Swipe Price Prediction: On-chain metrics show investors continue accumulating SXP despite rising prices

- The number of SXP coins inside exchanges has significantly decreased in the past month.

- Large investors are buying SXP even though the digital asset had a massive 100% rally in the last two weeks.

- Swipe price faces only one critical resistance level on the way up.

Swipe price had a significant 112% rally in the last two months reaching a new all-time high at $5.5. The digital asset’s bullish momentum remains strong as large investors continue to accumulate even more coins.

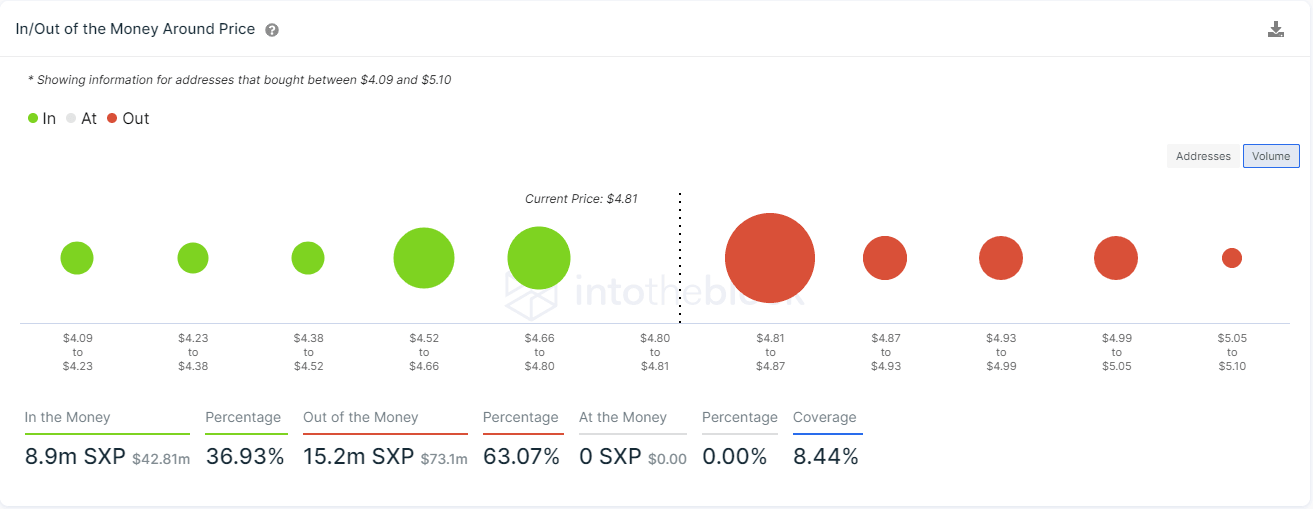

Swipe price is one barrier away from new all-time highs

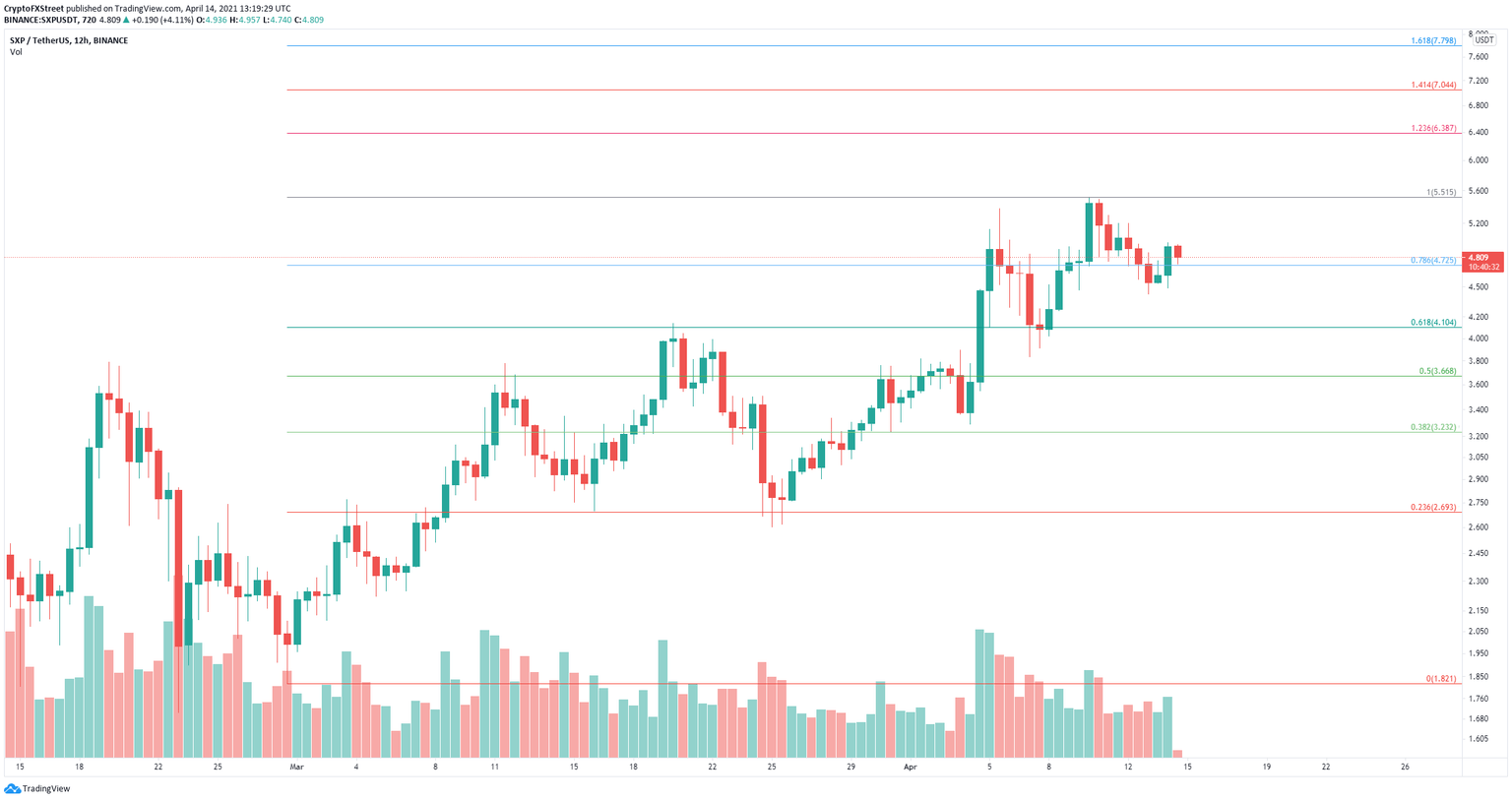

Although Swipe had a massive rally in the previous two weeks, the digital asset only faces one crucial resistance level ahead. The In/Out of the Money Around Price (IOMAP) chart shows that the area between $4.81 and $4.87 is the most significant with 11.3 million SXP in volume.

SXP IOMAP chart

Interestingly enough, the number of SXP coins inside exchanges has decreased notably since March 21, from 25.8% of the circulating supply to only 23.3% currently. This indicates that investors are not interested in selling and are holding Swipe.

SXP Supply on Exchanges

Additionally, the number of whales holding between 100,000 and 1,000,000 coins has spiked since the beginning of April by 15, adding credence to our theory above.

SXP Holders Distribution chart

If SXP bulls can push the digital asset above the key resistance area between $4.81 and $4.87, Swipe price can quickly jump toward the all-time high at $5.5. A breakout above this point should drive the digital asset at the 123.6% Fibonacci level ($6.38).

SXP/USD 12-hour chart

However, the IOMAP model also indicates that a breakdown below the most significant support level at $4.62 can push SXP down to the next level at $4.09, which coincides with the 61.8% Fibonacci retracement level

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B15.21.10%2C%252014%2520Apr%2C%25202021%5D.png&w=1536&q=95)

%2520%5B15.22.06%2C%252014%2520Apr%2C%25202021%5D.png&w=1536&q=95)