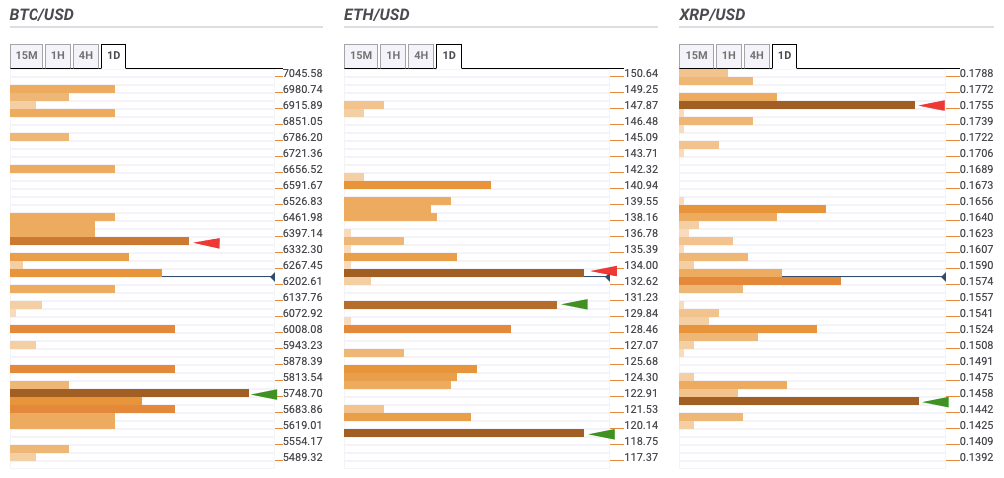

Top 3 Coins Price Prediction: Bitcoin, Ethereum and Ripple consolidate their price following as bulls and bears wrestle for control - Confluence Detector

Top 3 Coins daily confluence detector

Bitcoin

- Current Price: $6,210.65

- High: $6,381.39

- Low: $6,062.46

- R3: $8,167.87

- R2: $7,559.55

- R1: $6,883.31

- PP: $6,274.98

- S1: $5,598.74

- S2: $4,990.42

- S3: $4,314.18

The daily confluence detector shows one strong resistance and support level at $6,375 and $5,775, respectively. The former has the 15-min Bollinger Band, one-week Fibonacci 23.6% retracement level and SMA 100, while the latter has the one-month Pivot Point support-three.

Ethereum

- Current Price: $133.25

- High: $137.64

- Low: $129.58

- R3: $190.06

- R2: $171.69

- R1: $152.54

- PP: $134.17

- S1: $115.03

- S2: $96.66

- S3: $77.52

There are two healthy support levels on the downside at $130 and $119.50. The former has the one-day Fibonacci 38.2% retracement level and SMA 10, while the latter has the one-month Pivot Point support-two. On the upside, there is a strong resistance level at $133.50, which has the 15-min Previous Low, one-week Fibonacci 38.2% retracement level, 15-min Bollinger Band middle curve, SMA 5, SMA 50 and SMA 200.

Ripple

- Current Price: $0.1569

- High: $0.1613

- Low: $0.1544

- R3: $0.2039

- R2: $0.1897

- R1: $0.1733

- PP: $0.1591

- S1: $0.1427

- S2: $0.1285

- S3: $0.1121

Quite like Bitcoin, Ripple also has one strong resistance and support level, as per the confluence detector. Strong resistance lies at $0.1765, which has the Previous Year low. On the downside, good support lies at $0.145, which has the 4-hour and one-day Previous Lows and one-month Pivot Point support-two.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.