Top 3 Price Prediction Bitcoin, Ethereum, Ripple: A sea of red into weekly opening?

- The recent downside bias remains intact across the crypto market.

- Top 3 widely traded coins to shed about 15% each on the week.

The world’s no. 1 digital coin, Bitcoin, is seen resuming its recent bearish momentum, as we head towards the weekly closing. However, the second most traded cryptocurrency, Ethereum, remains the less hated amongst the top three most favorite digital asset, as it loses nearly 1.5% so far this Sunday. Meanwhile, the first coin now eyes the half-yearly lows once again, enjoying a market capitalization of $ 131.30 billion. The total market capitalization of the top 20 cryptocurrencies now stands at $199.10 billion, as cited by CoinMarketCap.

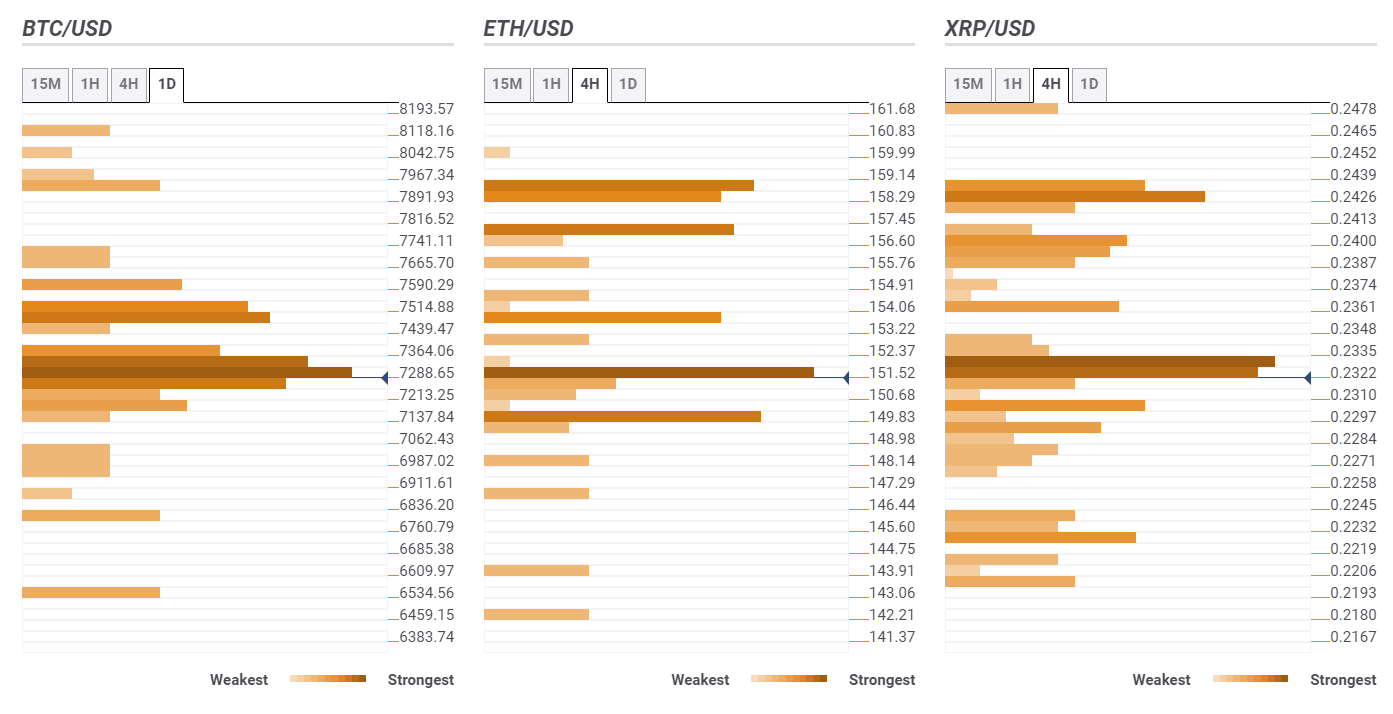

The top three coins are seen extending the downward spiral in the week ahead, with the key supports and resistances noted below, as indicated by the Confluence Detector.

BTC/USD: $ 6,787 – back on sight

Bitcoin is trying hard to defend the $ 7,100 mark, as it continues to meet heavy selling pressure, with the half-yearly lows of 6,787 now seen as the next downside target amid a lack of substantial supports to restrict the sellers.

Meanwhile, any recovery attempt is likely to get sold off into the initial resistance near 7,220/50, the confluence of the 23.6% Fibonacci Retracement (Fib) level of the weekly price action (1W), 10 and 50-hourly Simple Moving Averages (HMA).

Should the bulls manage to surpass the last, the critical resistances around 7,300 and 7,350 are unlikely to allow the recovery momentum to extend. That area is the intersection of the 38.2% Fib of the daily price action (1D), Bollinger band 1H Middle and the previous high on the hourly sticks (1H).

ETH/USD: Path of least resistance is to the downside

Ethereum has come under fresh selling pressure, as it continues to run into a pack of resistances on its every attempt above the 150 handle. The resistances are located between 151.50-152.00, where the Fib 38.2% and 23.6% Fib 1D, 10 and 5-4H SMA coincide.

Only a break above the last could call for a sustained recovery towards the next resistance aligned near the previous month of 153.28.

To the downside, the earlier support at 149.80, the intersection of the 23.6% Fib 1W and 61.8% 1D, is already breached, opening floors for further declines towards the 148 handle – the pivot point 1D S1.

XRP/USD: 0.2335 - the level for near-term bullish reversal

Ripple is seen consolidating around 0.2310 levels, as the bulls gather pace for a test of a strong resistance placed near 0.2335 (23.6% Fib of the weekly decline).

A break above that level, the coin is likely to face the next strong resistance near $ 0.2360, the confluence of the Bollinger 1H Upper and previous day’s high.

The ongoing sell-off is likely to intensify should it breach the 0.2285, daily low and Pivot Point 1D S1 confluence. The next support directly awaits at 0.2220, where the previous week’s low was reached.

See all the cryptocurrency technical levels.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.