Technical weekly – There is nothing either good or badbut thinking makes it so

In brief

BTC reclaimed the psychological 10000 levels again on Tuesday Asia; altcoins were mostly in the green.

Technical indicators show that BTC may be started to play the catch-up game, with sentiment remained mostly positive.

ETH still under the altcoin spotlight as the price of the second-largest crypto reached 250, while ADA and LTC were also in focus.

Market overview

The cryptocurrency markets were broadly in the green in the early Asia session on Tuesday, as traders and investors were cheered by the jumpof the BTC prices, which sent the leading crypto back above the key 10000 levels, reaching a fresh three-month high.

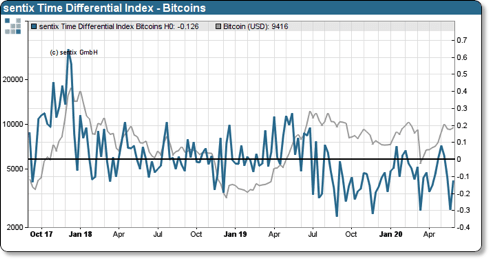

Markets may wonder whether if the current BTC rally could be continued at over 10000 levels, a survey shows that the positive sentiment remained intact. Sentix Bitcoin Time Differential Index measures the difference between the short-term sentiment and the medium-term perceptions, the Index reached -0.3 last week and slightly rebounded this week. Patrick Hussy, Managing Director at Sentix,said, "the strategic willingness to buy is coupled with a slight optimism in sentiment, which should lead to rising Bitcoins prices in the coming weeks.”

Figure 1: Sentix Bitcoin Time Differential Index (Source: Sentix)

Figure 2: BTC 25d Skew (Source: Skew)

Moreover, derivatives trading data may also support a BTC rally case. Data from Skew shows that BTC’s options skew remained in the negative territory (-8%), despite the number rebounded from the lows (-11.7%). A negative skew usually indicates the short-term volatility could increase and could favor a move on the upside. However, this could be only part of the picture; traders and investors probably don’t want to miss the rest of the derivatives trading data on the OKEx Dashboard by Skew.

Elsewhere, ETH continues under the spotlight, as the prices of the second-largest crypto have been testing the key 250 levels. NEO and ONT outperformed major altcoin, surged more than 8%. On the flip side, MKR and HBAR traded about 1% lower.

TRX is set to make a new product announcement next Monday, which could be a major focus for Tron watchers. Meanwhile, XMR’s technical conference MoneroKonis expected to start in the middle of the month. The annual event is set to focus onprivacy and financial technologyissues.

Price Analysis

BTCUSDT – The beginning of a new rally?

BTCUSDT produced a positive breakout from the previous triangle pattern and reached a three-month high. Chart-wise, we believe that it could be the beginning of a medium-term rally.

The daily MACD just produced a bullish crossover, signaling the upside momentum has been building up, while the RSI still not in the overbought zone yet, suggesting there could be still room to allow more upside movements.

At the same time, we noticed that the difficulty ribbon had squeezed again, meaningsome of the miners could have capitulated. As the renowned analyst Willy Woo explained, the flip of the difficulty ribbon could signal the beginning of a bull run. Although how long will that squeeze last is another question.

We believe 10500 could still be a significant resistance level, and the pair may not be successfully reclaiming such levels with just one attempt. We think that the previous two highs at 10077 and 9955 could be essential in the short-term. If the reclaimof these two levels is confirmed, it could solidify the foundation for going above 10500.

Figure 3: BTCUSDT Daily Chart (Source: OKEx; Tradingview)

ETH/USD – Signs show bulls are getting tired?

ETHUSD produced an even more significant breakout from the previous triangle pattern, and the rally has been continuing since then. However, some signs were showing that the rally could start to get tired soon.

We see the MACD remained positive, meaning the upside momentum was still somewhat intact. However, the RSI has already been in the overbought zone,signaling that the bulls may need more consolidations before continuing.

Moreover, the two lines of the stochastic have mixed together in the overbought area, that could be another worrying sign for the ETH bulls, as that could also strengthen the case of the rally starting to get tired.

We believe that the Apr 30 high near 227 could be the first level to watch on the lower side, while Mar 8 high near 251 could be another area to watch.

Figure 4: ETHUSD Daily Chart (Source: FX Street)

ADAUSDT – Time to turn?

ADAUSDT has been boosted by the recent announcement of the upcoming Shelley hard fork, and the pair has been one of the best performing cryptosin the past seven days.

However, we believe the rally could be healthier if consolidation is materialized.

Momentum indicators may also strengthen the case of price consolidation, as the stochastic initially produced a bearish crossover in the overbought zone. At the same time, the RSI was deep in the overbought area.

Also, the ultimate oscillator was in a bearish divergence, with the price produced some higher highs, while the UO didn’t follow.

The ideal case would be a consolidation at current levels, instead of a retest of the support at the channelbottom near 0.057.

Figure 5: ADAUSDT Daily Chart (Source: OKEx; Tradingview)

LTC/USD – Sets to test 200 MA

LTC/USD is expected to test the 200-day moving average area, which is just below 50 currently, and near the upper resistance of the triangle pattern. This is also an area that is not tested since early March.

We believe the current lackluster momentum may not allow the price to go above such levels in the short-term, although the MOM has somewhat breakout from the downward channel.

Since the RSI is reaching the overbought levels, that reinforces the case of retesting the lower support of the triangle before producing a breakout.

Figure 6: LTC/USD Daily Chart (Source: FX Street)

Author

Cyrus Ip

OKEx

Cyrus Ip has the privilege to work with OKEx as a Research Analyst, where he found some of the brightest talents in the crypto space.