Ripple's XRP eyes 45% rally as SEC may not follow through with appeal after Gensler's resignation

- Ripple sees another ETP debut in Europe following the launch of WisdomTree Physical XRP ETP.

- SEC Chair's upcoming resignation on January 20 suggests the agency may not appeal against Judge Torres's ruling.

- XRP open interest rises to new all-time high as the remittance-based token eyes a 45% rally to $1.96.

Ripple's XRP trades near $1.18, posting a 10% gain on Thursday following reports of Securities & Exchange Commission (SEC) Chair Gary Gensler's upcoming resignation and the launch of WisdomTree Physical XRP ETP in Europe. Meanwhile, the remittance-based token is eyeing a 45% rally after its open interest surged to a new all-time high.

XRP ETP, SEC Chair resignation and open interest surge

Asset manager WisdomTree announced that it launched a physical XRP exchange-traded product (ETP) in Europe on Thursday. The WisdomTree Physical XRP ETP (XRPW) will offer investors exposure to the spot price of XRP.

The asset manager claimed that the product is the lowest-cost XRP ETP in Europe and is 100% physically backed by the underlying product, secured in cold storage.

The announcement also highlighted that XRPW is already listed across exchanges Börse Xetra, SIX Swiss Exchange and Euronext Paris and Amsterdam.

We’re excited to announce the launch of the WisdomTree Physical XRP ETP, now listed on Börse Xetra, SIX Swiss Exchange, and Euronext Paris and Amsterdam.

— WisdomTree in Europe (@WisdomTreeEU) November 21, 2024

The WisdomTree Physical XRP ETP offers a simple, secure, and low-cost way to gain exposure to XRP, one of the largest… pic.twitter.com/30VAQVau8t

With the launch in Europe, many crypto community members anticipate the equivalent XRP ETF products will launch in the US.

The renewed interest comes after SEC Chair Gary Gensler announced that he would be stepping down from his role in the agency on January 20.

This Thanksgiving, I'm thankful for... https://t.co/FHDPaRnRkU

— Brad Garlinghouse (@bgarlinghouse) November 21, 2024

Gensler's administration played a crucial role in the SEC vs. Ripple case, which lasted for over four years before Judge Analisa Torres ruled that XRP sales to retail investors via exchanges don't constitute securities.

The Judge also fined Ripple $125 million for its institutional XRP sales — far less than the $2 billion penalty the SEC had requested.

While the SEC had stated intentions of filing an appeal, it's unlikely they'll tread down that path with Gensler departing the agency and President-elect Donald Trump promising a pro-crypto approach toward the digital asset industry.

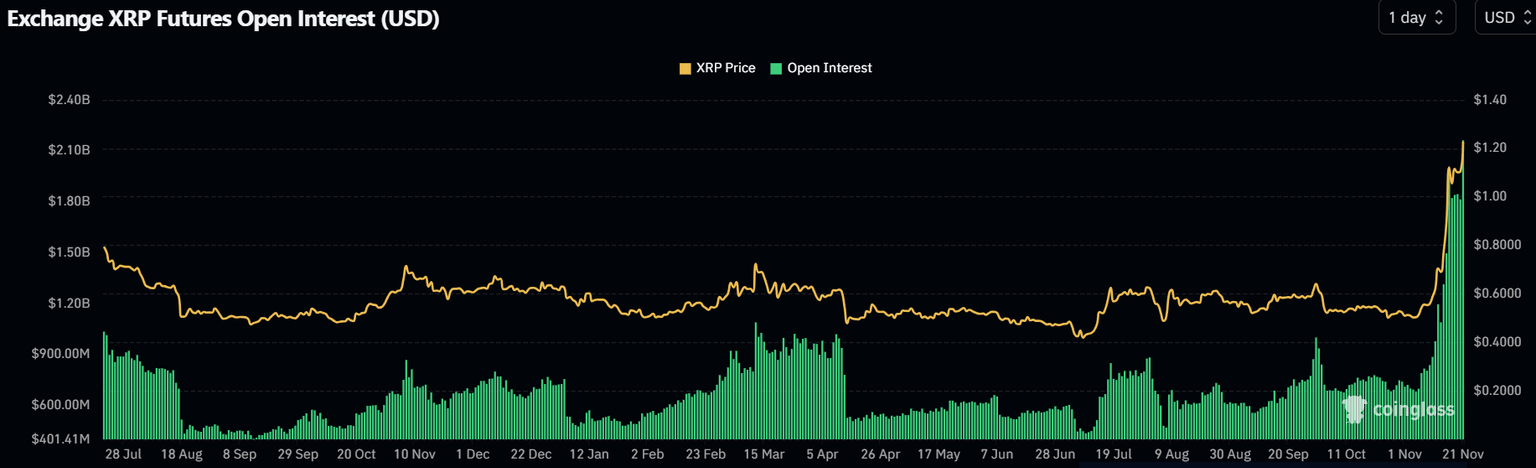

Meanwhile, XRP's futures open interest reached a new all-time high above the $2.1 billion mark on Thursday.

XRP Open Interest | Coinglass

Open interest (OI) is the total number of outstanding contracts in a derivatives market. The rising OI indicates strengthened bullish momentum among XRP futures traders.

XRP eyes a 45% rally to $1.96

XRP is up 10% after sustaining $13.8 million in liquidations, with liquidated long and short positions accounting for $8.63 million and $5.17 million, respectively.

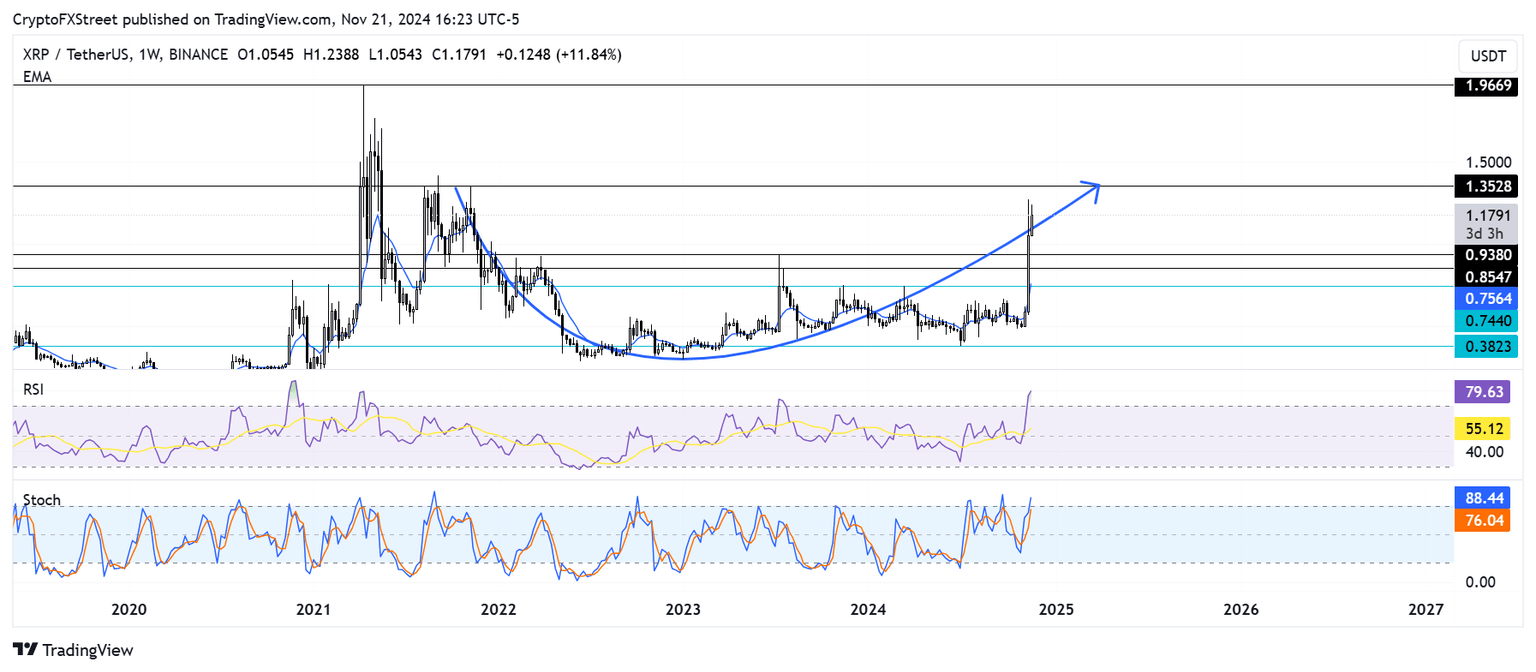

The remittance-based token is looking to complete a rounded bottom pattern as it approaches its three-year resistance near $1.35.

XRP/USDT weekly chart

A high volume move above $1.35 could see XRP rally over 45% to $1.96.

The Relative Strength Index (RSI) and Stochastic Oscillator indicators are in their oversold regions, indicating XRP may see a correction soon.

A weekly candlestick close below $0.74 will invalidate the bullish thesis.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi