SHIB Price Forecast: Shiba Inu could rally to $0.000009

- Shiba Inu price slides sideways out of extremely constricted trade conditions.

- Shiba Inu is currently testing a move above the daily Tenkan-Sen and Kijun-Sen.

- A breakout above $0.0000077 could generate a +25% gain.

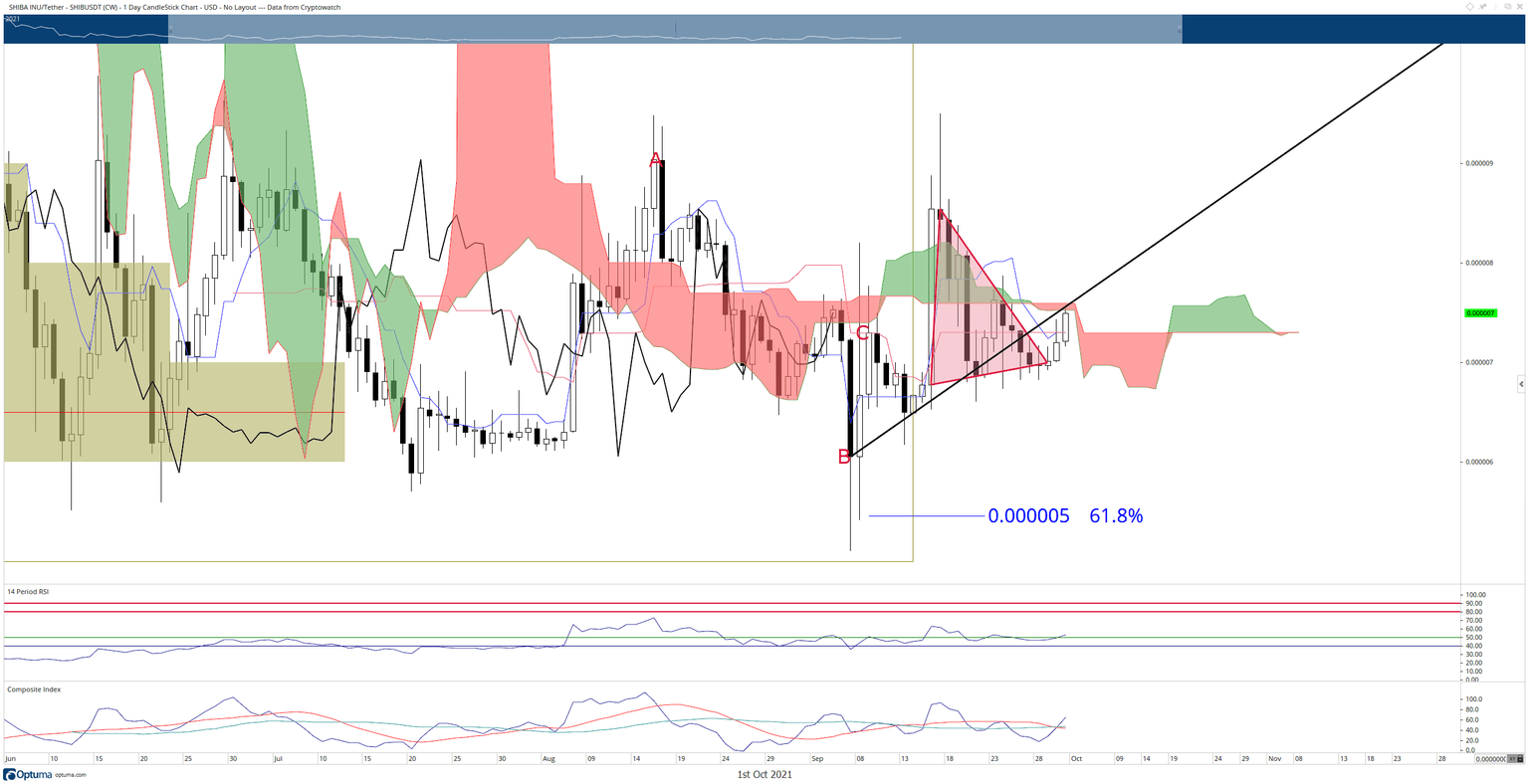

Shiba Inu price has made some positive gains since sliding outside of the bearish pennant formation on Wednesday. It tested a breakout above the Tenakan-Sen for the first time since September 19th and tested the Kijun-Sen. While Thursday’s price action saw Shiba Inu rejected against those two Ichimoku levels, Friday’s present trading conditions show it above both and moving higher.

Shiba Inu price moves higher to test key resistance at $0.0000077

Shiba Inu price has several conditions it must complete to initiate a breakout towards new significant highs. First, it needs to close above the Tenkan-Sen and Kijun-Sen at $0.0000074. Next, it will need to close above $0.0000077. $0.0000077 represents three critical resistance levels: a prior uptrend angle, Senkou Span A and Senkou Span B. A close above those resistance zones could propel Shiba Inu towards $0.000009

The Relative Strength Index and Composite Index show favorable conditions to any bullish breakout having significant and sustainable momentum. The Relative Strength Index has flattened out considerably while, most importantly, the Composite Index has crossed above both of its moving averages near the zero line. There is some danger that hidden bearish divergence may develop on one or both oscillators, but where Shiba Inu price closes will determine whether that divergence will be a concern.

SHIB/USDT Daily Ichimoku Chart

The current setup on the daily candlestick chart for Dogecoin killer Shiba Inu price is very tricky to forecast. The overall threat remains to the downside, but the current setup could very easily and very quickly turn bullish. However, any rejection against the Cloud and trendline or a close below the Kijun-Sen and Tenkan-Sen would confirm a bull trap and invalidate any bullish forecast.

Like this article? Help us with some feedback by answering this survey:

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.