Shiba Inu price fails to rally despite a 3 trillion SHIB accumulation from investors

- Shiba Inu price has been moving sideways, making minimal changes stuck under the $0.00000900 mark for two months now.

- In the last 48 hours, 3 trillion SHIB worth around $23 million was bought off the exchanges in hopes of triggering a rise, but the altcoin failed to do so.

- In fact, the pullback from investors this month has been such that Shiba Inu's velocity has dropped to lows last witnessed in January 2021.

Shiba Inu's price, for the most part of this month, has barely made any significant movement. The meme coin continues to disappoint investors, who are also failing to trigger significant change in the price action with their efforts. The resulting decline in token movement momentum might prove to be quite harmful to SHIB going forward.

Shiba Inu price action generates concern

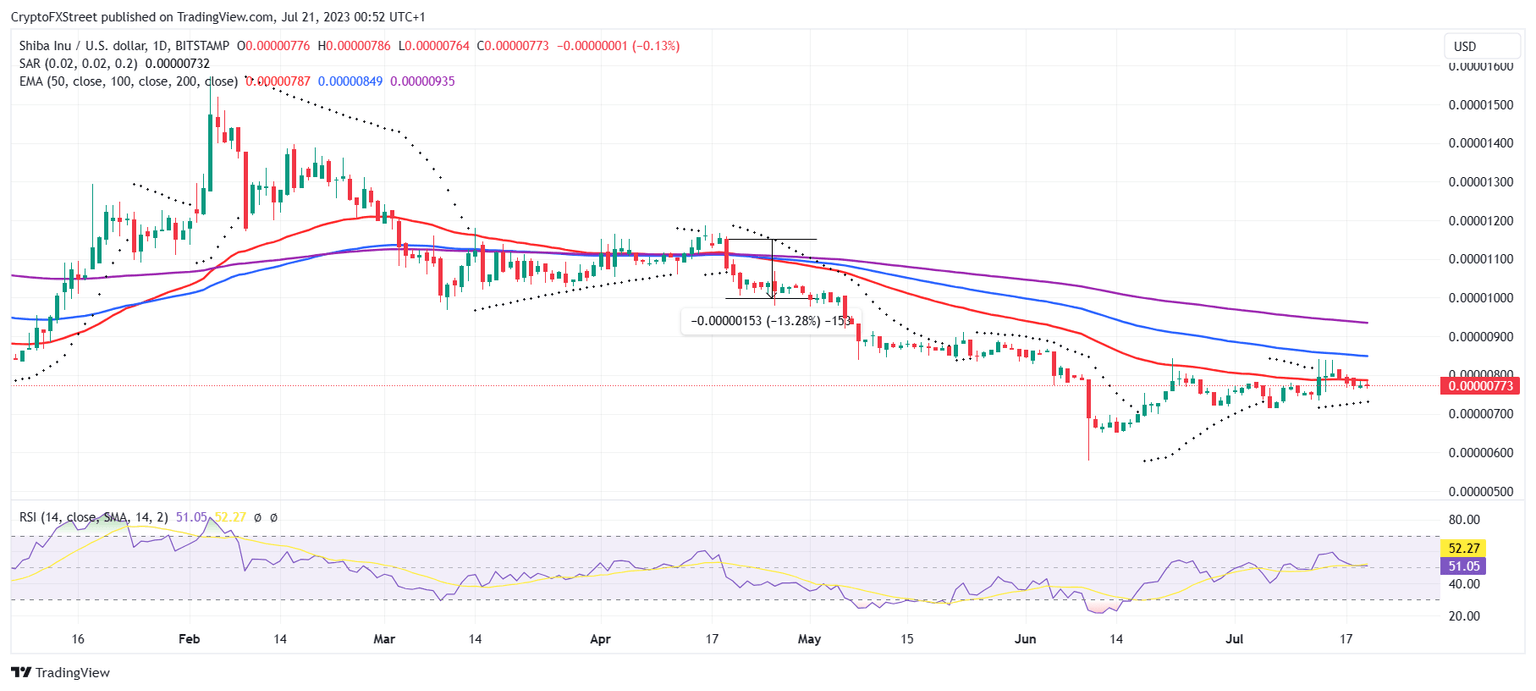

Shiba Inu price is at the same price level it was at the beginning of the month, trading at $0.00000773. All the ups and downs, which in themselves have been minimal, brought the meme coin back to this level producing no major change either in the demand or investors' demeanor.

SHIB/USD 1-day chart

While such behavior from an asset is considered to be a good sign during bear markets, Shiba Inu price actually needs to make some move in order to keep its investors from selling and bucking out. As a matter of fact, SHIB holders have been attempting to trigger a reaction out of the meme coin over the past few days.

Since sideways movement is generally considered to result in an increase in price eventually, Shiba Inu investors assumed sudden accumulation could lead to a bullish response from price action. Consequently, in the last 48 hours, about 3 trillion SHIB tokens worth over $23 million were bought from exchanges by investors.

Shiba Inu supply on exchanges

Alas, to their disappointment, Shiba Inu price did not witness any significant change. Since no change in price leads to investors sitting ducks, the movement of tokens also slows down, which is not a healthy sign for the network.

Velocity, which is the measure of the rate at which a token changes hands or moves through addresses, has noted a severe decline. In the case of Shiba Inu, this velocity stands at a two-and-a-half-year low, last noted in January 2021, making it a concern for the network as liquidity goes down.

Shiba Inu velocity

Thus, Shiba Inu price needs to be revived and rise soon in order to prevent a sudden burst of loss offset selling from its investors.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B05.19.36%2C%252021%2520Jul%2C%25202023%5D-638254963432862191.png&w=1536&q=95)

%2520%5B05.20.33%2C%252021%2520Jul%2C%25202023%5D-638254963940937673.png&w=1536&q=95)