Tempers are running hot in the latest round of Bitcoin FUD, but a longer-term perspective reveals “business as usual” for BTC.

Bitcoin (BTC) dived 17% when Tesla CEO Elon Musk criticized its energy consumption — but it’s already bouncing back.

On Thursday, fresh from its dip to $45,600, BTC/USD is trading above $51,000, having regained over half its lost ground.

With the drama still spreading, Cointelegraph considers why, on a fundamental level, Bitcoin is ultimately resilient to the actions of a single user — no matter how influential they are.

Proof-of-work doesn’t care

Bitcoin’s proof-of-work algorithm rewards both miners and investors over time because their years of work make the network stronger.

The longer Bitcoin continues, the less likely it is to succumb to an attack or see its participants leave the network for a different cryptocurrency.

This is precisely why Bitcoin continues to be the cryptocurrency of choice with competition — as many argue, no altcoin can “do Bitcoin” like Bitcoin.

When it comes to Musk, however, proof-of-work is significant for another reason. Just because one prominent investor changes their mind on Bitcoin’s merits and the price drops, miners have no added incentive to quit the network or cash out.

This aspect of “network effect” means that Musk ultimately provides Bitcoin with good rather than bad publicity — as even price shows, his words and actions do not change what Bitcoin is or what it is capable of.

“Why is proof-of-work crucial for bitcoin? Because a valid hash (PoW) is how P2P nodes know that a block is valid, without needing a server or trusted third party,” PlanB, creator of the stock-to-flow family of Bitcoin price models, commented on the phenomenon.

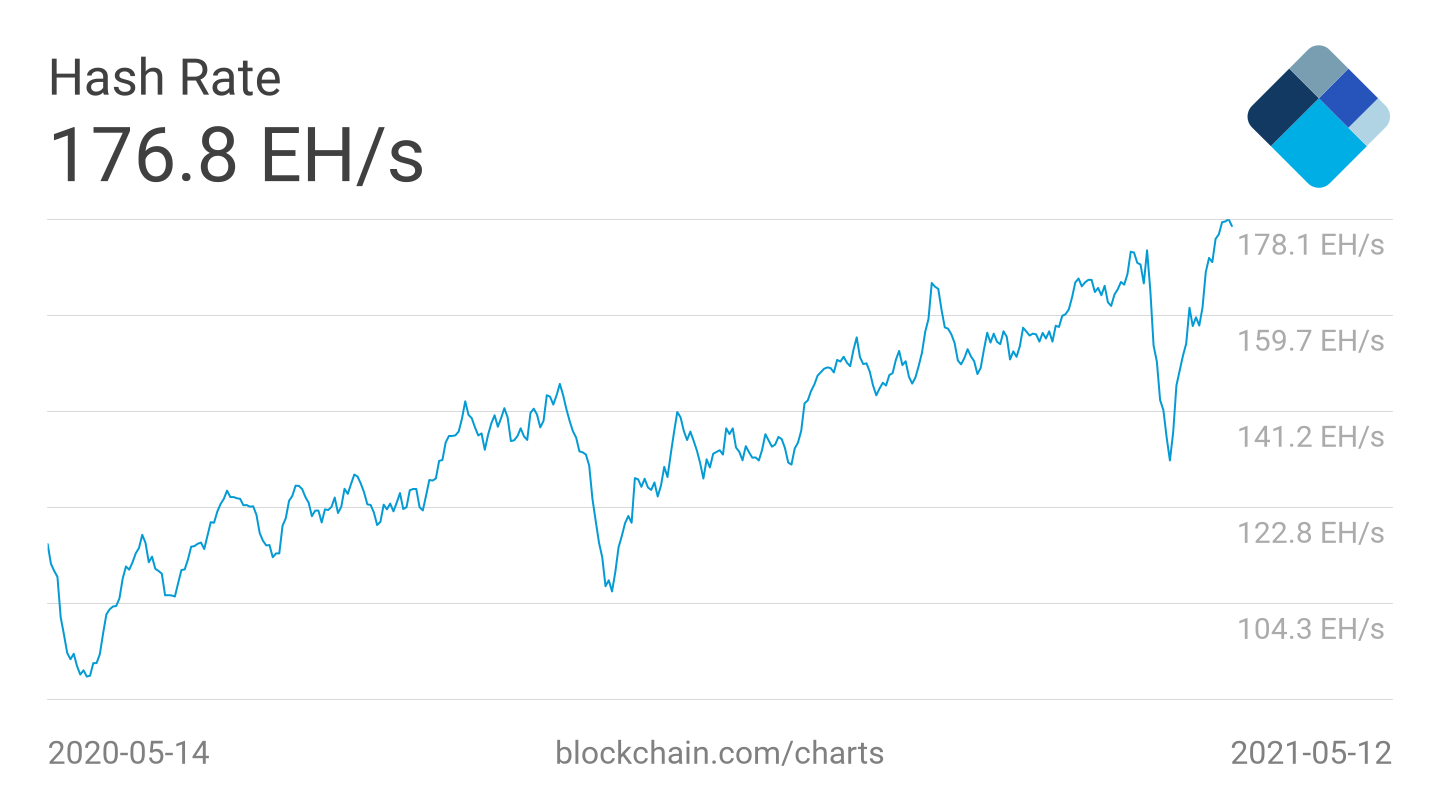

Bitcoin 7-day average hash rate 1-year chart. Source: Blockchain.com

Bitcoin 7-day average hash rate 1-year chart. Source: Blockchain.com

Price trends don’t care

Despite its abrupt dive after Musk’s words, Bitcoin’s recent price action speaks more to its resilience to criticism than its susceptibility.

In the event, BTC/USD spent a mere two hours in decline before reversing and holding higher levels. Not just that, but the dip also fits with regular price behavior seen this year and did not even violate any longer-term price trends.

A particularly important level that has characterized the 2020–2021 bull run has been the 21-week exponential moving average (EMA). Analysts have said that this level would dictate the price floor during dips — it even held during the previous bull run peak in 2017.

This time, Musk likewise failed to topple the indicator, and the brief wick to $45,650 was extinguished when it met the 21 EMA on the way down.

BTC/USD 1-week candle chart (Bitstamp) with 21-week exponential moving average. Source: TradingView

Bitcoin energy “consumption” doesn’t care

As ever with Bitcoin, it pays to zoom out.

Once the dust settles on Musk’s individual energy criticism, the wider “debate” on how eco-friendly Bitcoin is will continue in his wake. Most of the common accusations, however, have been long debunked as short-sighted and lacking evidence.

Just last week, Michael Saylor, CEO of major Bitcoin hodler MicroStrategy, gave a public interview, in which he reinforced the lack of merit inherent in claims that Bitcoin is “bad” for the environment.

Responding to Musk, he called Tesla’s decision to stop accepting Bitcoin for payments “ironic.”

“Ironic because no incremental energy is used in a bitcoin transaction,” he wrote on Twitter.

“The energy is used to secure the crypto-asset network, and the net impact on fossil fuel consumption over time will be negative, all things considered.”

Expanding one’s time horizon is thus essential to understanding why Bitcoin is worthwhile. As Saifedean Ammous, author of the popular book The Bitcoin Standard, often mentions, having a “low time preference” allows a BTC investor to understand that rejecting sound money for reasons such as the environment ends in more energy wasted on unsound alternatives.

This time, Ammous did not mince his words.

“Unless you’ve also switched your rockets and battery manufacturing to ‘more sustainable energy’ you’re going to look like a clueless big hypocrite here,” he tweeted, alluding to Musk’s other company, SpaceX.

“The world needs sound money far more than it needs your rockets & government-subsidized electric cars.”

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

TRON gains 10% in 2024, supply of stablecoins reaches over $50 billion in Q1

TRON, a blockchain-based digital platform, has seen positive growth in the first quarter of 2024, as seen in a Messari report. TRON noted gains across several metrics like market capitalization, revenue and total value locked.

XRP hovers near $0.50 as Ripple CTO addresses concerns related to stablecoin launch

XRP is hovering near $0.53 on Friday, spending nearly all week below $0.55. Ripple CTO David Schwartz addressed concerns on stablecoin and XRP utility on Thursday.

Terraform Labs set to restrict access for users in the US after recent ruling in SEC lawsuit

Blockchain company Terraform Labs said Thursday that it will restrict access to some of its products and services for US-based users as it expects to receive a court order soon in light of its legal battle against the US Securities and Exchange Commission (SEC).

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.