Solana price might not play in bulls' favor despite Grayscale SOL Trust launch

- Solana price has rallied by over 20% in the past week, but any further rise might overheat the market, triggering corrections.

- Grayscale Solana Trust, launched with 304,427 shares, is expected to draw in institutions and lead to a price increase.

- Institutional investors, on the other hand, are pulling out of Solana at the moment as retail participation declines by nearly 60%.

Solana price has been following Bitcoin’s cues to chart gains over the last week. While analysts are seeing potential in the asset for another leg of green candles, on-chain data is suggesting otherwise. However, the factor of institutional interest could sway the investors’ sentiment in either direction.

Solana price rally uncertain after Grayscale Trust launch

Solana price noted a 21% rally in the last seven days, but according to the crypto analyst Inmortal, this is not the end of the road for SOL. Despite most of the altcoins observing minimal rises, Solana is expected to shoot up to $28, resulting in many calling it the “most hated” rally. This is because SOL would trend against the majority of the altcoins and chart a five-month high.

Not a bad spot to take profits in lev positions.$SOL pic.twitter.com/eMkkYt5L9P

— Inmortal (@inmortalcrypto) April 13, 2023

Coincidentally, on April 17, Grayscale launched the Grayscale® Solana Trust (GSOL). The trust was announced with 304,427 shares that will be tracking the CoinDesk Solana Price Index. This is expected to draw in retail as well as institutional investors towards SOL, but the latter does not seem to be as interested at the moment.

According to investments received by digital assets for the week ending April 14, Solana failed to observe any inflows but instead registered outflows. Amounting to $2.1 million, the week-long outflows pulled SOL’s year-to-date net flows down from $10 million to $8 million. On the other hand, Bitcoin recorded nearly $104 million in inflows.

Solana institutional investors’ net flows

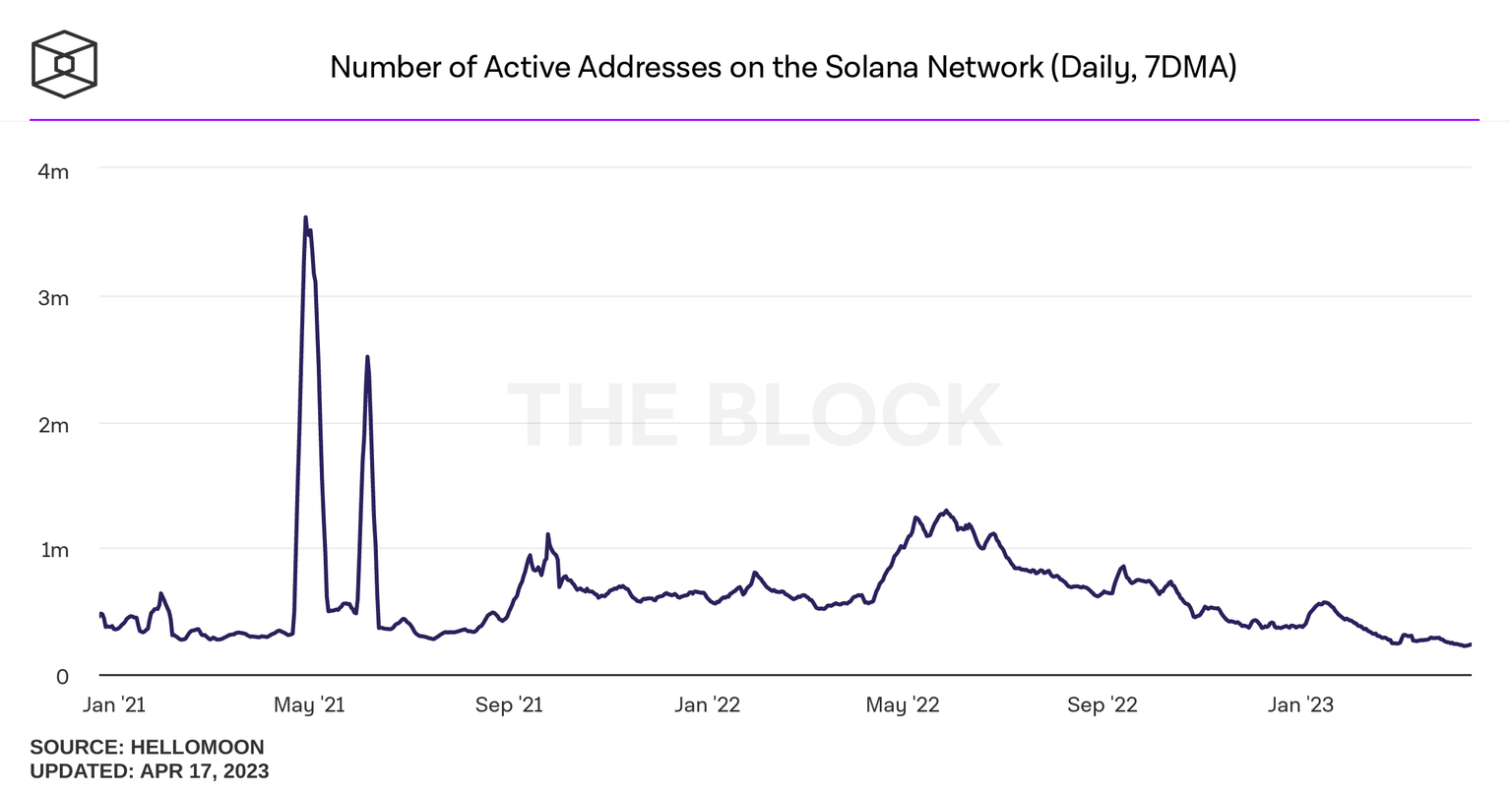

This shows that the majority of institutions are focused on BTC and not altcoins. Particular to Solana, its own users are exhibiting hints of skepticism in their behavior. Year to date, the number of daily active addresses has declined by 58.8% from 566,000 to 233,000 at the moment.

Solana daily active addresses

The uncertainty surrounding the alt season is also keeping investors away, with new SOL addresses falling by 39% from 188,000 at the beginning of the year to 113,000 at the time of writing. This has had an impact on the total value being moved on-chain. As it is, the value has dropped from an average of $34 billion in November 2022 to $2 billion as of now. The lack of participation will likely maintain the volume at a low.

Solana on-chain value

However, considering a scenario where Solana manages to rise above these issues to mark a rally, SOL is still not safe from corrections. The Relative Strength Index (RSI) is lingering right at the cusp of flipping into the overbought zone above 70.0.

A rise in prices resulting from sudden buying could overheat the market, which would be denoted by RSI’s presence in the overbought zone. This zone is synonymous with corrections as the market cools down, which might keep SOL from breaching the $28 mark.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.