Shiba Inu price fall likely as bearishness rains down on SHIB holders, bringing losses to June high

- Shiba Inu price has been moving sideways for the past ten days, right above the critical support line of $0.00000699.

- The lack of incentive to conduct transactions on-chain has left the network losing traction as the formation of new addresses hit a four-month low.

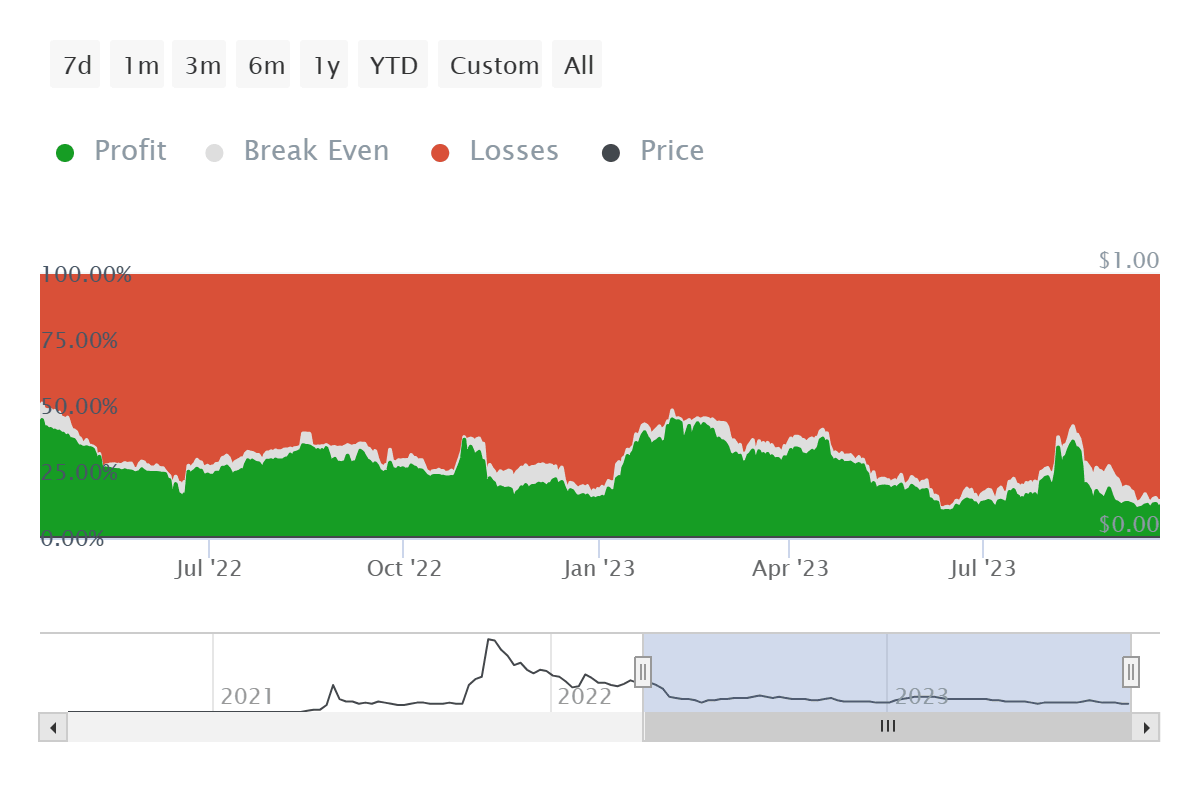

- Consequently, losses are rising at a rapid rate, leaving nearly 86% of all SHIB holders underwater.

Shiba Inu price has had a disappointing run over the past couple of weeks as the meme coin continued to post red candlesticks on the chart. While that came to a halt over the past ten days, the altcoin has shifted to moving sideways, making no progress but progressing the losses of its investors.

Shiba Inu price close to 2023 lows

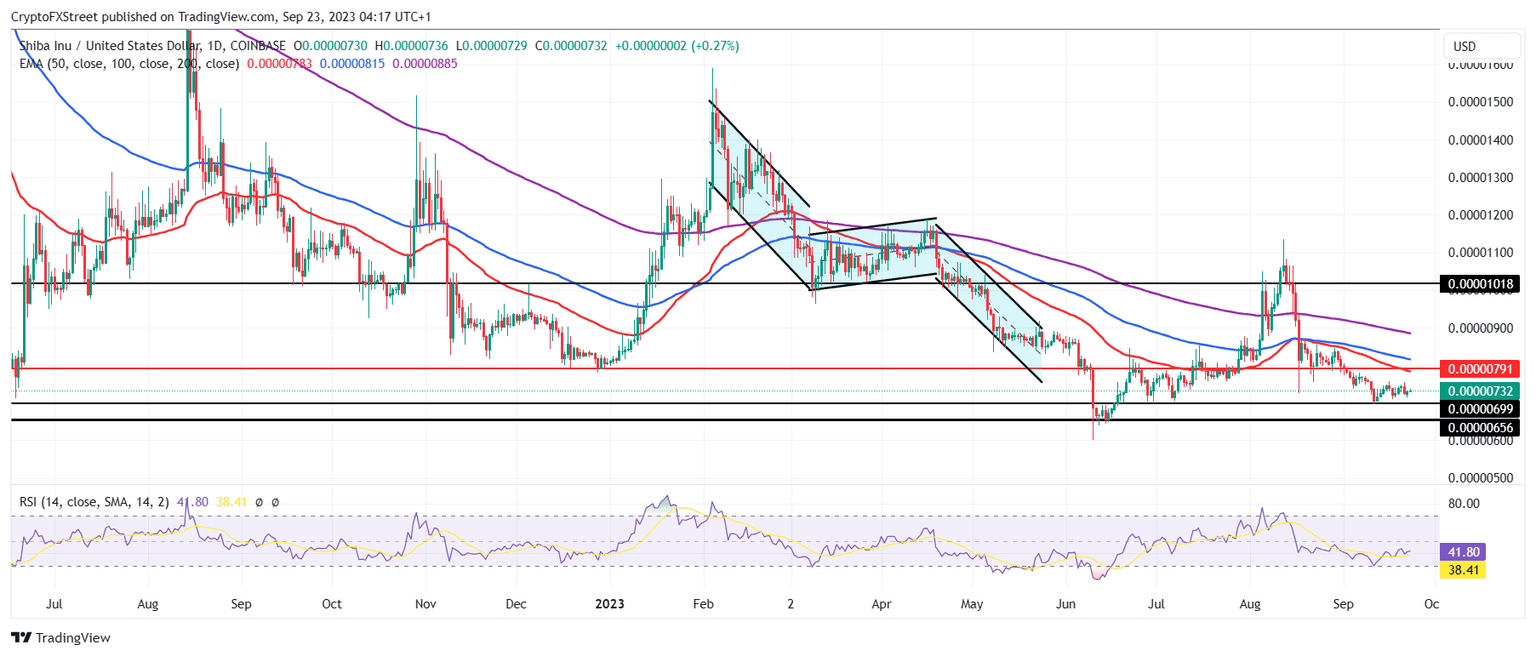

Shiba Inu price has seen nothing but declines since mid-August, nearly falling through the support line at $0.00000699. Trading at $0.00000734, the meme coin is treading very close to falling through the support line. The slip through this level would send SHIB towards the 2023 low of $0.00000656, which was last visited back in June this year.

Should Shiba Inu price lose this support too, it would end up forming fresh year-to-date lows. The chances of the same are not too bleak either, considering the Relative Strength Index (RSI) is under the neutral line of 50.0, suggesting persisting bearishness.

SHIB/USD 1-day chart

But if the meme coin manages to find support from its investors, a pullback toward the $0.00000791 barrier is also possible. Flipping this resistance into a support floor would also turn the 50-day Exponential Moving Average (EMA) into a support line. This would invalidate the bearish thesis and set SHIB up for a recovery rally.

The chances of a recovery are unlikely

One of the biggest supporters of any cryptocurrency’s rally is its investors, and in the case of Shiba Inu, the SHIB holders are not very motivated to be active on the chain. This is reflected in the low transaction volume of just $20 million on a daily average over the past month.

Furthermore, the altcoin’s lack of enticement impacted the new users that joined the network. The network growth, which indicates whether the project is gaining or losing traction in the market, has seen a dip, suggesting new addresses are not forming on the network. The decline has hit a four-month low, which could prove to be harmful for a price recovery.

Shiba Inu network growth

As for the present SHIB holders, not much can be expected out of them either since they have no motivation to be active on the network. This is because the losses experienced by the meme coin investors are rising by the day, hitting a three-month high.

At the time of writing, about 86% of the Shiba Inu investors are underwater, which naturally suggests that participants are awaiting recovery to either take profits or offset their losses.

Shiba Inu investors at a loss

Thus, going forward Shiba Inu price is most likely to continue moving sideways or dip to test the aforementioned support levels.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B08.49.46%2C%252023%2520Sep%2C%25202023%5D-638310390015607987.png&w=1536&q=95)