Shiba Inu price triggers activity from long-term holders; on-chain losses reach two-month high

- Shiba Inu price fell below the $0.00000900 mark to trade at $0.00000878 at the time of writing.

- Long-term held supply became suddenly active over the last 24 hours, consuming over 4,000 trillion days.

- In the same duration, the network noted significant losses as over 20 trillion SHIB was moved around under the original price.

Shiba Inu price has been moving sideways for the past week, but before that, the meme coin noted a strict downtrend movement. Standing inches away from the December 2022 lows, the altcoins are noting a sudden bearishness on-chain.

Is Shiba Inu price set for a rise or decline?

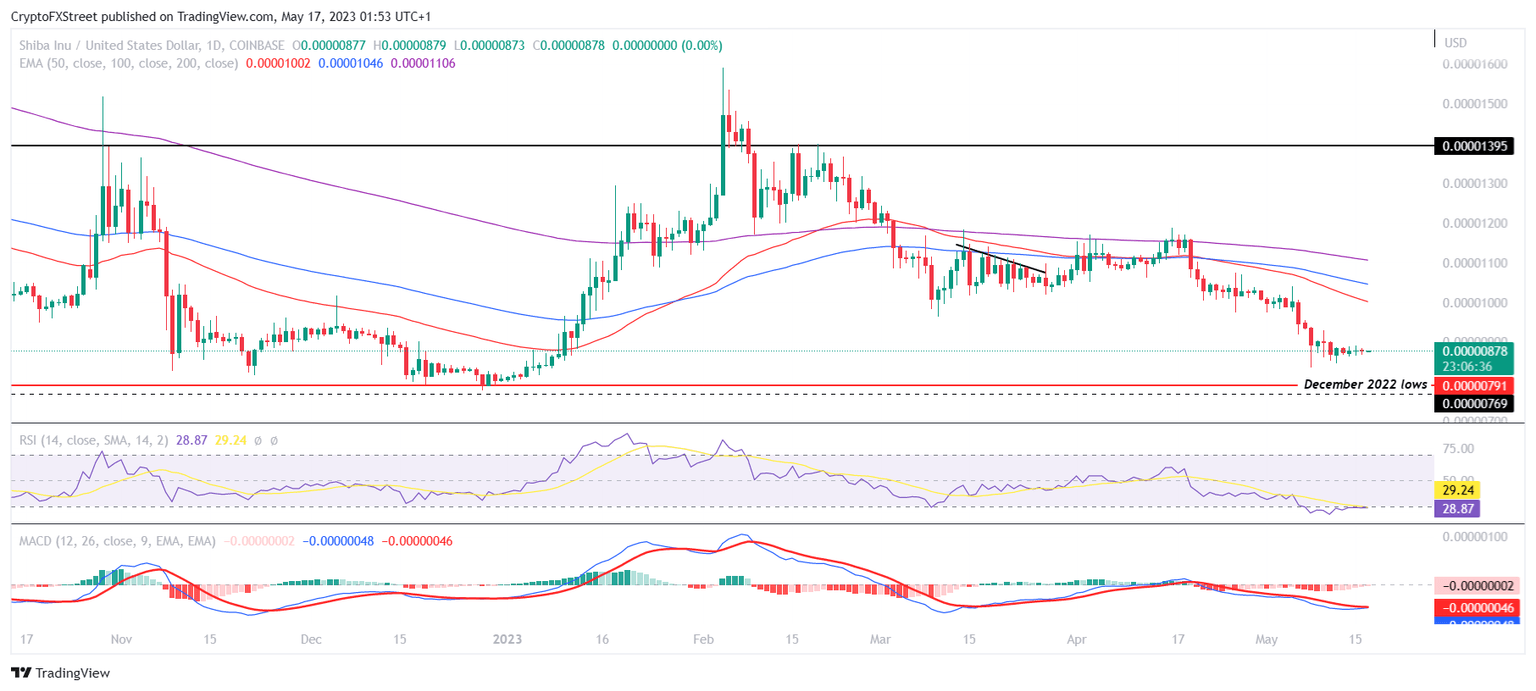

Shiba Inu price, trading at $0.00000878 at the time of writing, is still below the $0.00000900 mark. Over the last few days, the on-chain performance of the asset has been seen, which explains the growing concerns around investors’ profits.

SHIB/USD 1-day chart

The first sign of the same could be noticed on the age-consumed chart. This metric is usually used to judge the impact of the long-term held supply multiplied by the number of days it was held for. In the case of May 16, the total number of days being consumed was 4860 trillion days, which is a good sign.

Shiba Inu age consumed

This made two things apparent. One, long-term holders are expecting losses over the coming days as selling from the most loyal cohort of any cryptocurrency is not a good situation. Second, losses have already arrived.

The daily on-chain transaction chart noted the largest red bar since the end of March. The bar indicates that the transactions in losses trumped the transactions in profit on May 16 by a ratio of 1:20, as nearly 20 trillion SHIB worth $180 million were moved around despite being underwater.

Shiba Inu transactions in loss

Thus considering the intensity of bearishness across the network, Shiba Inu price might take a few days before recovery. According to the Relative Strength Index (RSI) indicator, the asset is currently oversold. Sitting below the 30.0 mark, the altcoin is susceptible to a bounce back, as noted in the past.

The first certain sign of recovery would be visible once Shiba Inu price flips the 50-day Exponential Moving Average (EMA) line at $0.00001006 into a support floor.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B05.22.52%2C%252017%2520May%2C%25202023%5D-638198824279605605.png&w=1536&q=95)

%2520%5B05.22.24%2C%252017%2520May%2C%25202023%5D-638198824481483156.png&w=1536&q=95)