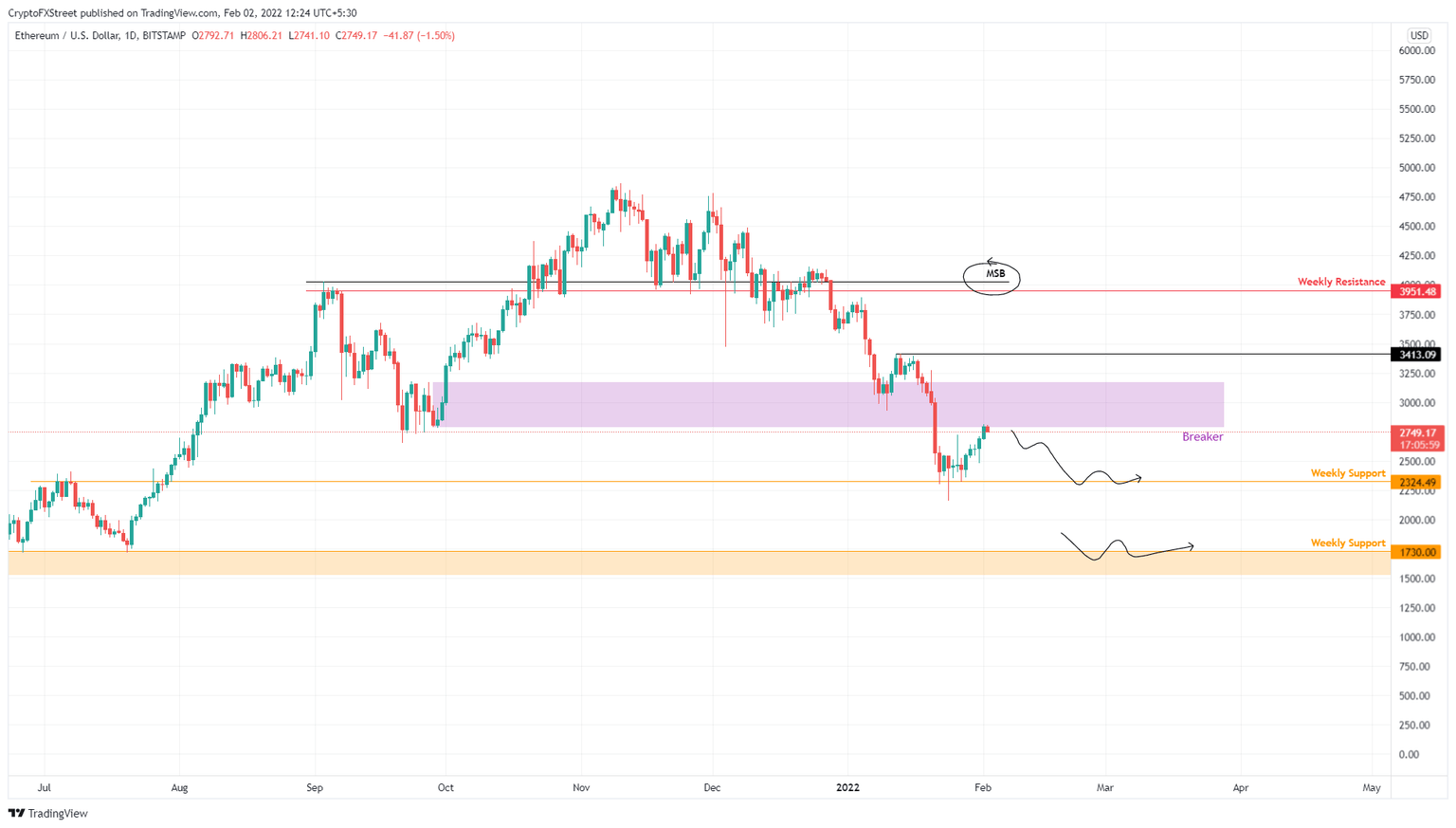

Ethereum price approaches its limit

Ethereum price has risen roughly 30% over the past ten days and is currently testing the supply zone, extending from $2,789 to $3,167. This barrier will pose stiff resistance and is likely to be where bulls face exhaustion.

Market participants can expect the Ethereum price to retrace to the weekly support level at $2,324 if the price rotates at the resistance barrier. In a dire case, ETH could slide as low as $1,730 where it will collect the sell-side liquidity resting below it.

ETH/USD 1-day chart

While things are looking limited for Ethereum price, a daily candlestick close above $3,413 will create a higher high and invalidate the short-term bearish thesis. This move has the potential to further propel ETH to $3,951.

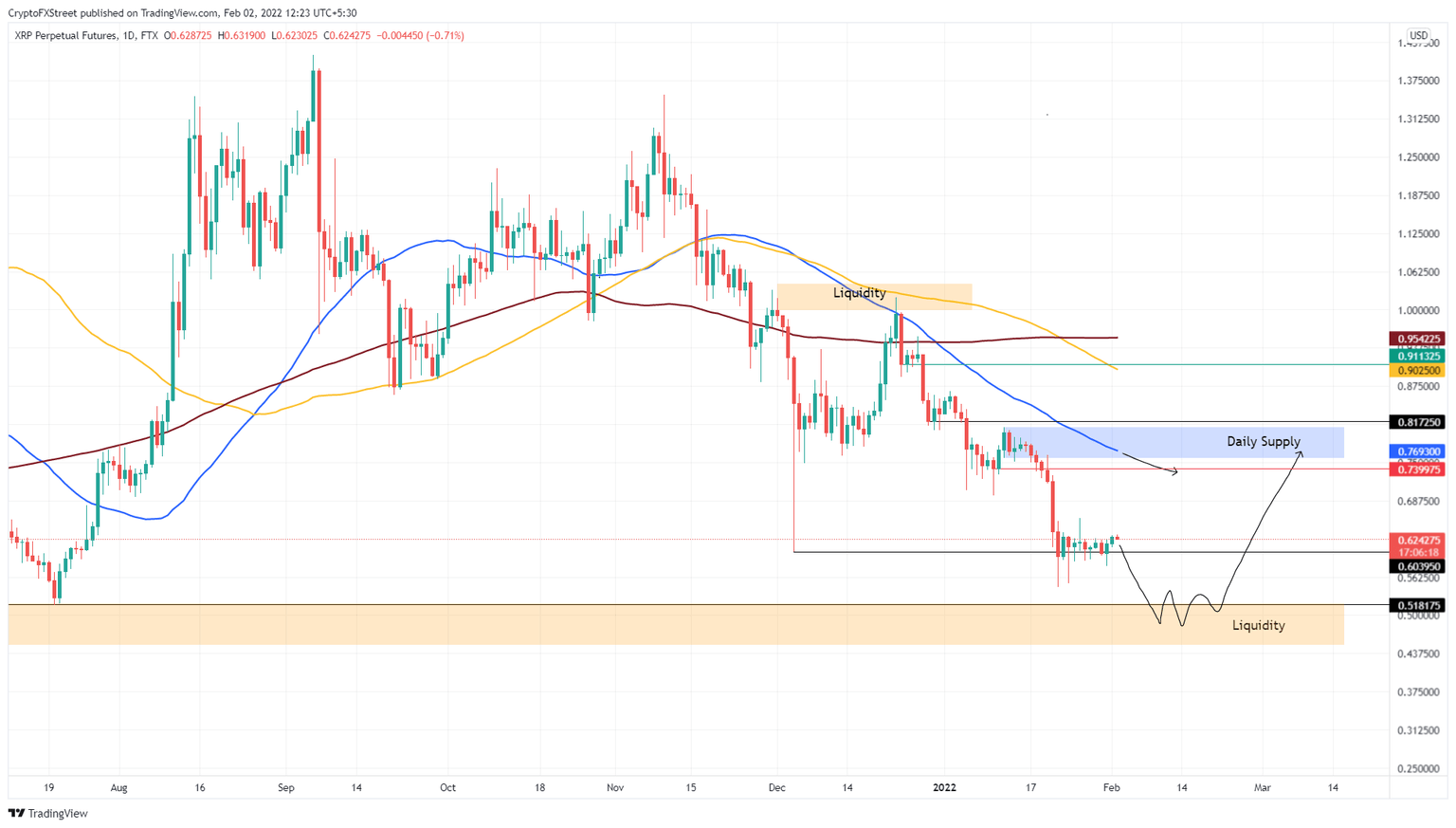

Ripple price continues to consolidate

Ripple price crashed in response to the Bitcoin crash on January 20 and January 22. The drop for XRP stabilized around the $0.604 support level. Since then, the remittance token has continued to consolidate around the said barrier.

This coiling up will eventually lead to a massive move in either direction. Judging by the current state of BTC, however, there is a good chance this sideways movement will continue before the Ripple price breaks lower and collects the liquidity resting below $0.518.

XRP/USD 1-day chart

Regardless of the bullish outlook due to the consolidation, upside for the Ripple price is capped at $0.739. Any move beyond this barrier is unlikely due to the presence of a resistance cluster there. A daily candlestick close above $0.817 will invalidate the bearish thesis and potentially kick-start a move higher.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.