Synthetix price crash scare leads to liquidation from investors as open interest falls by 20%

- Synthetix price dipped by nearly 6.5% during the intra-day trading hours before recovering to trade at $2.7.

- Over the past 24 hours, the altcoin noted heavy liquidation from investors as Open Interest declined by nearly 20%.

- Most of the bearishness is likely from retail holders, as large wallet holders have added over 5 million SNX in the past ten days.

Synthetix price had an impressive run these past two weeks as the altcoin increased to hit a three-month high. However, in the last three days, SNX has posted red candlesticks, with July 26 almost observing a significant decline. This fear of losses was reflected in the investor's behavior.

Synthetix price almost declined

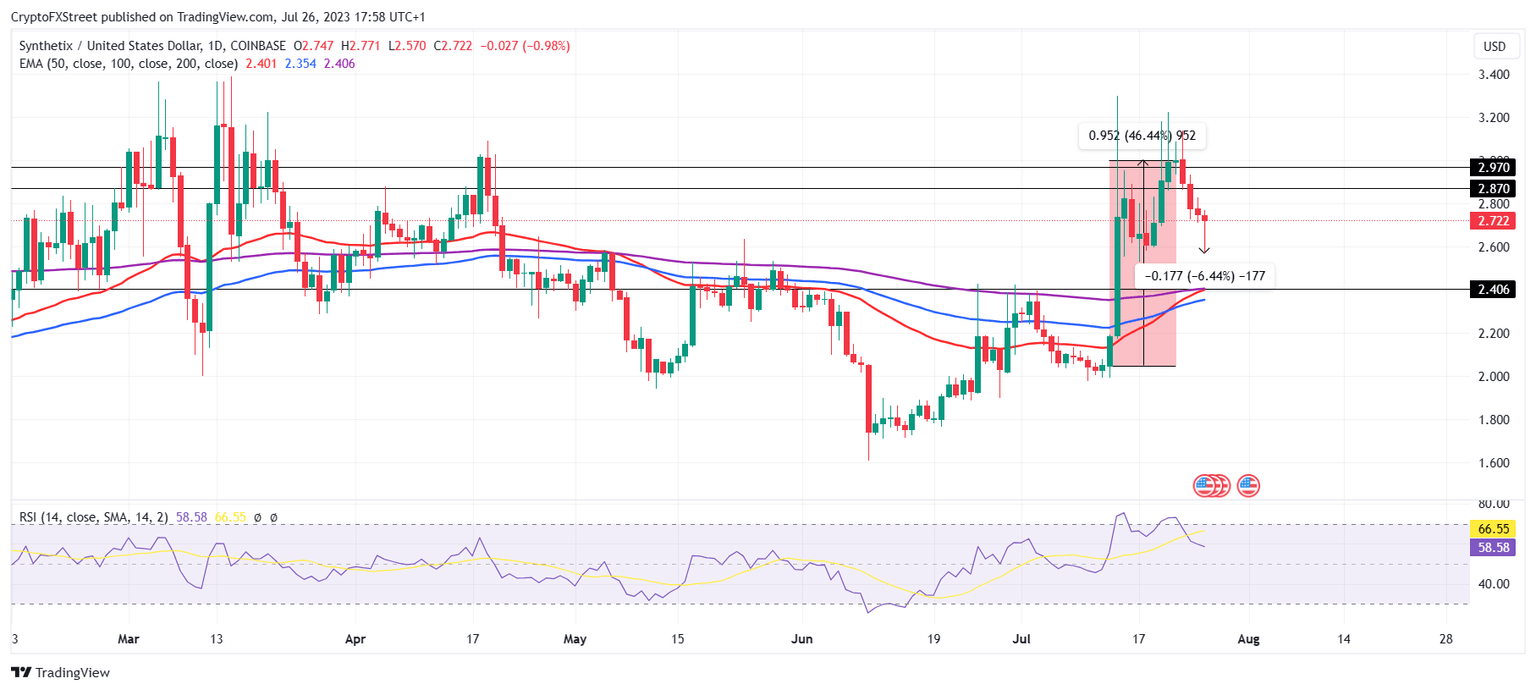

Synthetix price, trading at $2.7, fell by more than 6.5% during the intra-day trading hours. The price drop was the result of the market cooling down, as earlier this week, the rally led to SNX being overbought. The Relative Strength Index (RSI) broke below the 70.0 threshold after being overbought, signaling the correction that ensued.

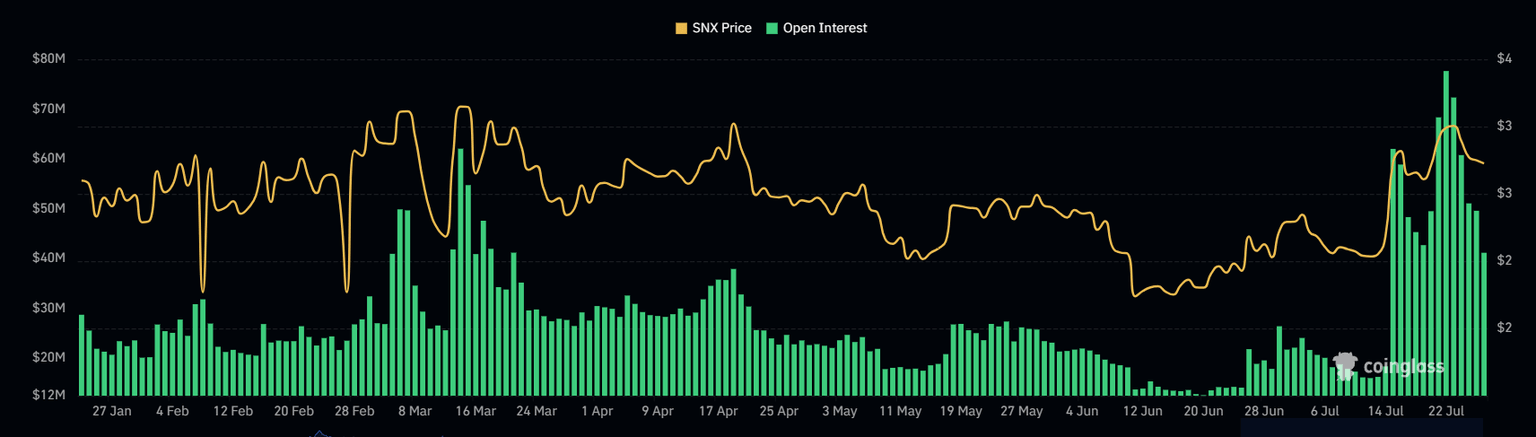

But today's volatility had a deeper impact on the cryptocurrency as it led to investors fearing losses and closing positions in the Futures market. Synthetix Open Interest fell by over 19%, removing more than $7.4 million from the market.

Synthetix Open Interest

This was the result of a few reasons. One is that investors manually liquidated their positions over the past 24 hours to offset any potential losses that might have occurred due to the price fall. Secondly, following the price drop, traders that were holding onto their short positions were liquidated in profits. And lastly, long positions noted forced liquidations due to the sudden decline. In line with the same, in the past day, SNX noted long liquidations worth more than $270,000.

Synthetix liquidations

Synthetix price thus has the potential to rally further and test the resistance levels at $2.8 and $2.9 before receding. As there is still some imbalance due to the sudden rally, SNX is likely to fill this by falling to test the support line at $2.4.

This level has not only been tested previously but also marks the collusion between the 50-day and 200-day Exponential Moving Averages (EMAs) making it a key support level.

SNX/USDT 1-day chart

Large wallet holders to prevent a crash

Interestingly, the price decline mostly impacted retail holders, who also potentially were the ones to close their positions today. Since July 15, large wallet holders - addresses holding between 100,000 SNX to 1 million SNX have observed an increase in their holdings.

This accumulation continued even as Synthetix price posted red candlesticks since July 22, with their holdings rising by 5 million SNX ($13.5 million) in the last ten days.

Synthetix large wallet holders holding

Thus their bullishness will likely offset any sudden decline in Synthetix price, as was observed today, and help in recovering any losses going forward.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B20.15.12%2C%252026%2520Jul%2C%25202023%5D-638259892933758698.png&w=1536&q=95)