Solana Price Forecast: $2.6B unstaked as SOL hits $265 resistance

- Solana price consolidated above $236 on Thursday, down 10.3% from last week’s peak of $264.

- Solana node validators have unstaked 10.8 million SOL ($2.6 billion) since prices crossed the $200 mark on November 8.

- The influx of unstaked coins into the market could potentially impede Solana's next $250 breakout attempt.

Solana price declined to $236 on Thursday, reflecting a 10.3% correction from the all-time high of $264 recorded last week.

On-chain data trends reveal rising sell-pressure among node validators booking profits could potentially impede the next breakout phase.

Solana price tumbles 10% after failed $265 breakout

Propelled by key bullish catalysts like Securities and Exchange Commission (SEC) chair Gary Gensler’s exit confirmation, rising memecoin demand and Canary Capital’s SOL ETF application, Solana price has emerged as one of the biggest gainers in November 2024.

However, recent market trends observed over the past week show Solana has entered a steep consolidation phase after a new all-time high milestone sparked a profit-taking wave.

Solana price action | SOLUSD

The chart above depicts how Solana's price rose 70.5% between Trump’s re-election on November 5, to reach a new all-time high of $264.4 on November 22.

However, since failing to stage a decisive breakout above the $265 territory, Solana has succumbed to a sharp 10% rebound, trading as low as $236 on Binance at the time of writing on Thursday.

Investors unstaked $2.6 billion as Solana raced to all-time highs

When an asset price takes a sharp downturn after hitting a milestone price, it signals rising sell-side pressure from holders looking to take profits at the market top.

On-chain data trends show that Solana’s key insiders began selling when SOL price crossed the $200 mark shortly after Trump’s reelection.

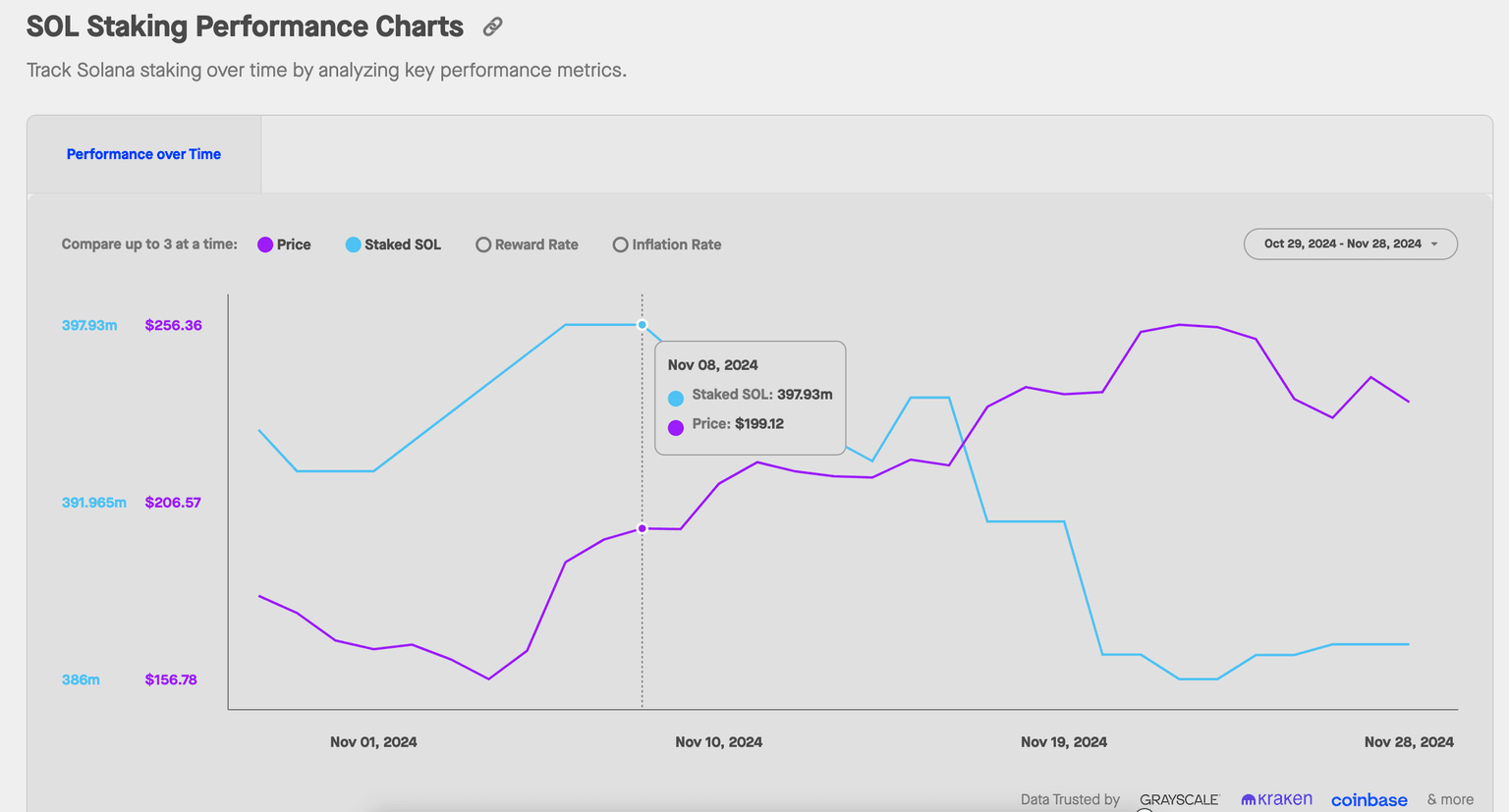

The chart below tracks daily changes in the total number of SOL coins deposited in staking contracts to validate transactions and secure the network.

Solana staking data | Source: StakingRewards.com

Looking at the chart above, Solana’s key stakeholders held 397.9 million SOL in staking contracts on November 8.

But as Solana's price breached the $200, the investors began to make rapid withdrawals from the staking network.

The latest data shows the total staked value has now declined to 387.1 million SOL on Thursday.

Solana’s network validators have effectively unstaked 10.8 million SOL, worth approximately $2.6 billion when valued at the current price of $236 per coin.

For any Proof of Stake (PoS) network, such a rapid decline in staking deposits raises major bearish concerns.

First, it signals that the majority of Solana’s key investors staged large sell-offs at all time high prices, locking in record profits.

More so, having flooded $2.6 billion worth of SOL coins within three weeks, Solana’s bloated short-term supply could nullify upward momentum, as bulls push for an instant rebound toward the $250 level in the days ahead.

Solana price forecast: Bearish sell-wall looms large at $250

From a technical standpoint, Solana's price is flashing multiple bearish potential as SOL faces a critical resistance near $250.

In the short-term price projection, the Donchian Channels (DC) middle band around $229 acts as the immediate support level.

Failure to hold this level could see SOL retesting the lower band at $194.

Solana price forecast | SOLUSDT (Binance)

Volume Delta data further validates a bearish outlook, with a negative trend of -291,730, signaling waning buyer momentum.

This negative divergence between price action and volume highlights weak bullish strength and raises the risk of a major pullback.

On the upside, the psychological resistance level at $250 remains the key level to watch, where sell walls could trigger significant downward pressure.

A close above $250 could mark the start of a bullish reversal, especially if supported by a spike in Solana trading volumes.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.