Swipe Price Prediction: SXP targets $1.60 as it may have reached a bottom

- A bottom seems to be in place for Swipe, as bulls takeover.

- Big bullish breakouts confirmed on the 1D chart.

- Swipe traders eye massive upswing, with A focus on $1.60.

SXP/USD extends its five-day winning streak into Saturday, mainly driven by a chart-based buying-wave.

However, the news that Automated Clearing House (ACH), a US financial network for e-payments, is now supported in Swipe Wallet also collaborates with the upbeat momentum.

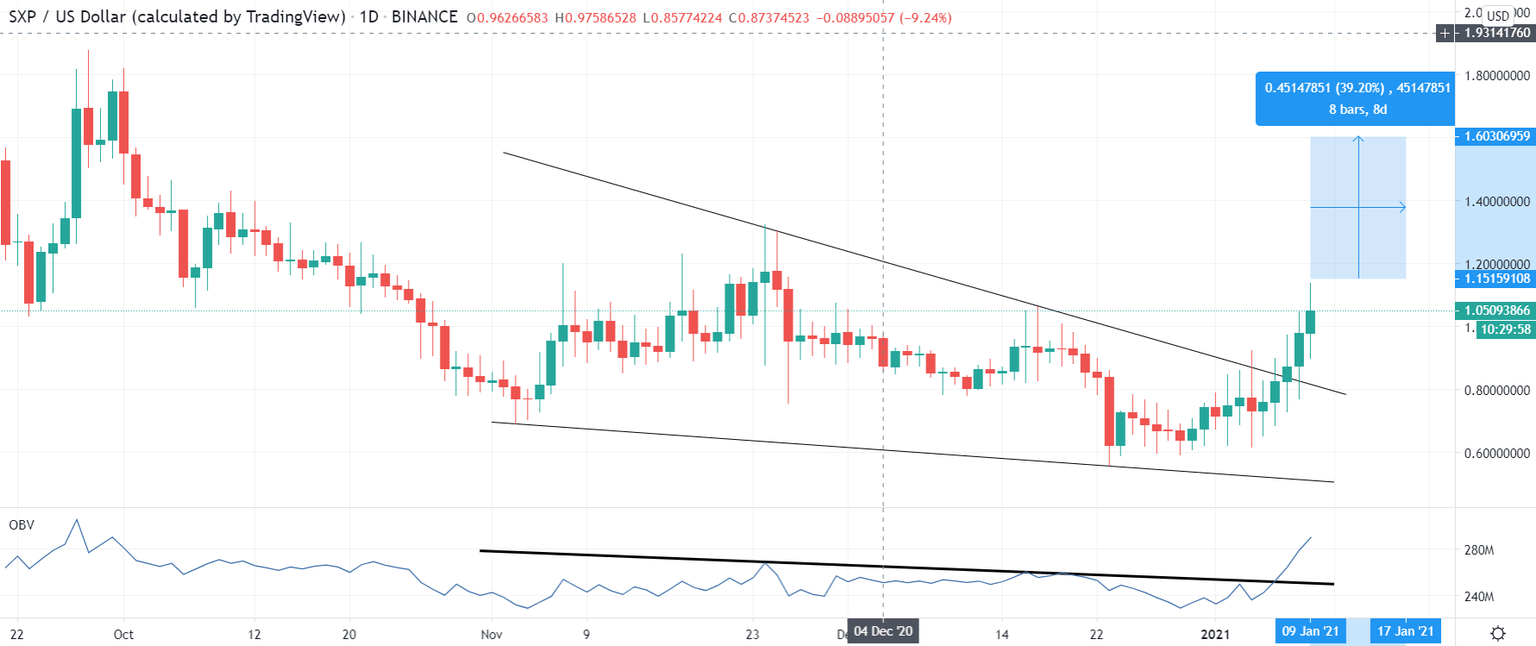

SXP/USD: Daily chart

From a short-term technical perspective, a bottom seems to have formed in SXP/USD after the downslide from mid-August 2020.

The price charted a falling wedge breakout on Thursday, opening doors for a recovery rally towards the measured target of $1.60.

The bullish breakout on the On-Balance-Volume (OBV) index added credence to the upside break. The indicator is usually used to track the trading sentiment of large and institutional investors, as it provides a running total of an asset's trading volume and indicates whether this volume is flowing in or out of a given security or currency pair, per Investopedia.

Meanwhile, the pattern resistance now support at $0.8232 will offer the first line of defense on any retracement. Traders could resort to dip-buying, with the next relevant support seen at the January 4 low of $0.7316.

All in all, Swipe’s path of least resistance appears to the upside.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.