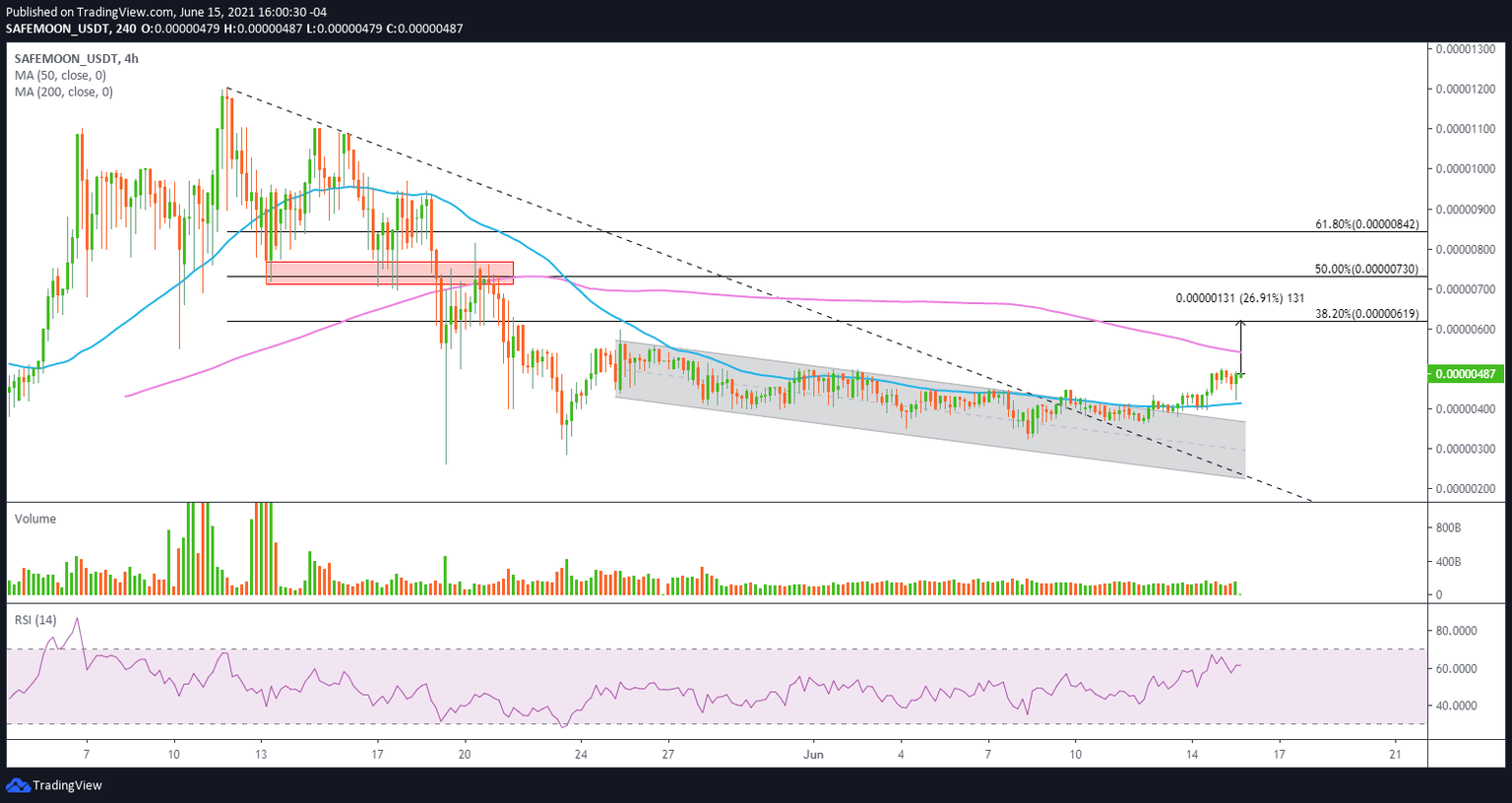

SafeMoon Price Prediction: SAFEMOON defeats critical resistance, targets 25% rally

- SafeMoon price shatters the dominant descending channel with a 13% gain.

- SAFEMOON 50 four-hour simple moving average (SMA) has now turned higher, bringing instant support.

- Important Fibonacci retracement levels of the May correction are still a fair distance from the current price.

SafeMoon price was engulfed in a period of indecision as it drifted lower in a multi-week descending channel. The existence of the firm upper channel boundary and the magnet effect of a falling 50 four-hour SMA blocked any directional clues for SAFEMOON. The resounding break with the channel and magnet effect has positioned the rookie cryptocurrency to entertain a rally to the 200 four-hour SMA and beyond.

SafeMoon price enlightens a new outlook

Over the last few weeks, blockchain security firms, Hashex and Pera Finance have revealed significant vulnerabilities in the SafeMoon digital infrastructure that could lead to third-part intrusions and cost investors millions.

SafeMoon did acknowledge the vulnerabilities, and they stated a hard fork in the future is needed to solve the problems. Nevertheless, the news is a fresh warning sign to retail investors that they should seek to understand the underlying technologies of new cryptocurrency projects before deciding to allocate capital.

The bearish news seems to have been silenced by the CEO’s recent announcement that the project is involved in the Dogecoin and SpaceX partnership, as SafeMoon price staged a successful breakout from the descending channel, logging a 27% gain at today’s high. The resulting turn higher in the 50 four-hour SMA, now at $0.00000413, provides some magnitude of downside stability as the SAFEMOON rally steers higher.

SAFEMOON investors could use pullbacks to the 50 four-hour SMA to initiate positions for a rally to the declining 200 four-hour SMA at $0.00000543, delivering a 30% gain. If patience is not abundant, a rally to the 200 four-hour SMA from the current price will yield a 12% return.

A strong bid could propel SafeMoon price to the 38.2% Fibonacci retracement of the May correction at $0.00000619, generating a 27% profit from the current price. The four-hour Relative Strength Index (RSI) supports such upside before it would trigger an overbought reading.

If the cryptocurrency complex environment improves, FOMO may drive SAFEMOON to the 50% retracement at $0.00000730. It is a level that will be a challenge due to the price congestion associated with the May 13-20 period.

SAFEMOON investors should apply trailing stops during the advance, but not too tight as the altcoin does experience wide percentage shifts on intra-day charts. Trailing stops would be best used with a specific time close, such as a one-hour or four-hour close.

SAFEMOON/USDT 4-hour chart

On the flip side, if SafeMoon price cannot maintain support at the 50 four-hour SMA at $0.00000413 on a pullback, SAFEMOON will be vulnerable to test the June 8 low at $0.00000326.

Investing in the cryptocurrency market carries significant risks, and the recent revealing of security vulnerabilities in the SafeMoon infrastructure amply those risks. Nevertheless, SafeMoon price has taken the first step towards a new advance, but it still needs to prove itself before speculators can make grandiose projections.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.