Terra co-founder Do Kwon flees to Serbia to avoid arrest, say Korean officials

- Terra founder Do Kwon is in Serbia, according to Korean officials investigating the collapse of Terra Labs and its token LUNA (aka LUNC).

- The Korean Ministry of Justice is seeking help from Serbian officials.

- Luna Classic price hovers around $0.000166.

_XtraLarge.jpg)

Terra Labs founder Kwon Do-Hyung is in Serbia, as reported by a local media Chosun. The report says that Do Kwon avoids arrest by Korean officials who believe he has fled to Serbia.

Korean officials zero in on Do Kwon

According to Korean investigation authorities, Terra Labs founder Do Kwon is currently in Serbia. The official added, “Recently, we obtained intelligence that CEO Kwon was in Serbia, and it was found to be true.”

Interpol has already issued a Red notice on the founder and is seeking help from authorities worldwide to arrest Do Kwon. Seoul Southern District Prosecutor's Office's Financial and Securities Criminal Unit is looking to arrest the founder on charges of providing false information to investors, which led to losses in billions of US dollars to participants around the world.

However, the Terra Labs founder has previously mentioned on his Twitter account that he was not on the “run” or avoiding arrest and has “nothing to hide.”

I am not “on the run” or anything similar - for any government agency that has shown interest to communicate, we are in full cooperation and we don’t have anything to hide

— Do Kwon (@stablekwon) September 17, 2022

Luna Classic price struggles to inflate

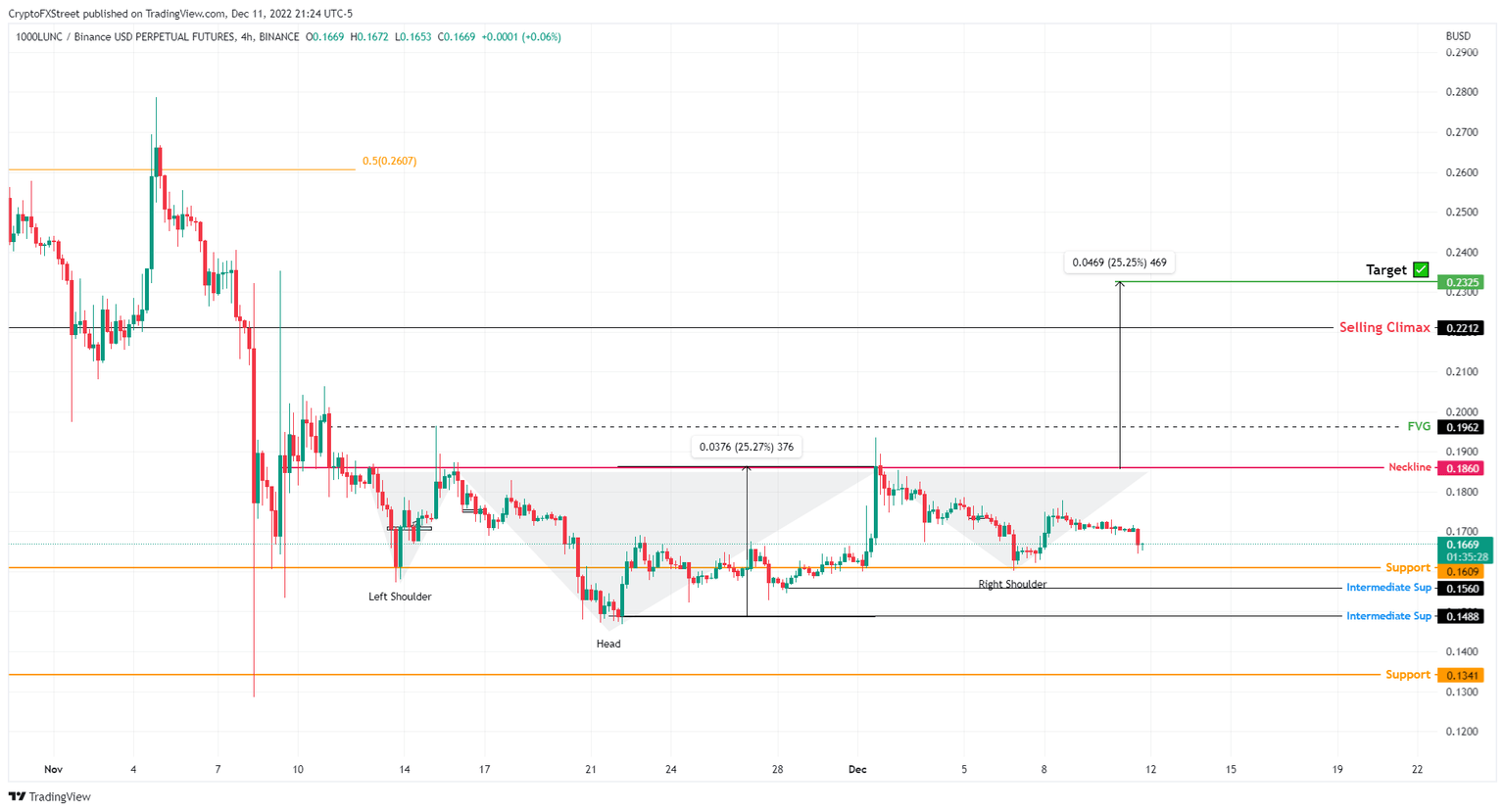

Luna Classic price previously showed an inverse head-and-shoulders formation on the four-hour chart. However, the recent drop in Bitcoin price has caused LUNC to delay its breakout.

From a technical point of view, a decisive breakout above the neckline at $0.000186 forecasts a 25% upswing to $0.000232.

LUNC/USDT 4-hour chart

If the selling pressure continues to build up, knocking Luna Classic price to produce a four-hour candlestick close below $0.000160 will invalidate the bullish thesis. In such a case, LUNC could slide lower and retest the $0.000156 and $0.000148 support levels.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.