Terra Classic supporters want USTC peg to the dollar restored, a bullish catalyst for TerraUSD price

- Terra Classic supporters have proposed a plan to re-establish USTC's peg with US dollar.

- A community member, "Redlinedrifter," submitted the proposal with key insights about TerraUSD.

- While it's not the first move by Terra community to revamp the stablecoin, USTC surged around 10% on the news.

TerraUSD (USTC), the famous algorithmic stablecoin that has since been renamed from UST, depegged from the US dollar around a year ago, causing the Terra ecosystem to collapse in its wake. In the latest development, suppers of the Terra Classic blockchain are devising a plan to revive the ecosystem by restoring its attachment to the USD.

Terra Classic community to restore USTC peg

In a recent proposal from a Terra Classic community member going by 'Redlinedrifter', the Terra Classic blockchain advocate is among those looking to revive the ecosystem of the algorithmic stablecoin by restoring the USTC token's value parity to the USD.

Focusing on "USTC incremental re-peg, buybacks, staking, and swaps," the proposal headlines:

USTC Repeg and Revitalisation of the Terra Classic Ecosystem through the Implementation of an Algorithmic Peg Divergence Fee & Buyback Protocol, Unidirectional Swaps and USTC Staking.

In the proposal, Redlinedrifter affirmed that while Do Kwon's decentralized money creation was a positive initiative, "serious issues need to be addressed" for the community to re-establish the token's value peg with the USD.

Further, Redlinedrifter suggested the "Divergence Protocol" idea. Notably, the working mechanism of this protocol is that it "applies an algorithmic/dynamic fee equal to the difference between the peg and the market price." Accordingly, the innovative mechanism would implement a dynamic fee structure to impose a fee relative to the deviation between the $1 peg and the token's market value.

The divergence fee structure represents a new strategy for addressing previous challenges that prevented the USTC stablecoin's ability to maintain its USD peg. Redlinedrifter concludes the proposal by saying:

I believe this proposal outlines an approach to revitalizing our ecosystem in an equitable manner that will appeal to both USTC and LUNC holders.

The proposal is up for discussion for a week on Agora before the community member submits a signaling prop to proceed. Below is a representation of the amount of engagement received.

Not the first time

Efforts by the Terra community to revamp Do Kwon's stablecoin idea are not new. In October 2022, they introduced a new "soft-pegged stablecoin" concept built atop the Terra Phoenix network through a whitepaper.

TerraUSD price reacts with a 10% uptick

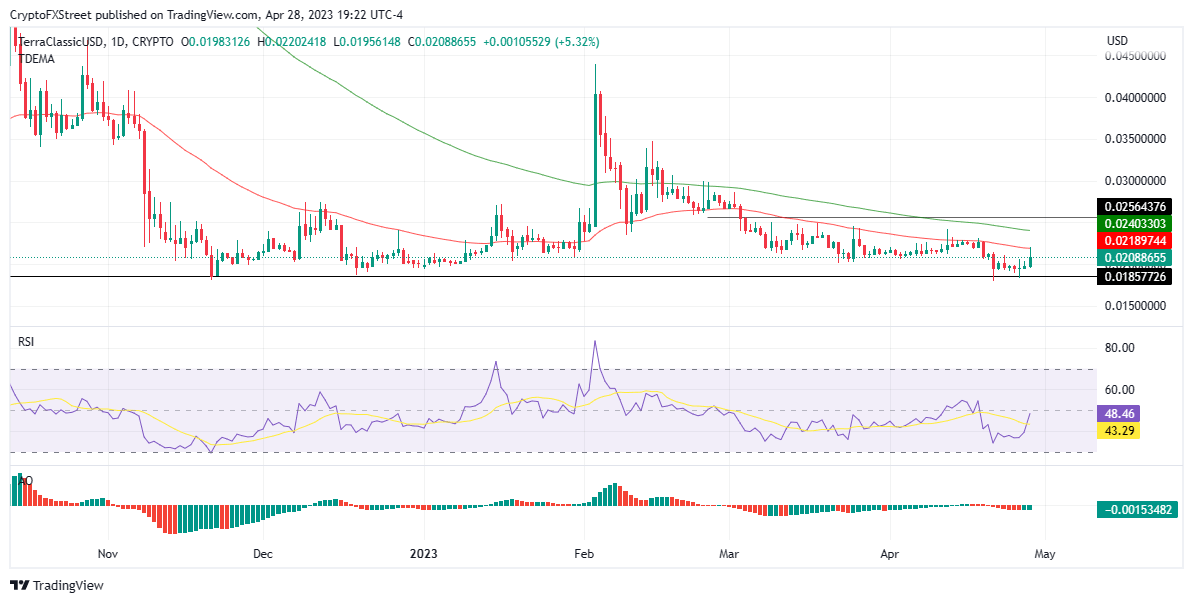

TerraUSD (USTC) price has reacted to the proposed development with a surge of around 10%, rising from $0.019 to an intraday high of $0.022 on Friday before falling back to the current price of $0.020. An increase in bullish momentum could solidify the uptrend for the once-stable token.

If the northbound move sustains, TerraUSD price would soon flip the 50-day Exponential Moving Average (EMA) at $0.021 into support. Sidelined investors coming in at this level could bolster the uptrend, leading USTC to the 100-day EMA at $0.024.

In a highly bullish case, TerraUSD price could soon tag the $0.025 resistance level, denoting a 20% ascent from current levels.

The upward move by the Relative Strength Index (RSI) also supports the bullish thesis, indicating a newly found price strength as traders embrace USTC. Further, the RSI had just sent a bullish signal when it crossed above the Stochastic RSI on April 28. Traders heeding this call to buy USTC could increase chances for a further upside.

USTC/USD 1-day chart

On the flip side, if investor interest in USTC wanes, TerraUSD price could face a rejection and pull back toward the $0.018 support floor.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.