SafeMoon presents massive buying opportunity before 80% breakout

- SafeMoon price was obliterated during Saturday’s flash crash.

- New-all time lows halted further downside momentum.

- Enormous Ichimoku and price gaps have created fantastic buying opportunities.

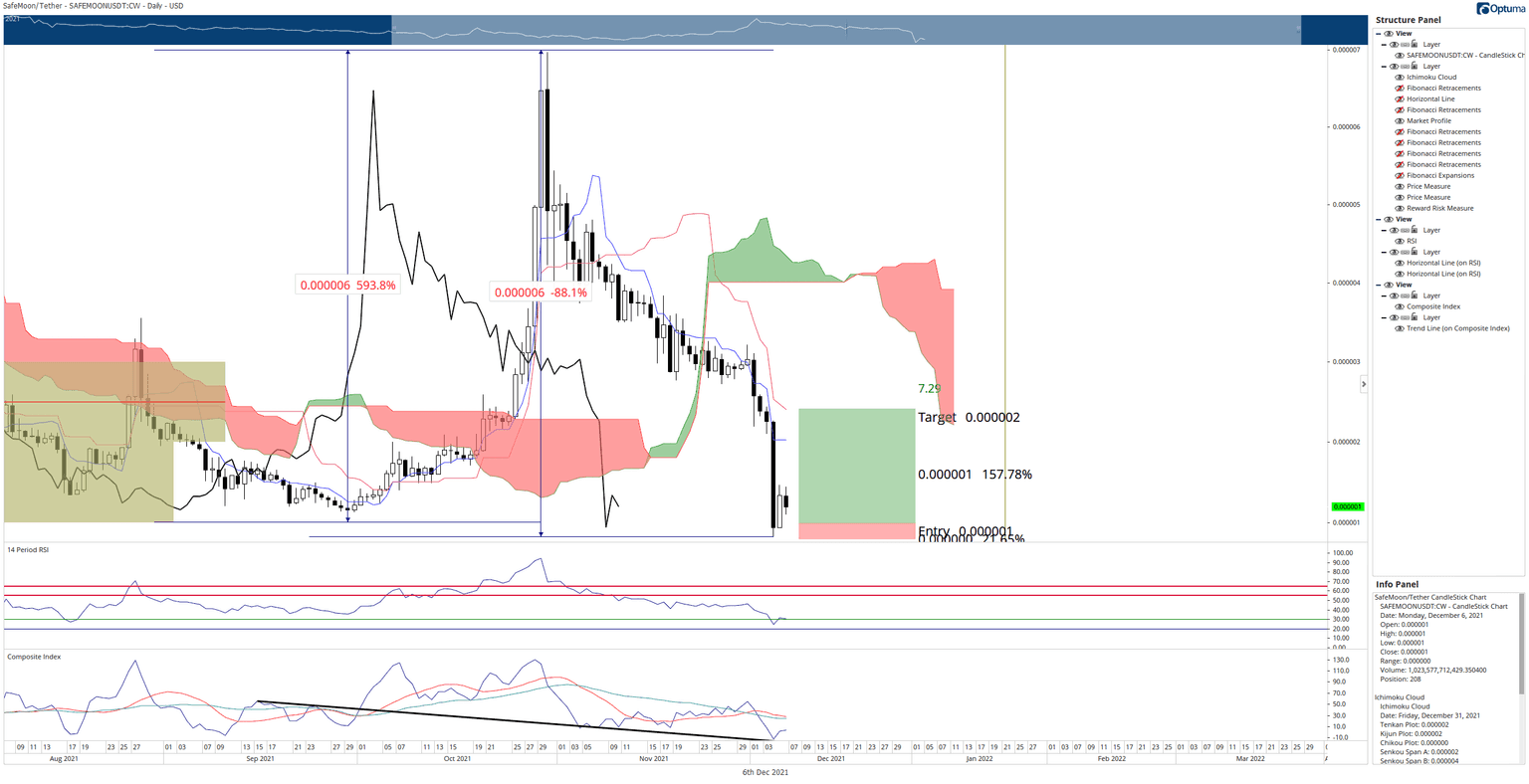

SafeMoon price, one of the most outstanding performers of 2021, is now one of the biggest pump and dump examples of 2021. After rising nearly 600% between September 29th and October 29th, SafeMoon crashed more than 88% to create a new all-time low on December 4th

SafeMoon price trade setup is the definition of low risk, high reward

SafeMoon price has a fantastic trade setup on its daily chart. The hypothetical long entry is a buy stop order between $0.0000010 and $0.0000014, with a stop-loss order at $0.00000090 and a profit target at $0.0000022. The projected profit target is the daily Kijun-Sen, but some conservative traders would likely consider the Tenkan-Sen at $0.0000020 as a more appropriate exit to protect profit.

The positive expectancy ratio of the hypothetical long trade is increased due to SafeMoon’s oscillators. The Composite Index is trading at all-time lows, indicating a likely market bottom. That market bottom is probably confirmed by the Relative Strength Index finding support between the two oversold levels in a bear market, 30 and 20.

It is very likely that, due to the massive sell-off on Saturday, many current SafeMoon bulls and future buyers will wait to see if there is any further downside momentum. A short period of consolidation near the $0.0000010 value area would be perfectly appropriate and expected.

SafeMoon/USDT Daily Ichimoku Chart

The hypothetical long entry will be invalid if SafeMoon price makes a new low near the $0.00000080 price levels. If that occurs, any further speculators could likely abandon SafeMoon in the long term.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.