Shiba Inu Price Forecast: SHIB investors still have a shot at a 41% rally

- Shiba Inu price, despite a 13.57% decline, still has not invalidated the double bottom bullish reversal pattern.

- SHIB is treading above the stop loss of $0.0000094, with minor hints of recovery.

- A 5% increase from the current price would result in an invalidation of the bearish thesis and a bullish reversal.

Shiba Inu price has yet to note a comeback, and the flow of funds into Bitcoin following the spot Bitcoin ETF approval has made the same a lot more difficult. Nevertheless, SHIB has an opportunity to note a reversal since it has not completely invalidated the bullish thesis.

Shiba Inu price has a shot at rally

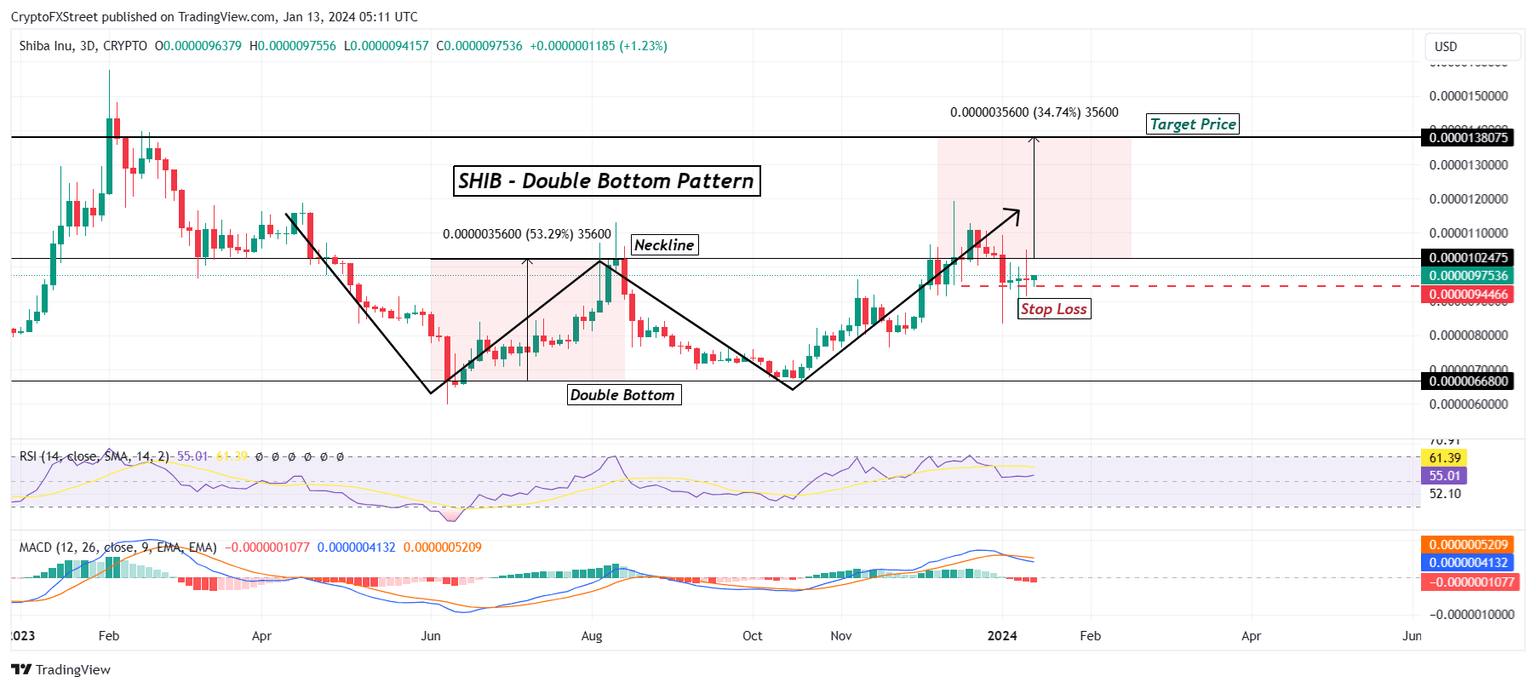

Shiba Inu price fell by a little over 13% in the last couple of days but is still hanging above the support line at `094. This price level also marks the stop loss of the double bottom pattern observed over the nine months. This macro bullish reversal pattern dictates a probability of a potential 34% rally based on the target achieved using the pattern which is marked at `138.

The double bottom pattern, also known as the 'W' pattern, is formed when an asset hits two distinct lows at the same level on separate trading sessions.

The support level is identified as the point at which the price of an asset drops twice. In the context of SHIB, this support level is noted at $0.0000066. SHIB experienced a rebound from this level in early June and again in the last week of October.

To deduce potential growth, one can analyze the double bottom pattern by assessing its height. The anticipated increase above the breakout level, referred to as the neckline, is considered the projected growth. For Shiba Inu, the breakout level is set at $0.0000102, and the pattern's height positions the target at $0.0000138. This represents an approximate 35% increase above the breakout level. This target is set at about 41% above the current trading price of `097.

If the breakout level is successfully tested as a support floor, the bullish pattern will be successful, and the chances of a long-term rally are likely.

SHIB/USD 3-day chart

However, if SHIB falls through the stop loss level, the double bottom pattern would fail, invalidating the bullish thesis and sending the meme coin to lows below `090.

The price indicators Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are sending out mixed signals at the moment. This means that Shiba Inu price could sustain above the stop loss price point for a while, and if the investors' funds once again begin flowing into the altcoins, SHIB could have a shot at a recovery rally.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.