Shiba Inu price prepares for a multi-month breakout following a 10% increase in 24 hours

- Shiba Inu price is on the verge of breaching its 11-month-old downtrend line.

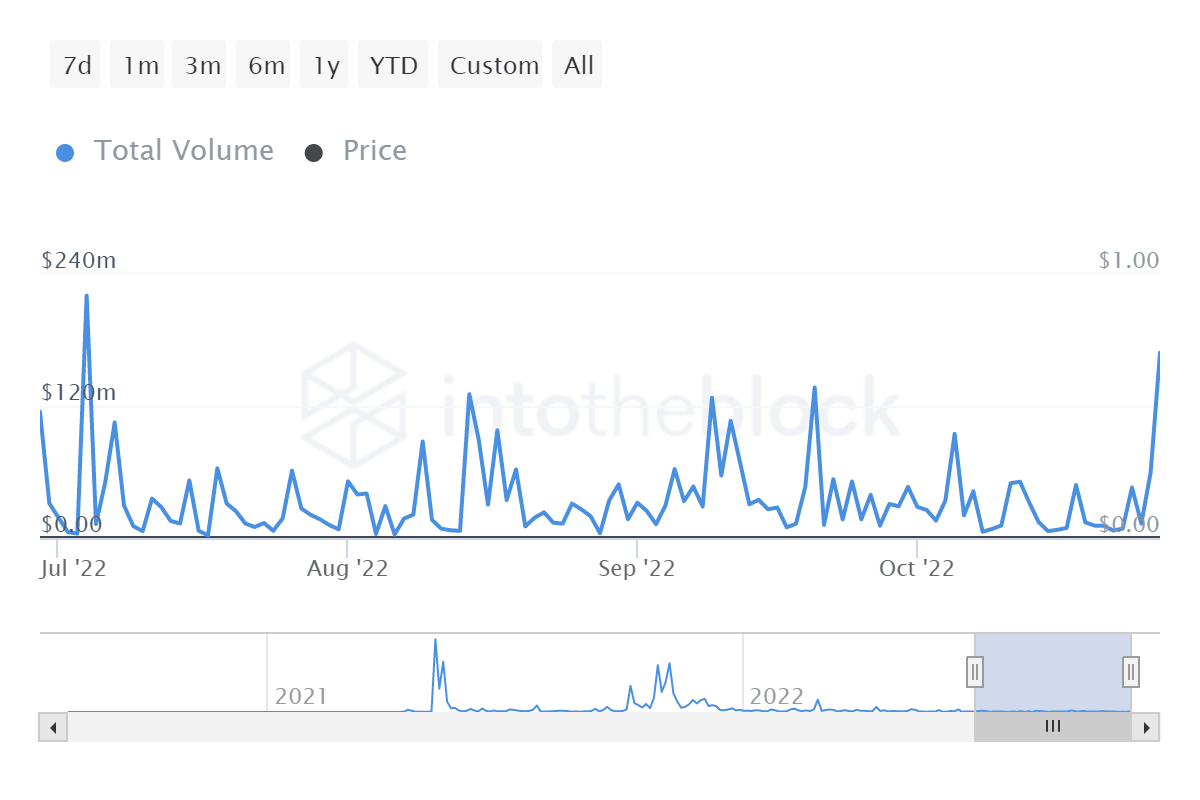

- SHIBprice rise on Friday triggered whales to conduct the highest volume of transactions in almost four months.

- The single-day increase in SHIB’s market value also triggered the highest accumulation in over six months.

Shiba Inu price led the crypto market’s rise as the total market capitalization climbed to $960 billion. SHIB is known to have a volatile investor base, and the same was verified over the last 24 hours as whales, and retail investors alike became active after months.

Shiba Inu price to break free

Shiba Inu price had been trading under a downtrend line since December 2021, keeping the altcoin from engaging in any bullish momentum. Episodes of price rise did push the meme coin to test the downtrend line to no vain as SHIB failed all its previous attempts, making this the sixth time the meme coin is aiming to rise above it.

Currently trading at $0.00001178, Shiba Inu was up by 10.82% on Friday. Sitting at the cusp of breaching through, the cryptocurrency reclaimed the support of the 50-day (red) Simple Moving Average (SMA) and the 100-day (blue) SMA.

A further price rise would flip the downtrend line into support, which could indicate a bullish resurgence for the coin.

However, if SHIB fails to do so and falls back, it will need to remain above the critical support of $0.00000730. This will be avoided if investors refrain from engaging in a sell-off right away, which seems to be the current sentiment.

Shiba Inu investors rise again

Following the price rise, on-chain metrics showed that Shiba Inu investors became active once again. Within the same 24 hours, over three trillion SHIB were bought off of exchanges, which is a positive sign for SHIB.

Buying during an unprecedented hike shows that investor confidence is high right now and that they will be holding on to their assets as they expect a further increase in price.

Whales and retail investors both shared this sentiment. Whale transactions (transactions worth more than $100,000) touched $168 million, the highest in four months. Despite this, selling was not observed on-chain.

Shiba Inu whale transactions

If this bullishness persists, SHIB will have an opportunity to rise further and establish $0.00001200 as a solid support base.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B23.32.44%2C%252028%2520Oct%2C%25202022%5D-638025797428895236.png&w=1536&q=95)