Tezos price hints at steepening recent crash through retest of $1.33

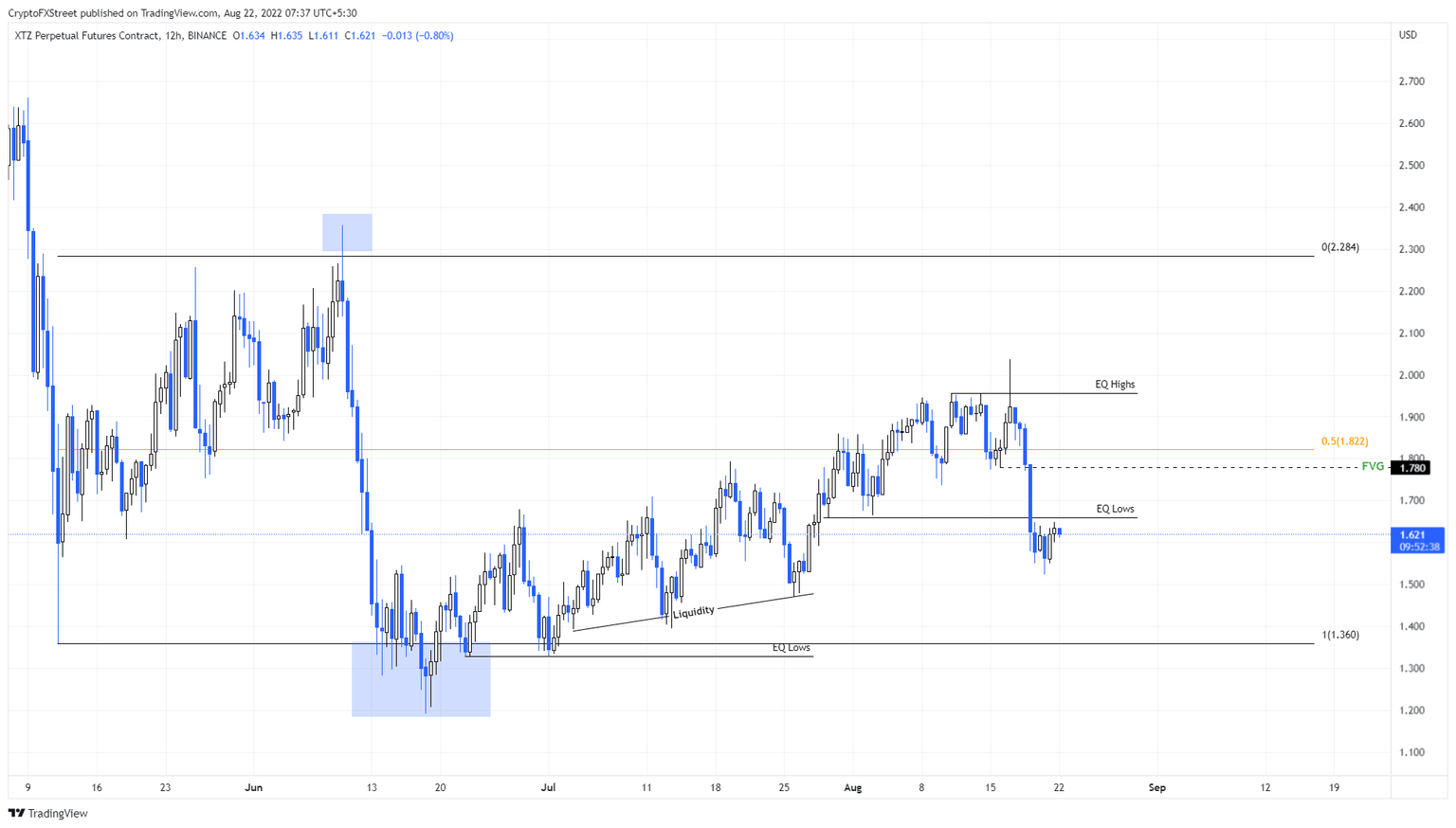

- Tezos Price has collected liquidity resting above $1.95 and $1.66 levels, as discussed in the previous article.

- Now, investors can look at the liquidity resting below July swing lows and equal lows formed at $1.33.

- If a recovery rally takes place first, then investors can expect Tezos to revert to the mean at $1.78 before a down move.

Tezos Price has created a shift in the market structure and is currently favoring the bears. After weeks of higher highs and higher lows, XTZ recently produced a lower low and could potentially continue doing the same, but investors need to be cautious of mean reversion.

Tezos Price and mean reversion possibility

Tezos Price had created equal highs at $1.95 and equal lows at $1.66, making it an easy target for market makers to push the price to their liking. As discussed in a previous article, these liquidity points were swept, resulting in a 20% crash.

As XTZ price hovers around $1.62, investors need to take a step back and read the big picture. Tezos is still inside the range extending from $1.36 to $2.28 it created in early May 2022. A look at the lower limit reveals that there are three distinctive higher lows created in July and equal lows at $1.33.

If the bearish trend continues, a sweep of $1.33 seems likely. In such a case, investors can expect an 18% crash. However, the better option for short-sellers would be to wait for a reversal from the current position to $1.78 or $1.82. Since this mean reversion followed by a sweep of $1.33 could result in a 27% sell-off.

XTZ/USDT 1-day chart

On the other hand, if Tezos Price flips the $1.82 barrier into a support floor, investors should be cautious of a potential reversal in the trend. However, a daily candlestick close above $1.95 or roughly $2.00 will invalidate the bearish thesis and indicate the resumption of an uptrend.

In such a case, market participants can expect XTZ price to revisit the range high at $2.28.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.