Solana hovers around $180, resists sell-off despite $22 million SOL transfer

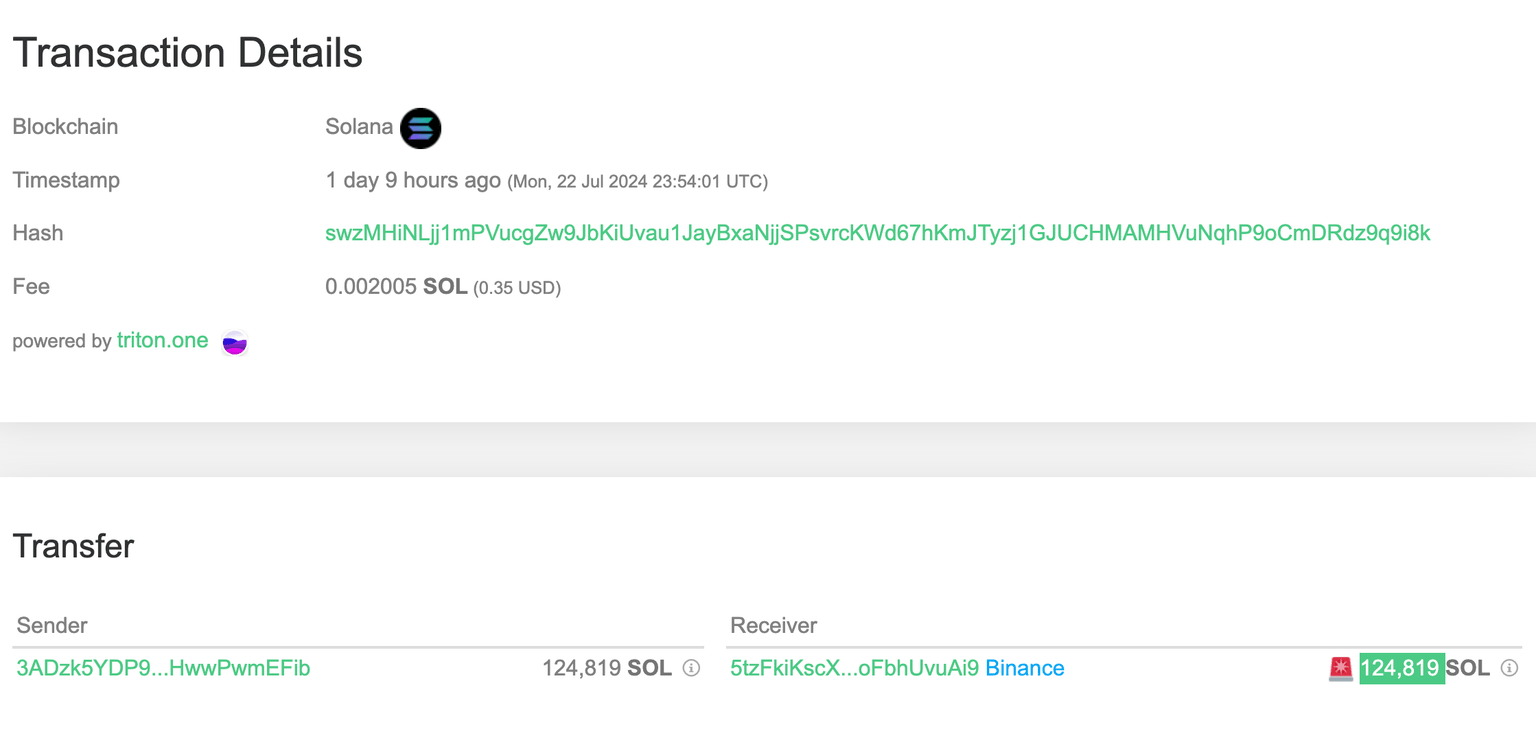

- Solana whale transferred nearly 124,000 SOL tokens to Binance on Monday.

- The $22 million transfer could contribute to selling pressure on Solana, raising concerns among traders.

- Franklin Templeton runs its node on the Solana network and hints at SOL ETF in a cryptic tweet on X.

- SOL extends gains by 2% on Wednesday and hovers near $180.

Solana (SOL) adds 2% to its value on Wednesday, riding on the optimism among market participants after the first day of Spot Ethereum ETF trading. Solana hovers around $180 at the time of writing, and the key market movers are a large-volume SOL transfer to Binance and news of likely a Solana ETF.

Data from Whale Alert, an on-chain tracker, shows a large volume Solana’s transfer to Binance on Monday. Even as Solana in exchange wallets climbs, suggesting more selling pressure as a higher volume of the asset is available for sale, the Ethereum alternative holds on to recent gains and extends its rally on Wednesday.

Solana is the apple of the eye, even as Spot Ether ETF receives SEC approval

Solana has been in the spotlight since traders anticipated Spot Ethereum ETF approval and when the Securities & Exchange Commission (SEC) gave a green flag to the investment product.

Solana is considered a close competitor to Ether, the native token of the smart contract network. With its relevance among traders, the market eyes Solana as the asset that is likely to receive SEC approval for a Spot ETF. The speculation is fueled by asset manager Franklin Templeton’s recent cryptic tweet on X.

According to its website, the asset manager runs a Solana node. Therefore, a tweet mentioning SOL and the existence of other assets that warrant an ETF product supports talks of a Solana ETF on X.

Besides Bitcoin and Ethereum, there are other exciting and major developments that we believe will drive the crypto space forward. Solana has shown major adoption and continues to mature, overcoming technological growing pains and highlighting the potential of high-throughput,…

— Franklin Templeton Digital Assets (@FTI_DA) July 23, 2024

Solana holds steady near $180, fear of sell-off persists

Solana trades close to $180 early on Wednesday. The native token of the Solana chain held on to its recent gains despite a looming fear of sell-off.

Data from Whale Alert shows a $22 million SOL transfer to Binance, a centralized exchange platform, on Monday. A rise in exchange deposits is typically considered a precursor of a sell-off in an asset because it implies a higher volume of the asset is available for sale on the platform.

Solana transfer to Binance

Solana is currently trading sideways and could correct to support at $166.92, the 61.8% Fibonacci retracement of the rally from the March 5 low of $105 to the March 18 peak of $210.18. SOL could collect liquidity in the Fair Value Gap (FVG) between $161.60 and $167.27, as shown in the SOL/USDT daily chart below, and make a comeback to the March 18 peak above $200.

The key resistance is the May 21 top at $188.89.

The Moving Average Convergence Divergence (MACD) momentum indicator supports the recent gains in SOL and shows underlying positive momentum in Solana’s uptrend.

SOL/USDT daily chart

On the other hand, a daily candlestick close under $166 could invalidate the bullish thesis. SOL could then dip to key support at the July 2 top of $155.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.