Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

- Solana has risen more than 2,000% since its 2022 lows following the FTX collapse.

- SOL outperformed both Bitcoin and Ethereum in trading volumes for over a year since the decline.

- Solana has maintained a positive net capital inflow since September 2023, indicating that most token holders are in profit.

Solana (SOL) is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

SOL outperforms Bitcoin and Ethereum with $776 million in capital inflows daily

Solana has seen incredible progress in 2024 marked by new all-time highs and increased activity on its blockchain.

Solana's rebound has been remarkable, especially with its growth after plunging to a low of $9 following the collapse of FTX in 2022. Since then, SOL has risen over 2000%, with its price outperforming Bitcoin and Ethereum, according to Glassnode's report.

The report shows that Solana has surpassed the two giant cryptocurrencies in 344 out of 727 trading days since the 2022 event.

BTC/SOL/ETH Price Performance. Source: Glassnode

Likewise, Solana witnessed more capital inflow during the same period, using the relative Realized Cap change as a measuring tool.

This suggests that SOL has taken in fresh capital and liquidity, indicating increased demand for the asset among investors.

Glassnode stated that this new band of investors bringing in capital is the major driver of Solana's growth.

A key reason for this growth in new investors is the surge in meme coin activity the Solana blockchain experienced during the year. With SOL serving as the base currency for settling these meme coin transactions on the Solana network, high demand pushed it to a new all-time high of $263 on November 23.

The report also noted that Solana has maintained a positive net capital inflow since September 2023, with $776 million worth of new capital flowing into its network daily.

Adding to that, Glassnode highlights the holder cohort with the highest profit-taking volume since January 2023.

Tokens held from 1 day-1 week, 1 week-1 Month and 6-12 months all realized profits of $13.7 billion, $14 billion and $15.7 billion, respectively.

This connotes equality of market share among these classes of holders, which accounts for 51.6% of all profit realized.

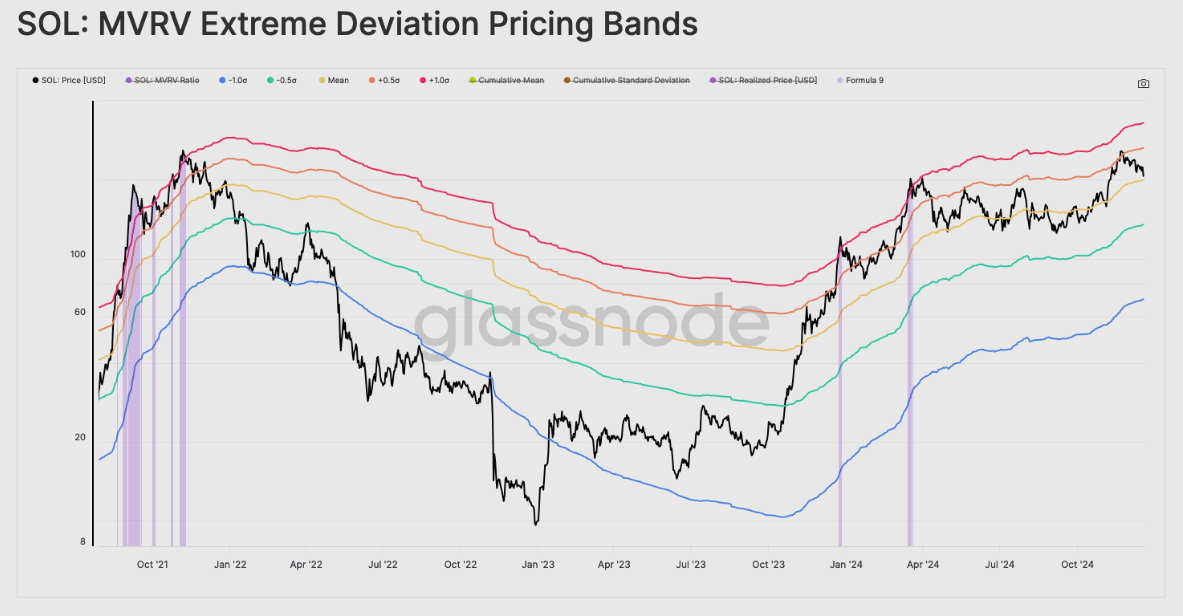

SOL: MVRV Extreme Deviation Pricing Bands. Source: Glassnode

"This suggests the market is relatively heated, but also suggests the potential for further room to run before the profit held by the average investor reaches its extreme band of +1σ, enticing a flurry of profit taking and distribution," wrote Glassnode.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi