Solana records largest inflows among all crypto funds amid SOL price surge to record high

- Cryptocurrency funds focused on Solana have witnessed the biggest inflow among all digital currencies last week.

- Solana recorded $7.1 million of inflows after SOL reached an all-time high at nearly $82.

- Another Ethereum competitor, Cardano also posted higher inflows than ETH at $6.4 million last week.

The recent weeks have witnessed positive price action, which led to an increase in assets under management to $57.3 billion, the highest record since mid-May. Ethereum competitor Solana has seen the biggest inflows across the entire cryptocurrency market.

Ethereum competitors recorded higher inflows than ETH

Last week, cryptocurrency funds saw $21 million of net inflows, taking the total assets under management to $57.3 billion as the market recovered from losses from the months prior. This level has been the highest since mid-May before the cryptocurrency markets corrected.

The week marked the first week of inflows recorded after six consecutive weeks of outflows, signaling increased positive investor sentiment.

Funds in North America have continued to post outflows, while funds in Europe posted inflows. According to the report from CoinShares, this divergence suggests the beginning of a turn in sentiment for cryptocurrencies.

Ethereum witnessed minor inflows of $3.2 million last week, while its competitor Cardano has also posted inflows higher than ETH, recorded at $6.4 million.

Solana, another Ethereum competitor that offers a flexible infrastructure and quicker transaction settlement saw the largest inflows of any cryptocurrency last week, resulting in $7.1 million.

The SOL token reached an all-time high last week, tagging $81.98.

Solana price primed for a surge toward $100

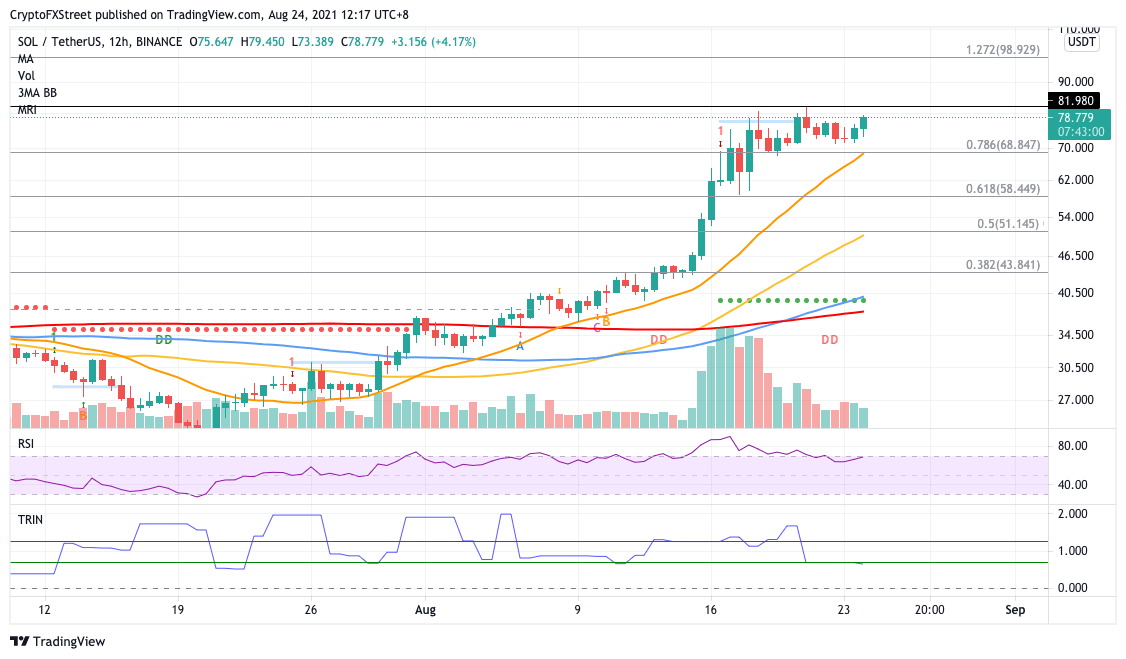

Solana price surged nearly 270% from the July 20 low, reaching its record high at $81.98 on August 21. Although SOL is moving steadily sideways, the Ethereum competitor is ready for another climb up to $100.

To target higher levels, Solana price must slice above its all-time high at $81.98 and flip the level from resistance into support before reaching the 127.2% Fibonacci extension level at $98.92.

The Relative Strength Index (RSI) shows a slight bearish divergence, indicating that the strength of the rally has subsided. However, the Arms Index (TRIN) suggests that there continues to be more purchasing volume than selling volume, printing a bullish bias for the altcoin.

SOL/USDT 12-hour chart

Should there be a lack of buying pressure around the current levels, Solana price may continue to consolidate before its next rally. SOL may discover immediate support at the 20-day Simple Moving Average (SMA), coinciding with the 78.6% Fibonacci extension level at $68.84.

Although unlikely, further selling pressure may push Solana price lower toward the 61.8% Fibonacci extension level at $58.44.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.