Tether reserves on exchanges hit $8.99 Billion, demand on exchanges could explode

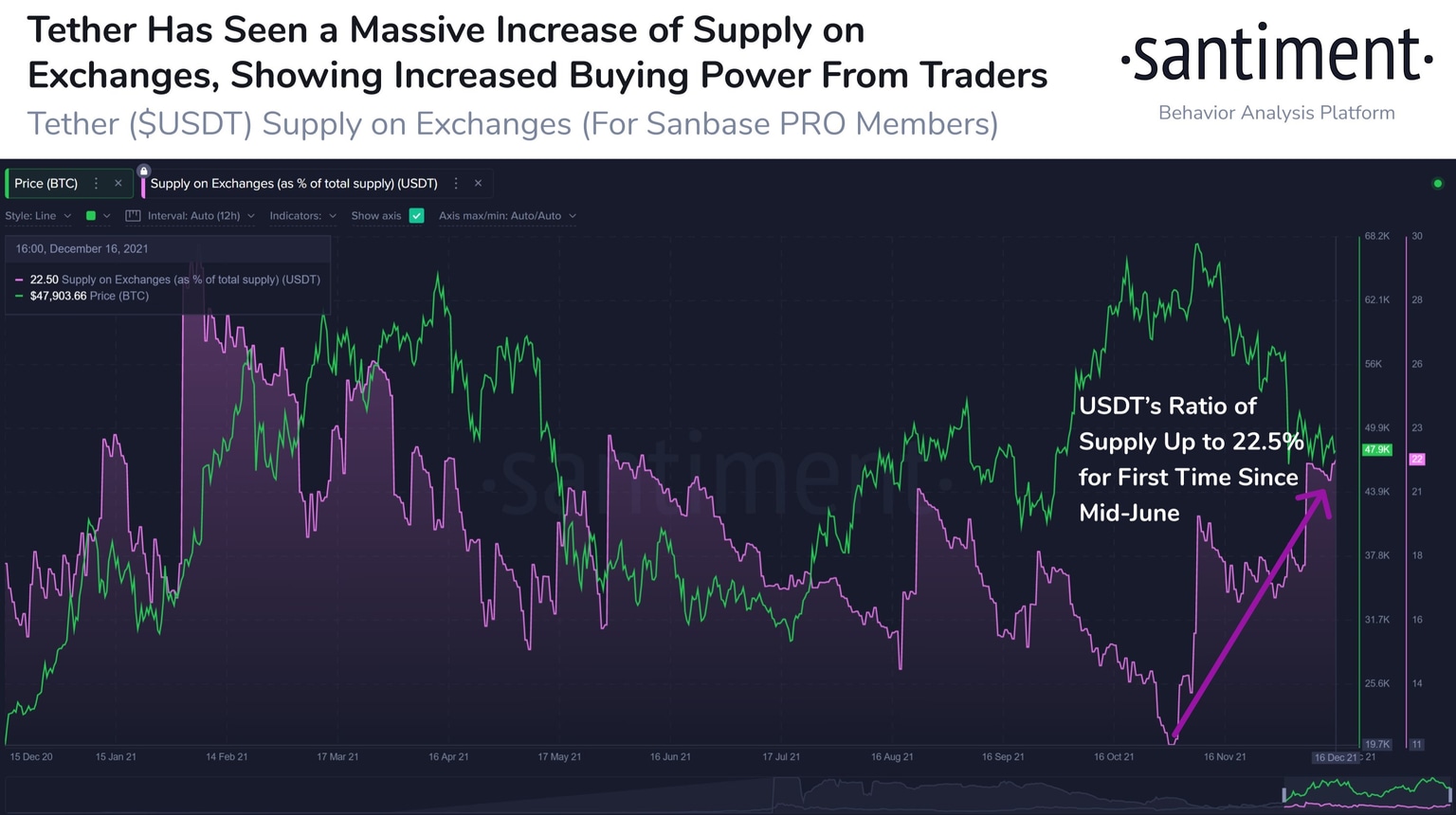

- Tether supply on exchanges hit a peak of $8.99 Billion, indicating a rise in the buying power of traders.

- The ratio of Tether is now 22.5% across crypto exchanges, the highest level in the past six months.

- Tether recently responded to Myanmar’s shadow government's acceptance of the stablecoin as currency, calling it a bold move.

- Spike in Tether balance across exchanges is considered a sign of increased demand from investors, new traders entering the crypto ecosystem.

Tether is considered a bridge from fiat to cryptocurrencies for new investors. A spike in the stablecoin reserves across exchanges could mean a rise in buyers.

Tether reserves on exchanges hit peak, signal rising demand

Based on data from crypto intelligence firm Santiment, Tether reserves on exchanges have increased. Tether supply worth $8.99 Billion is on crypto exchanges. Tether stablecoin ratio on exchanges has crossed 22.5%, the highest level over the past six months.

Tether supply increased on crypto exchanges

The accumulation of Tether on exchanges has historically indicated an increase in buying power or demand. Proponents expect the current spike in Tether balance to drive the demand for cryptocurrencies higher.

Tether’s utility has increased with the acceptance of the stablecoin as an official currency for Myanmar’s shadow government. In response to the acceptance of USDT by Myanmar’s National Unity Government of the Republic (NUG), Tether’s blog reads,

The fact that it [NUG] has chosen to recognize USDT as an official currency is a commendation to the strength of the US dollar and its ability to provide a safe haven to citizens of the world.

Despite criticism from US Senator Elizabeth Warren, demand for Tether has increased across cryptocurrency exchanges based on Santiment data.

Senator Warren criticizes stablecoins and believes that they pose a risk to the economy. Directing capital inflow to DeFi, a sector where investors are least protected from scams. The Senator has called for a clampdown on stablecoins.

Stablecoins pose risks to consumers & to our economy. They’re propping up one of the shadiest parts of the crypto world, DeFi, where consumers are least protected from getting scammed. Our regulators need to get serious about clamping down before it is too late. pic.twitter.com/hMOT1HIQgn

— Elizabeth Warren (@SenWarren) December 14, 2021

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.