Tether's 40% surge on exchanges to $10 billion hints at bullish momentum

- Tether's exchange reserves have surged to $9.99 billion, indicating potential crypto buying.

- USDT's surge in exchange reserves highlights investor moves to safeguard capital in the face of market volatility.

- Despite the growth of Tether (USDT), the stablecoin market cap has been on a declining trend, suggesting a bearish market outlook.

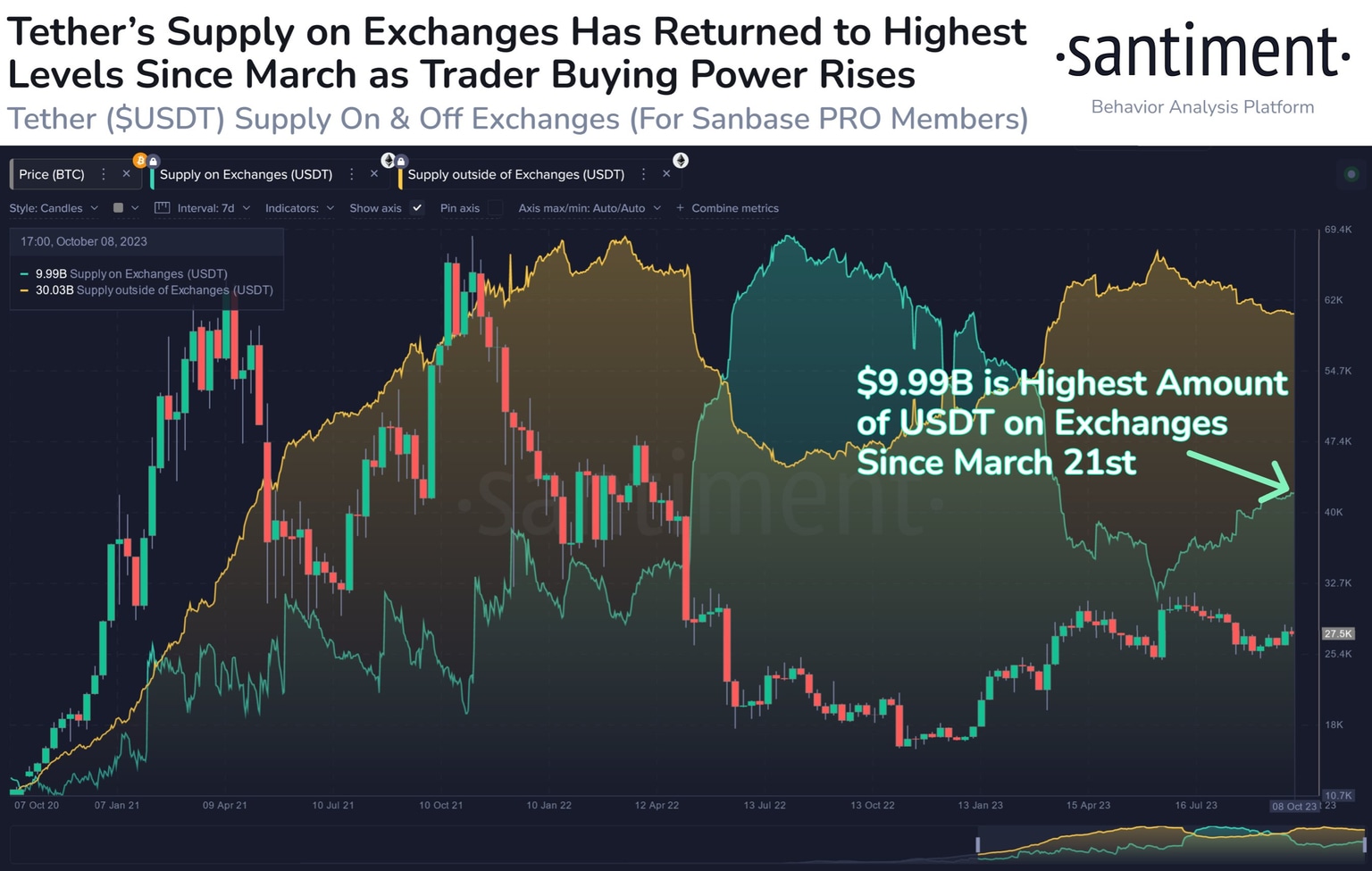

Tether (USDT), the largest stablecoin by market cap, has witnessed a significant surge in its exchange reserves. Santiment, a prominent crypto data provider, noted that the amount has reached $9.99 billion. This surge, marking a seven-month high, can translate to bullish sentiment.

Tether (USDT) reserves rise to $9.99 billion

The surge in USDT holdings on exchanges underlines selling pressure for the largest stablecoin. The trend often translates to conversion by buying riskier crypto assets.

Tether exchange supply

A closer look also reveals that while USDT has been in demand, the overall stablecoin market cap has been on a steady decline. A report by Binance recently found that the stablecoin market cap has shrunk for 18 consecutive months to a September low of $123.8 billion. At the time of writing, the cumulative stablecoin market cap remains in the same bracket.

The decline can be attributed to the uncertain regulatory climate and the bearish outlook that has permeated the market. However, USDT market capitalization has been the largest at $83.5 billion.

Opposing market trend by capitalization decline

Santiment highlights that USDT holdings on exchanges have seen a 40% increase since June. Another indicator that trading activity in the crypto sector can intensify is investors are laying low with USDT instead of any of a number of volatile digital assets.

This is done to safeguard capital erosion during market weakness. Especially when the crypto market has recorded double-digit erosion in market capitalization across all cryptocurrencies in the last week, based on CoinGecko research. However, USDT reserves on exchanges metric can promise buying pressure on various crypto assets, leading to a broader market upturn. Meanwhile, Tether supply outside of exchanges comes to $30 billion, as per Santiment.

The news also comes at a time when Coinbase director Conor Grogan tweeted about Alameda Research's controversial relationship with Tether. The cryptocurrency trading firm with ties to the FTX bankruptcy reportedly redeemed $38 billion worth of Tether (USDT) tokens in 2021, said Grogan. However, Alameda may not have possessed a corresponding amount in assets under management, suggested by the allegation.

Onchain data shows that Alameda was responsible for minting $39.55B of USDT, a number that is 47% of Tether's circulating supply today

— Conor (@jconorgrogan) October 9, 2023

A previous report by Protoss estimated the number at around $36.7B; I was able to update these figures with additional wallets I found pic.twitter.com/fYBvGAYlFd

While the surge in USDT reserves on exchanges appears to signal heightened crypto buying pressure, it occurs with declining stablecoin market capitalization driven by regulatory uncertainties and a bearish market outlook. These opposing market forces require investors to brace for volatility.

Author

Shraddha Sharma

FXStreet

With an educational background in Investment Banking and Finance, Shraddha has about four years of experience as a financial journalist, covering business, markets, and cryptocurrencies.