Stellar (XLM) sheds 7% after eye-popping gains

- XLM is losing ground after strong growth at the beginning of the week.

- The support is seen on approach to $0.0670.

Stellar, the 10th largest digital asset with the current market value of $1.5 billion, has been all over the place recently. On November 5, the Stellar Development Foundation (SDF) burned 55 million XLM tokens worth of $4.6 billion. The team explained thee move by thee desire to make thee network more efficient. The coin skyrocketed by more than 20% on response

However, the strong upside momentum proved to be unsustainable as the coin partially reversed the gains. At the time of writing, XLM/USD is changing hands at $0.0752, down 7% on a day-on-day basis. Notably, XLM hit $0.0667 low on Wednesday and thus erased all the gains related by the burn.

XLM/USD, the technical picture

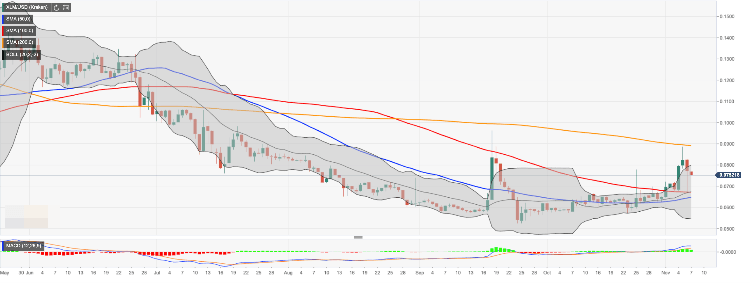

On the intraday charts, the critical support awaits us on approach to $0.0670. It is created by a confluence of SMA100 (Simple Moving Average) daily, the middle line of the daily Bollinger Band, and the lowest level of the previous day. Once it is out of the way, the sell-off is likely to gain traction with the next focus on $0.0650 (SMA50 daily) and $0.0570. This area limited the sell-off for the best part of October.

On the upside, we will need to see a sustainable move above $0.0800 for the upside to gain traction. This area is strengthened by the upper line of the Bollinger Band. The next resistance comes at $0.0830 (the Thursday's high) and $0.0890 (SMA200 daily).

XLM/USD, the daily chart

Author

Tanya Abrosimova

Independent Analyst