Three reasons why Terra (LUNA) price rallied by 20%

The growing interest in stablecoins, new partnerships and the improving state of the wider market back LUNA’s newfound bullish momentum.

Altcoins continue to move higher while the price of Bitcoin (BTC) remains trapped in the $31,000 to $36,000 price range.

The predictable range appears to be helping Terra (LUNA), a blockchain protocol that specializes in fiat-pegged stablecoins like TerraUSD (UST) to power a price-stable global payment system.

LUNA/USDT 1-day chart. Source: TradingView

A quick scroll through the project’s Twitter feed indicates that the team behind LUNA has been busy as the month of June was full of protocol upgrades as well as new partnerships and integrations.

Some of the major developments for the Terra ecosystem include the launch of Mirror V2, the addition of Terra farming opportunities on Dfyn and the listing of LUNA on the Crypto.com exchange.

Support from Terraform Labs provides a boost

Price action for Terra received a boost on July 7 after Terraform Labs (TFL), the company behind the Terra blockchain, committed to using 50 million Terra SDT (SDT) worth roughly 70 million UST from the TFL stability reserve fund to capitalize the yield reserve for Anchor protocol (ANC).

TFL will be capitalizing Anchor's yield reserve using 50 million SDT (~70 million UST) from the TFL Stability Reserve Fund.

— Terra powered by Luna (@terra_money) July 7, 2021

Supporting Anchor and the Terra community is the mission of TFL, which includes ensuring the long-term interest and success of the Terra ecosystem. https://t.co/5369ZCQZuv

This was done in order to provide enough time to introduce more types of collateral and self-sustainable protocol improvements that are due to be released in the coming weeks as part of Anchor V2.

The move will also help keep the rate offered to UST stakers on the Anchor protocol at 20%.

Partnerships highlight stablecoin demand

Another possible source for the current bullish momentum came after the team announced a full-stack partnership with Harmony (ONE) protocol that will enable the migration of UST to the Harmony ecosystem.

We're excited to announce a full-stack partnership with @terra_money, working together to grow both the @harmonyprotocol and @terra_money #DeFi ecosystems https://t.co/lCDgPdSSHI @Cointelegraph ( @d0h0k1) pic.twitter.com/iAnKdUqryx

— Harmony (@harmonyprotocol) July 7, 2021

This partnership highlights the growing demand for reliable and secure stablecoins that are capable of operating across multiple blockchain networks to help conduct operations and facilitate ecosystem expansion.

Cointelegraph Markets Pro signals that something is brewing

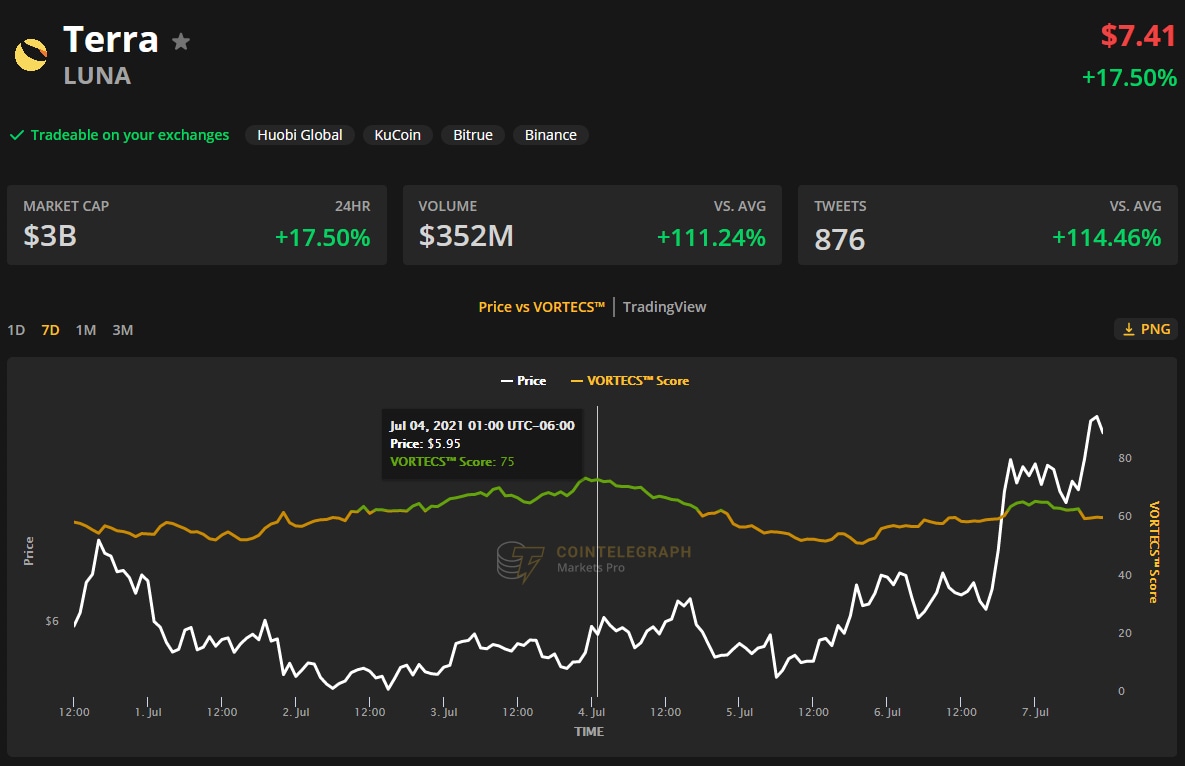

VORTECS™ data from Cointelegraph Markets Pro began to detect a bullish outlook for LUNA on July 3, prior to the recent price rise.

The VORTECS™ Score, exclusive to Cointelegraph, is an algorithmic comparison of historic and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity.

VORTECS™ Score (green) vs. LUNA price. Source: Cointelegraph Markets Pro

As seen in the chart above, the VORTECS™ Score for LUNA began to climb into the green zone on July 3 and registered a high of 75 on July 4, around 35 hours before its price began to increase 36% over the next two days.

The rising interest in integrating with the Terra ecosystem is a recent example of the growing significance that stablecoins play in the wider cryptocurrency ecosystem, a trend that continues to grow stronger as new participants enter the crypto space.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.