Shiba Inu's SHIB rockets 26%, leads Memecoin gains

Shiba Inu-themed tokens were the top gainers during early Asian hours on Monday gaining as much as 26% in the past 24 hours, data from analytics tool CoinGecko showed.

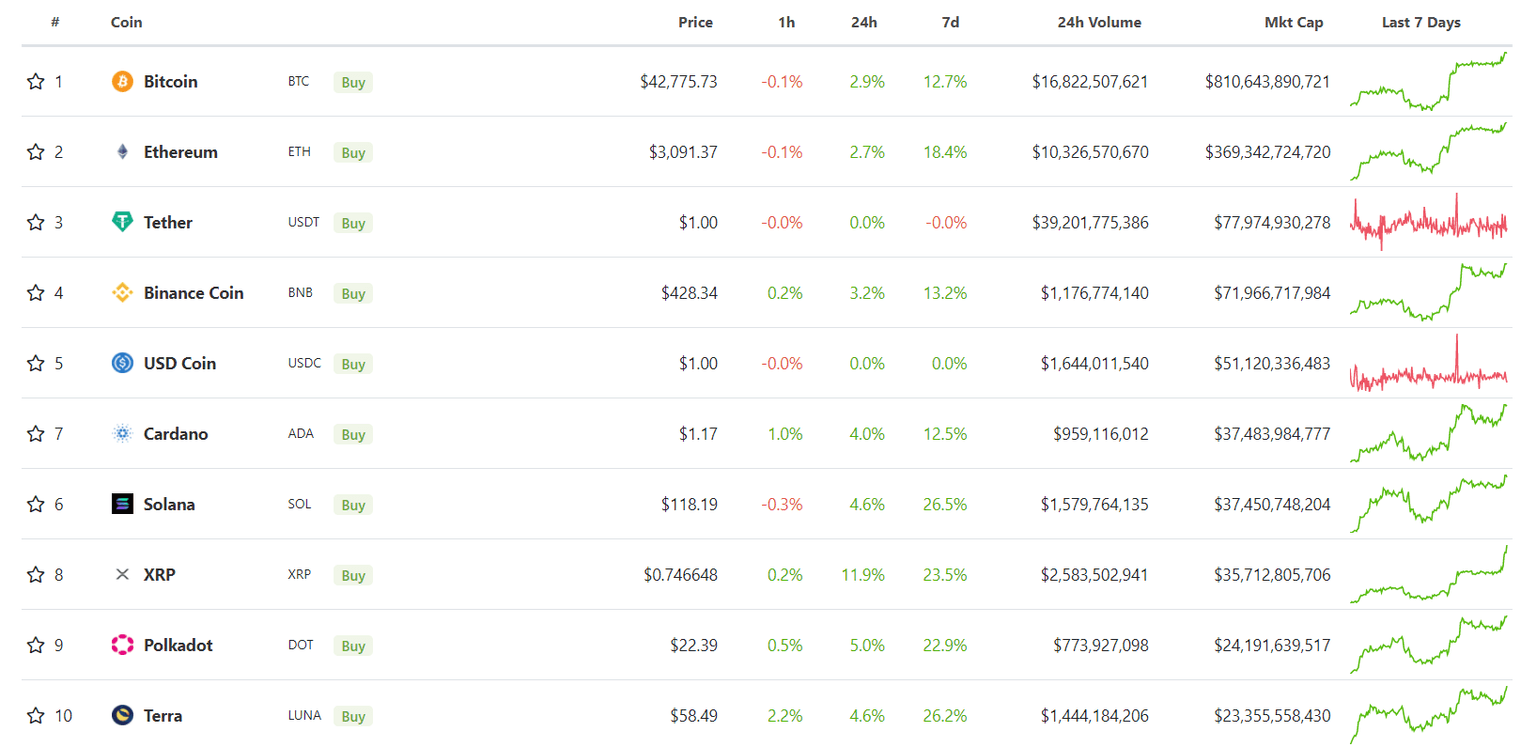

The move came amid a broader recovery in the crypto market as bitcoin and ether regained the $42,000 and $3,000 price levels respectively. Gains on the top ten cryptocurrencies by market capitalization ranged from a low of 1.6% on Terra’s LUNA to highs of 9.9% on XRP.

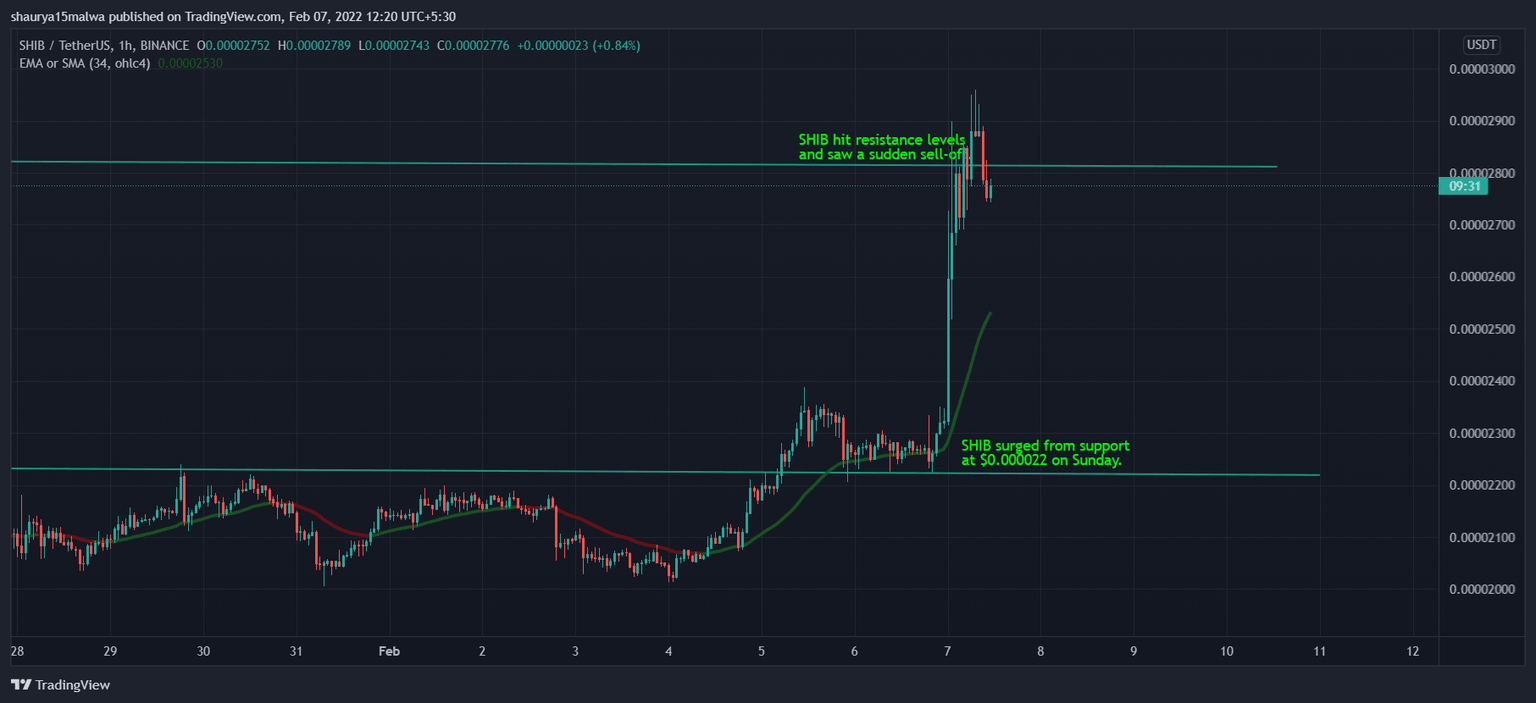

Memecoins led market moves outside of the top ten cryptocurrencies. Shiba Inu’s SHIB tokens surged to $0.000029 during Asian hours from the $0.000022 level on Sunday evening, a surge of over 24%, while Dogecoin’s DOGE jumped to $0.169 from $0.145.

Price charts showed SHIB hit resistance at the $0.000029 level, causing a sell-off during the Asian morning hours that brought prices lower.

The price movement caused nearly $10 million in losses to liquidations for traders of SHIB-tracked futures products. In the past 24 hours, traders lost $4.31 million to Binance’s 1000SHIB futures product, which holds 1,000 SHIB per contract. Traders also lost $5.49 million in SHIB futures. Over 74% of SHIB futures were short or betting against a price rally.

SHIB’s weekend surge came days after developers unveiled a tie-up with Welly’s, a fast-food chain selling burgers and fries. The partnership involves rebranding Welly’s stores to include Shiba Inu-themed products and imagery, and the issuance of non-fungible tokens (NFTs) for customers, developers said. Community members can buy products using SHIB and participate in Welly’s expansion via Shiba Inu’s decentralized governance forum ‘Doggy DAO.’

Elsewhere, prices of Floki Inu’s FLOKI – another Shiba Inu-themed token – bumped 17% to exchange hands at $0.00004 in Asian hours, recovering some of the losses from last week after developers disabled its cross-chain bridge after discovering an exploit. The bridge allowed users to transfer assets between the Ethereum and Binance Smart Chain networks. No FLOKI was affected in the attack, developers confirmed at the time.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.