Stellar Price Forecast: XLM to shoot 60% if it clears this key resistance level

- Stellar price has underperformed when compared to other altcoins as it trades around $0.139.

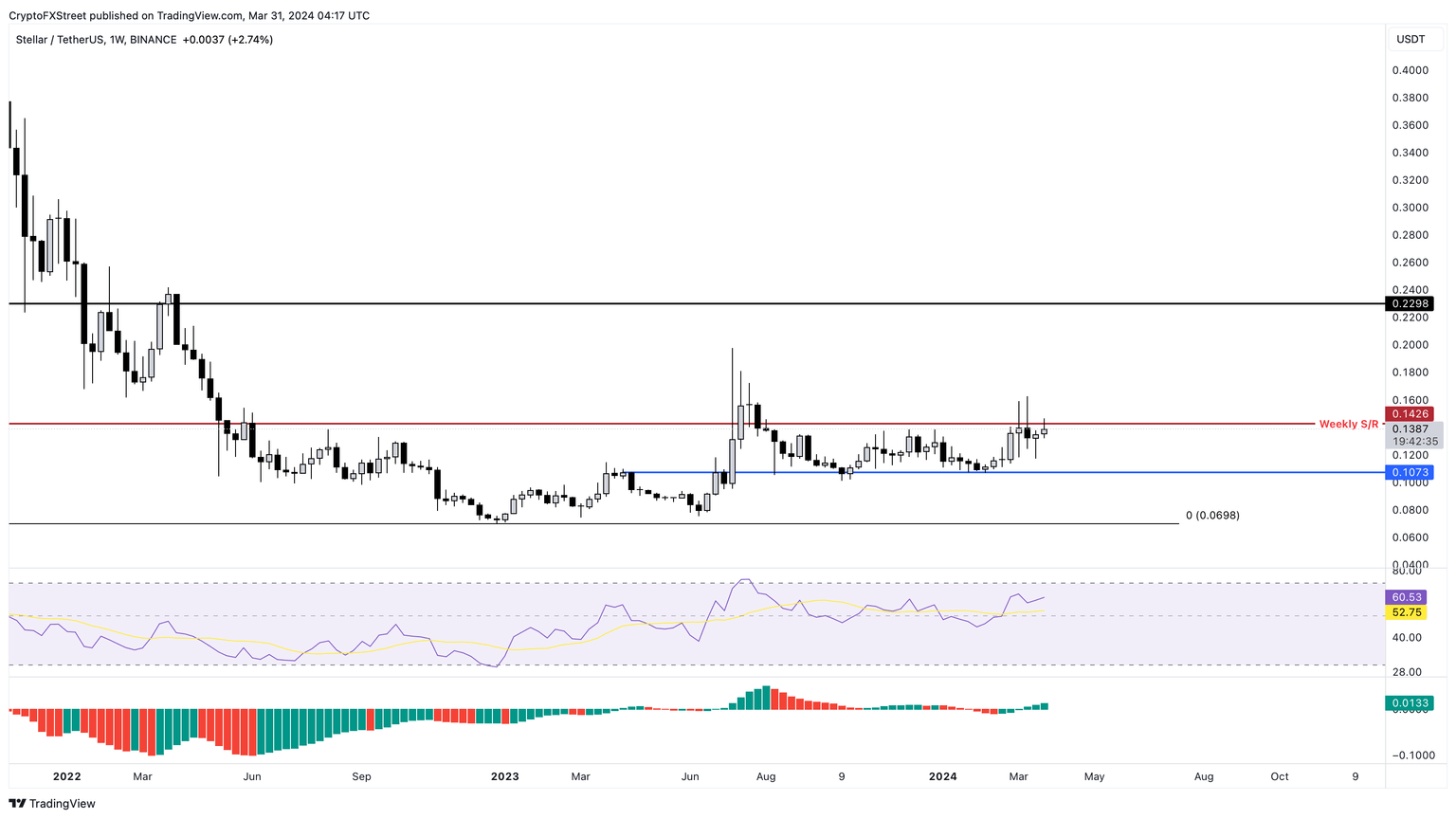

- A flip of the weekly level at $0.142 could trigger a 60% move to $0.229.

- A breakdown of the $0.107 support level will invalidate the bullish thesis for XLM.

Stellar (XLM) price has been hovering below a critical resistance level for nearly two years. As XLM climbs higher, it contests this hurdle and anticipates a breakout rally.

Also read: Ripple's move above this key level could trigger nearly 50% rally for XRP

Stellar price at pivotal point

Stellar price slipped below the $0.142 support level in mid-May 2022 and has traded below it for nearly two years. Even before May 2022, this barrier served as an important level that kickstarted a 484% rally in late 2020 and mid-2021. Therefore, a retest of this level is critical, and a flip would be crucial to achieving an ascent.

Investors should note that a successful flip of the $0.142 resistance level into a support floor would suggest that Stellar price is due for a rally. In such a case, XLM bulls will most likely eye a retest of the $0.229 level, roughly 60% away.

The Relative Strength Index (RSI) has recovered from dipping below the mean level of 50, suggesting that the bullish momentum is still in play. The Awesome Oscillator (AO) also displays a similar positive outlook.

XLM/USDT 1-week chart

On the other hand, if Stellar price faces another rejection due to selling pressure spike from XLM holders or due to the bearish market outlook, it could fall back to the $0.107 support floor. This level is crucial since it has served as a base for attempting a breakout above $0.142.

If Stellar prices flips this level into a resistance level, it would invalidate the bullish thesis by producing a lower low. In such a case, XLM could crash 35% and tag the range low at $0.069.

Also read: XRP price stuck below $0.65 resistance, Ripple lawsuit could suffer from Coinbase defeat

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.