This is why a mere 15% rally in Lido DAO price could be a game-changer for LDO holders

- Lido DAO price took a slight hit over the past 24 hours to decline by around 10% to trade at $2.15.

- Investors' supply of over $300 million worth of LDO awaits a trigger for profits at $2.50.

- The altcoin shares a negative correlation of -0.09 to Bitcoin that might prove to be in its favor.

Lido DAO price is following the rest of the market due to the regulatory events that transpired in the last few days. However, the DeFi token is generally unlikely to pursue the path set by any other cryptocurrencies, including the likes of Bitcoin. This might play in favor of LDO.

Lido DAO price had a setback

Lido DAO price did take a 10% hit in the past 24 hours, but a recovery may not be far away for the cryptocurrency. The reason behind this is that the Moving Average Convergence Divergence (MACD) indicator is the only instance in some of the top cryptocurrencies not to observe a bearish crossover. The MACD line (blue) is still keeping above the signal line (red), which suggests that there is some bullishness still left for the altcoin.

LDO/USD 1-day chart

This is crucial for Lido DAO price as the liquid staking protocol token needs to recover soon in order to flip its losses into support again. A demand wall for more than 146 million LDO is present at $2.35, the average price at which they were purchased. In order to ascertain absolute profits, though, the price needs to touch $2.50, which is the upper limit of the demand wall range by noting a 15% rise.

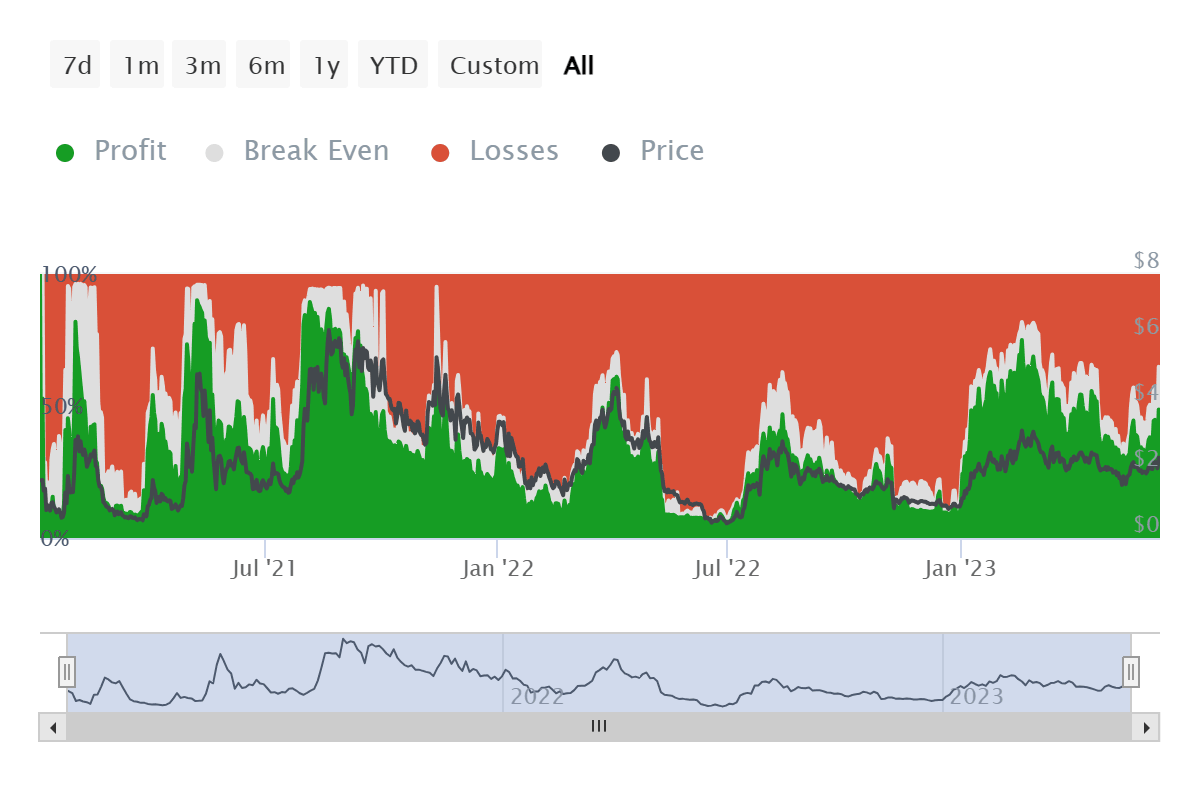

Lido DAO GIOM

The resultant profits would be worth over $300 million for about 5.55k addresses and also act as a trigger for further increases in price. At the time of writing, Lido DAO holders stand to be some of the most profitable investors, with more than 45% of all addresses safe from losses. This figure would further increase once the demand wall is also breached.

Lido DAO investors in profit

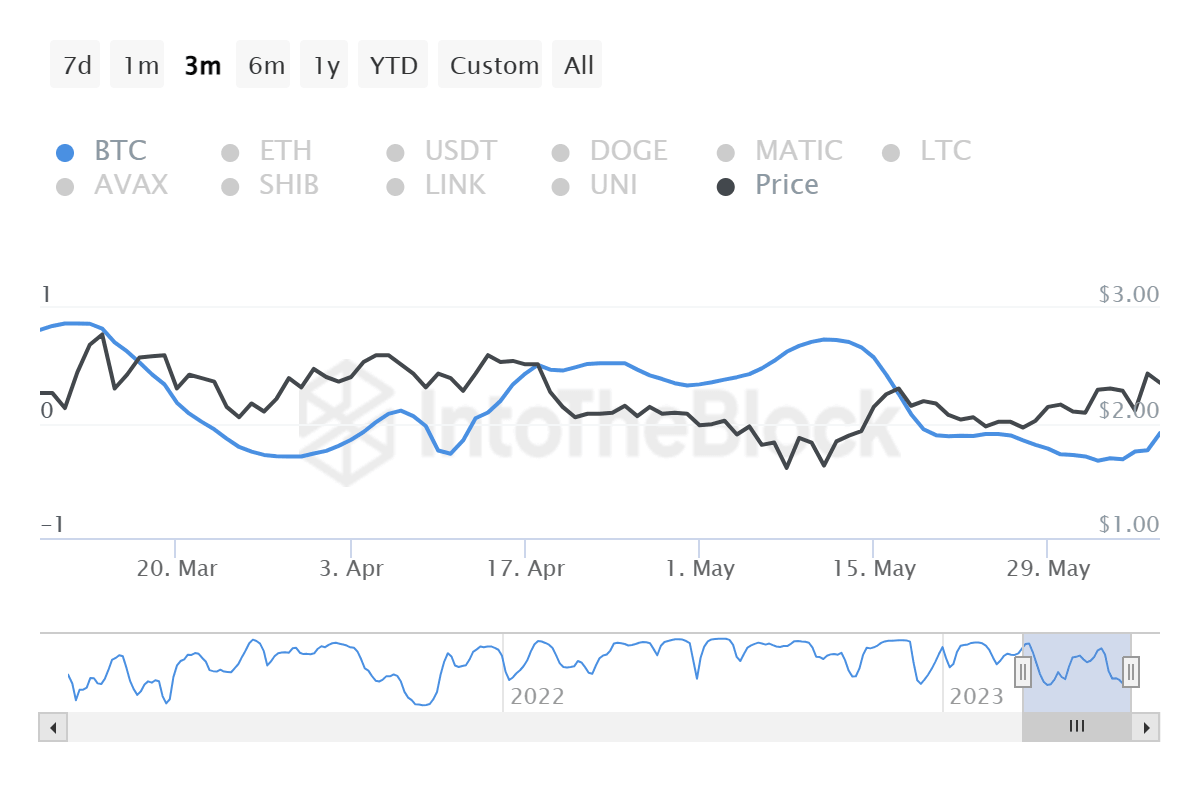

Bitcoin might prove to be of huge help here as LDO shares a negative correlation with the biggest cryptocurrency in the world. Even before the 10% crash in the case of Lido DAO price, the coin was trending upwards while BTC was facing red candlesticks over the week. Thus the negative -0.09 correlation might help the altcoin if Bitcoin price was to slip on the charts.

Lido DAO correlation with Bitcoin

However, should BTC trend upwards, the resulting price movement for LDO may not be as helpful in achieving profits as one may expect.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.