Solana bulls holding ground at $90 spells bullish breakout for next week

- Solana bears are dictating price action with a few technical indicators in their corner.

- However, the devil is in the detail with positive divergence in the RSI.

- This could point to a bullish breakout to come as soon as next week, with prices trading back above $146.

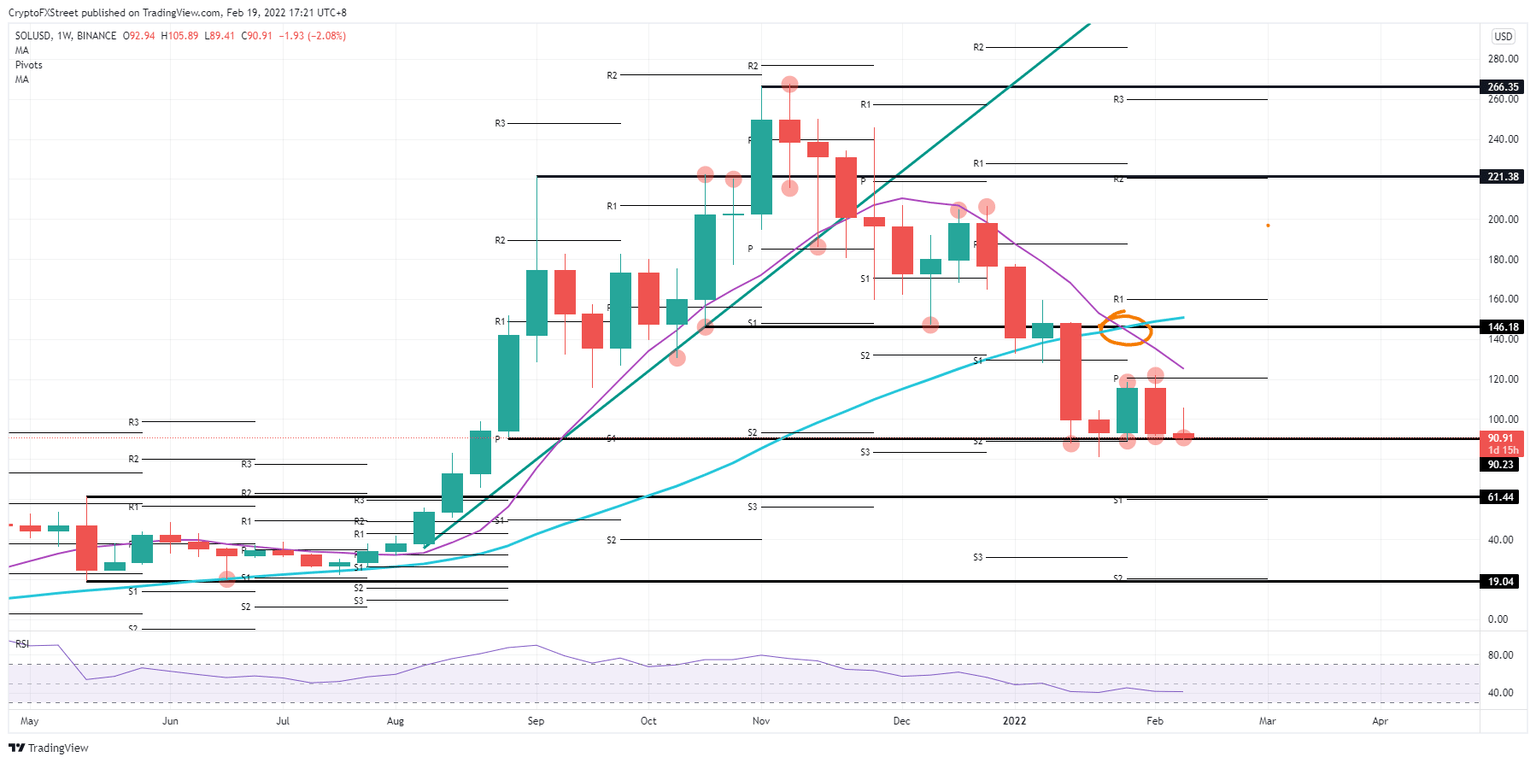

Solana (SOL) price action has been delivered to the mercy of bears for the moment, but those same bears could be facing a surprise to come as early as next week. Although bears are squeezing bulls against the $90-handle and investors have already stepped in multiple times these past few weeks to save SOL price action from falling, the Relative Strength Index (RSI) is flatlining to slowly grind back higher, pointing to a bullish breakout. Expect as soon as next week to see the price shoot back up first to $120, breaking the high from last week and next target $146 to the upside, holding 55% gains.

Solana bulls are setting the stage for 55% gains over the coming week or two

Solana price action got a bit delivered to the mercy of bears since the downturn in January. The firm rejection against the monthly pivot at $120 last week only added more short positions against SOL price action. But the devil is in the detail as usual, and the RSI would already long be trading in the oversold area.

As SOL bulls have been buying and defending $90-handle, the RSI is even slowly grinding up, showing positive divergence and could point to a possible bullish breakout. As bulls hoard any SOL coins available at these levels, bears will be unable to start booking profit and buying at higher prices. This will spiral into a buying frenzy and quickly ramp up the price towards $120 against the monthly pivot.

SOL/USD weekly chart

As the ultimate target will be $146, once bulls have taken out the high from last week, the 55-day Simple Moving Average (SMA) has not yet proven its strength as being the bearish camp at the moment. With the death cross formation, the 55-day becomes a price-action cap. So that one could cut short the profit target for bulls at $146 and rather see another rejection around $120, turning price action back down to $90 for bulls to pick it up again as the squeeze to the downside continues.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.