Tezos price is prepared for a nice bounce to $5 as indicators turn bullish

- Tezos price has defended a critical support level and aims for a rebound.

- The digital asset is on the verge of a significant breakout towards $5.

- Several indicators have turned in favor of Tezos in the short-term.

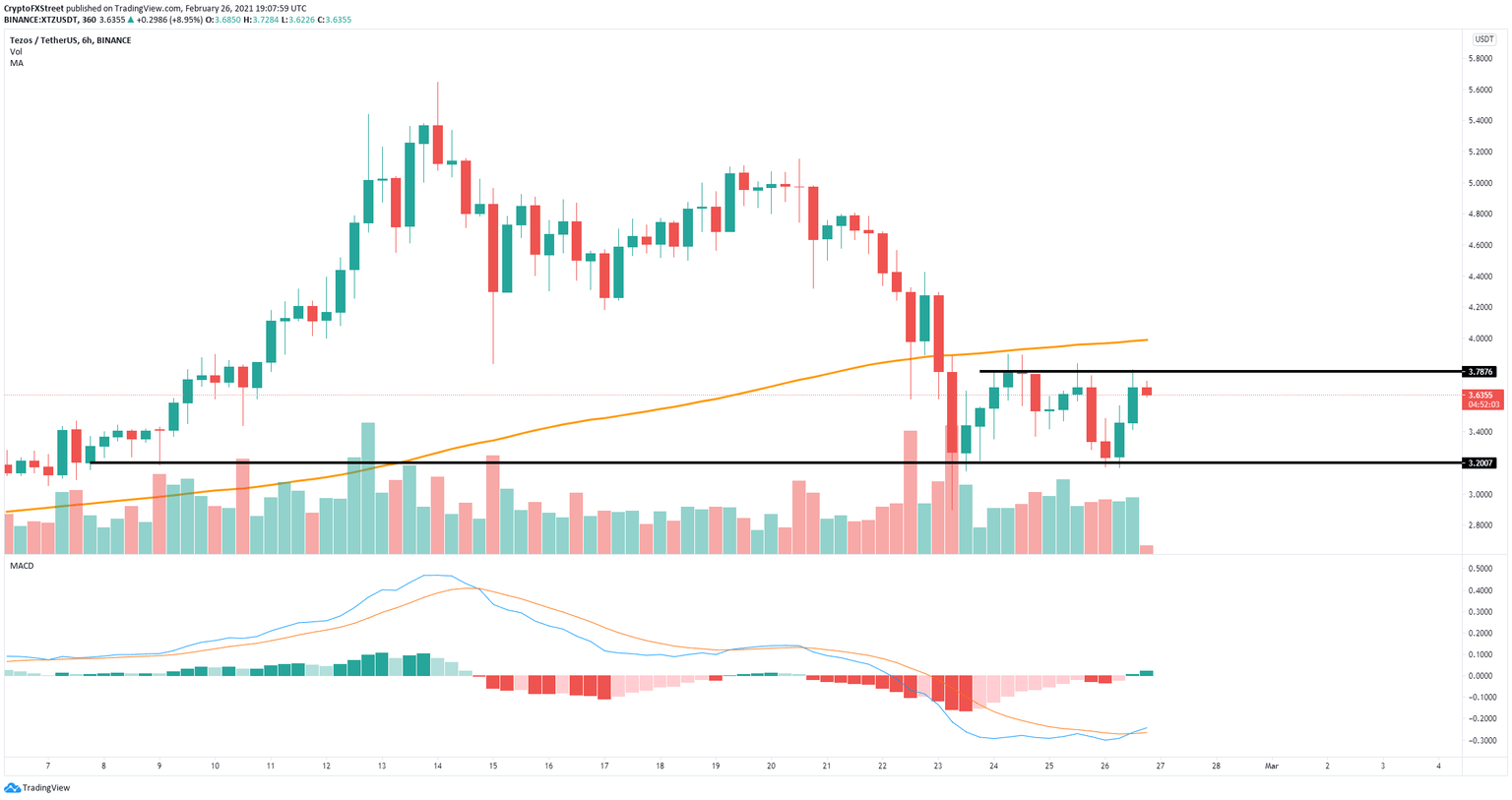

After a significant sell-off, XTZ bulls managed to hold its price above a key support level at $3.2. Several indicators show that the digital asset is poised for a leg up above $4 in the short-term.

Tezos price on its way to new highs in the short-term

Tezos has defended a crucial support trendline established at $3.2 and aims for a rebound towards $5. The next resistance barrier is located at $3.8, which means that a breakout above this point should swiftly push Tezos price towards $5.

XTZ/USD 6-hour chart

There is additional resistance at $4, which is a psychological level, and the 50-SMA. The MACD has also just turned bullish for the first time since early February, adding credence to the bullish potential bounce to $5.

On the other hand, if XTZ gets rejected from the top trendline at $3.8, it can quickly drop towards the previous support level at $3.2. Losing this point would drive Tezos down to $3.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.