Solana community plans SOL fork to tackle SEC enforcement action and FTX, Alameda collapse

- The US Securities & Exchange Commission labeled Solana as a security.

- An investor in MagicEden supported the fork proposal and argued that it would help get rid of the SEC’s security label.

- The collapse of FTX and Alameda and the SEC’s actions have rallied supporters in favor of the fork.

The Securities & Exchange Commission (SEC), the most high-profile US financial regulator, recently labeled Solana’s native token SOL as a security. The team behind Solana responded to the SEC’s allegation by espousing the belief that the token is a non-security.

SOL price suffered a blow in response to the SEC’s actions, and the community proposed a fork to tackle the new challenge posed by the regulator. The proposal to fork Solana garnered support from key influencers and investors in the SOL ecosystem, making it likely that the community would fork the token in the near term.

Also read: Top 5 cryptos traders are buying after SEC crackdown on $100 billion worth of assets

Solana community proposes fork to address challenges posed by SEC crackdown

HGE.ABC, an investor in Solana-based NFT marketplace MagicEden, reminded the community that Ethereum (ETH) is a fork of Ethereum Classic (ETC) from July 2016. A fork occurs when a community makes a change to the blockchain's protocol or basic set of rules.

The Ethereum fork serves as an inspiration for the Solana community proposing the same with SOL. The expert argues that a fork could tackle the new challenges posed by the SEC’s labeling of the asset as a security and the fallout from the FTX/Alameda collapse of 2022.

Bold but not a bad idea actually. Community fork solana will get rid of sec issue.

— HGE.ABC (@HGEABC) June 10, 2023

No bankruptcy will dump on you for next 3 years continuously.$ETH is a fork of $ETC and doing well.

Blink twice if you agree https://t.co/fWxbkMQ4aI

Colin Wu, a Chinese journalist, argues that Solana’s listing as a security by the SEC is likely the only trigger for willingness to fork among community members. There is no actual fork plan, he writes, and the community has a mixed opinion on the proposal.

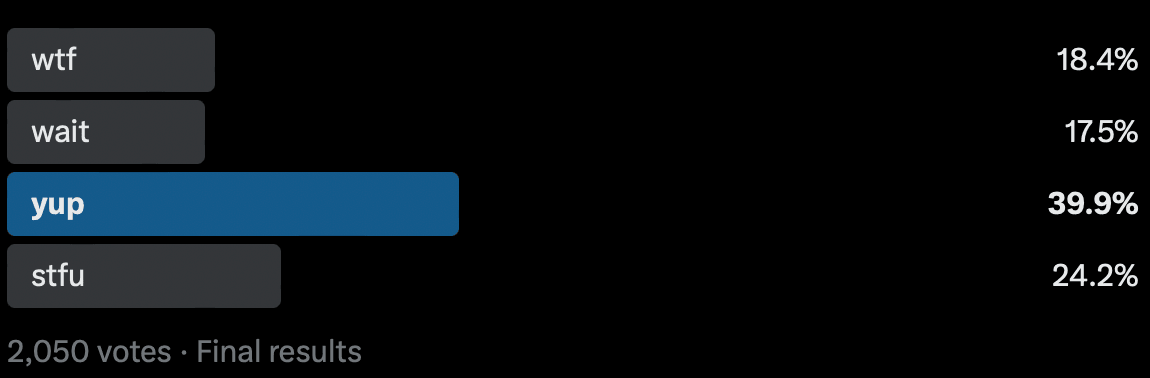

A leading DeFi investor and member of the “y007ts” NFT holders club, identified as @capsjpeg on Twitter, started a Twitter poll to get a response to the fork proposal. 39.9% out of 2,050 poll respondents supported a fork in Solana, while 17.5% proposed waiting.

Votes on proposal to fork Solana, 39.9% in favor

@capsjpeg reminded traders that the two largest cryptocurrencies by market capitalization, Bitcoin and Ethereum, both went through forks in the past. It is, therefore, considered a viable solution by supporters within the community.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.