Three reasons why Litecoin whales could push LTC price to $100 before third halving

- Litecoin's third halving, LTC20, is estimated to happen on August 10, fueling a bullish thesis for the asset’s price.

- Less than 80 days away from the event, an expert from Santiment predicts increased participation by big players.

- Whales are likely to push the Bitcoin-alternative’s price to $100 before a final pullback ahead of the halving.

Litecoin (LTC), a decentralized peer-to-peer cryptocurrency, is gearing up for its third halving, an event that is considered a bullish catalyst for the altcoin.

Litecoin on-chain metrics paint bullish picture for LTC price

The LTC20 halving event is likely to happen on August 10, based on estimates from Santiment. Less than 80 days away from the block reward halving, the Litecoin network has noted a significant increase in on-chain activity. The halving event is scheduled to take place on block 2,140,000, according to Santiment, and the mining reward will be slashed from 12.5 LTC to 6.25. The exact timing of the halving and its block height isn’t set and may vary according to different estimates.

Typically, a reduction in the asset’s supply and an increase in demand drives prices higher. This has previously occurred at Bitcoin halving events, and experts at Santiment have noted a significant upside reaction in prices ahead of a long-anticipated event like a halving.

Litecoin’s halving is therefore not “priced in” and considered a bullish catalyst. Ahead of the event, three metrics can give clues over the likelihood of a possible rally for LTC:

- Social volume, or the number of mentions of Litecoin across social media platforms.

- Transaction volume, or the value moved on the Litecoin network.

- Whale activity, or the number of transactions by large-wallet investors.

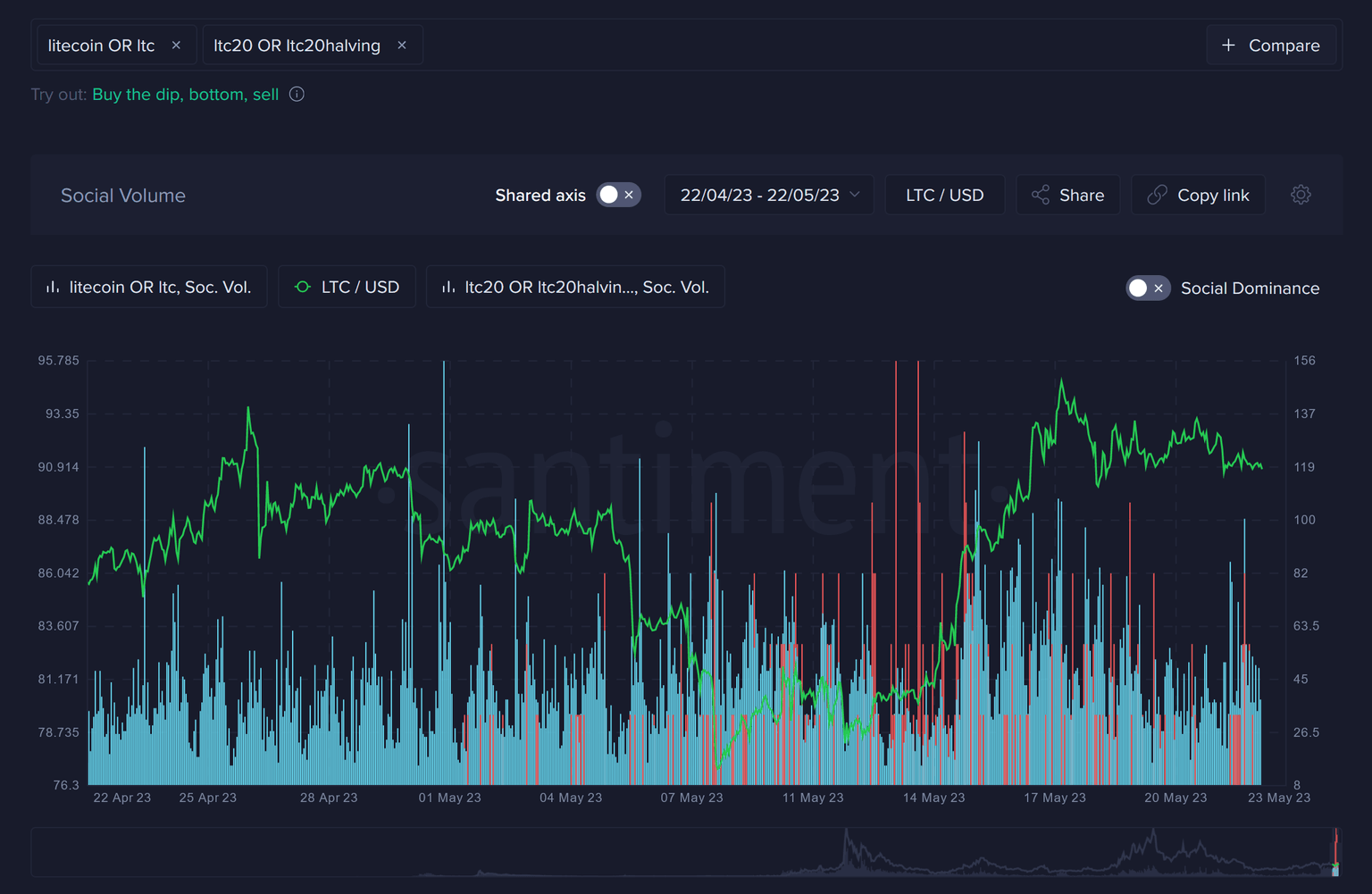

Social volume on the rise

Based on data from crypto intelligence tracker Santiment, discussions about LTC20 are increasing, pushing the asset in a “crowd discovery” phase where traders show growing interest in Litecoin.

Litecoin social volume

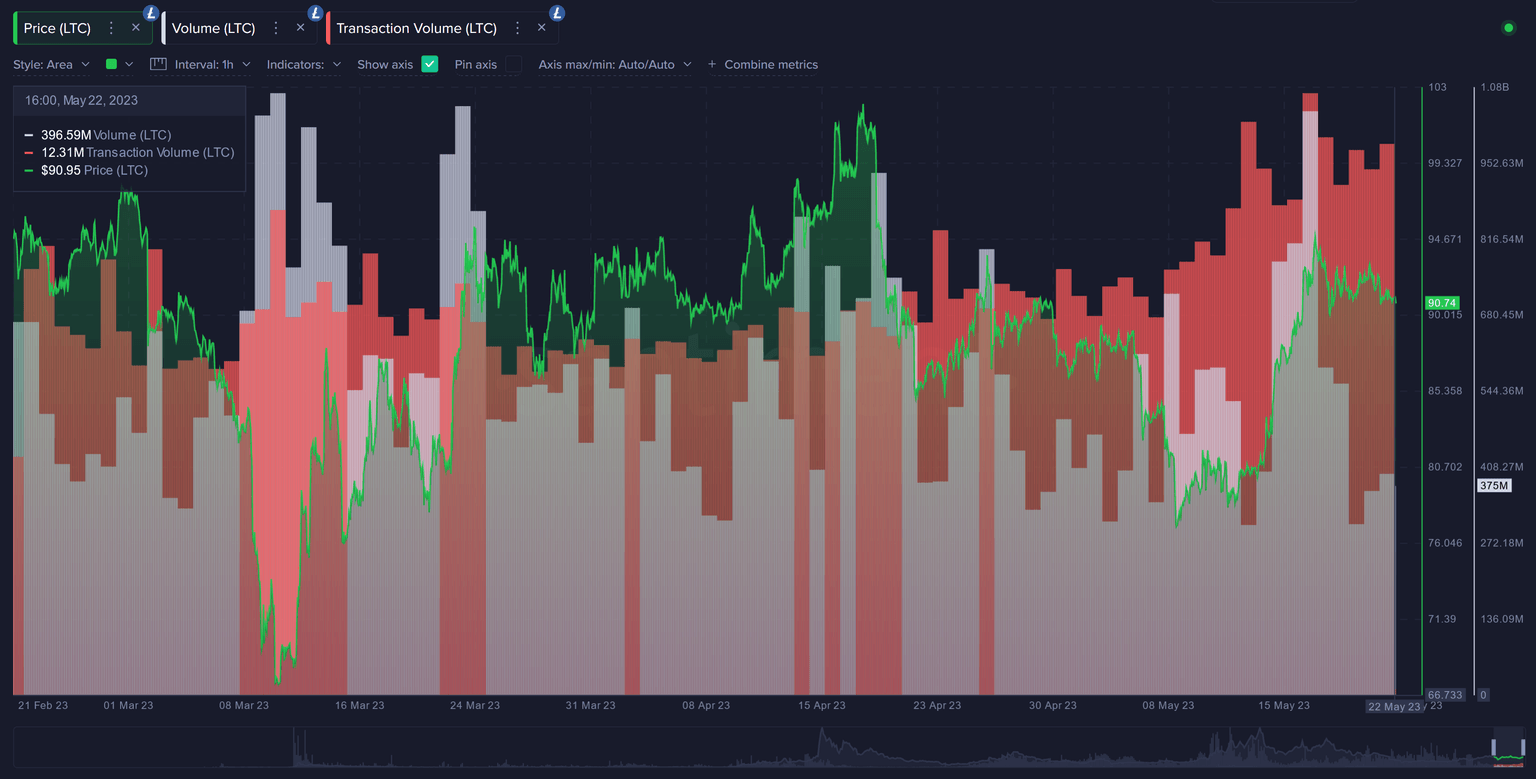

On-chain transaction volume rises steadily

The value moved on the Litecoin blockchain increased as crowd participation and interest among traders climbed. Since May 8, there has been a steady rise in Litecoin’s on-chain transaction volume.

Litecoin on-chain transaction volume

According to Brian Quinlivan, director of marketing and on-chain expert at Santiment, if transaction volume continues to increase, it would be a sign of increasing interest from large wallet investors or “big players” in the ecosystem.

Network activity and rise in unique addresses

The volume of unique addresses interacting on the Litecoin network has recently skyrocketed, hitting a one-year peak in the second week of May. While LTC price bottomed, addresses were scooping up the altcoin at a discount ahead of the halving event.

Active address count has decreased over the past week, but experts expect a rebound as the LTC20 halving event comes closer.

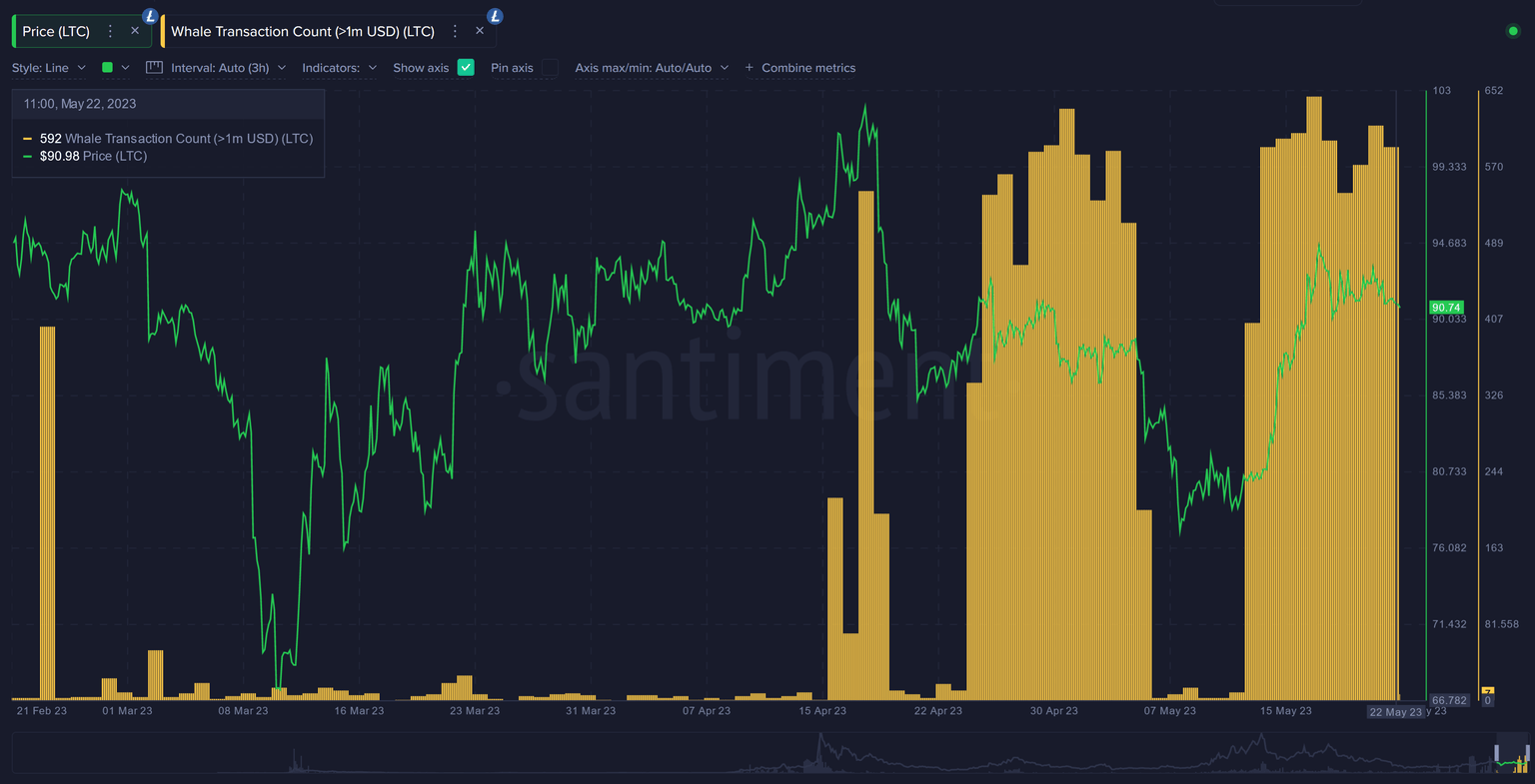

Whales likely to push Litecoin price to $100

Rising anticipation surrounding bullish on-chain metrics and the upcoming halving event likely mean that average trading returns on the short and mid term may cool down before a recovery, Quinlivan says.

Within two months of the halving event, around mid-June, Quinlivan expects a spike in traders’ anticipation surrounding LTC and argues that whales are likely to push its price to a $100 bullish target before a final dip or correction in the asset. Litecoin traded at around $91.8 at the time of writing, up 0.8% in the last 24 hours.

Litecoin whale transactions

Whales are likely to drive a Litecoin rally to $100 as there are waves of between 500 and 600 transactions exceeding $1 million in value on the LTC network, daily for a few days before declining 95% in the following week. This activity is typical of periods of accumulation, followed by profit-taking by whales on the Litecoin network.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.