Ripple whales dump 100 million XRP as XRP price suffers the waning bullishness of SEC lawsuit win

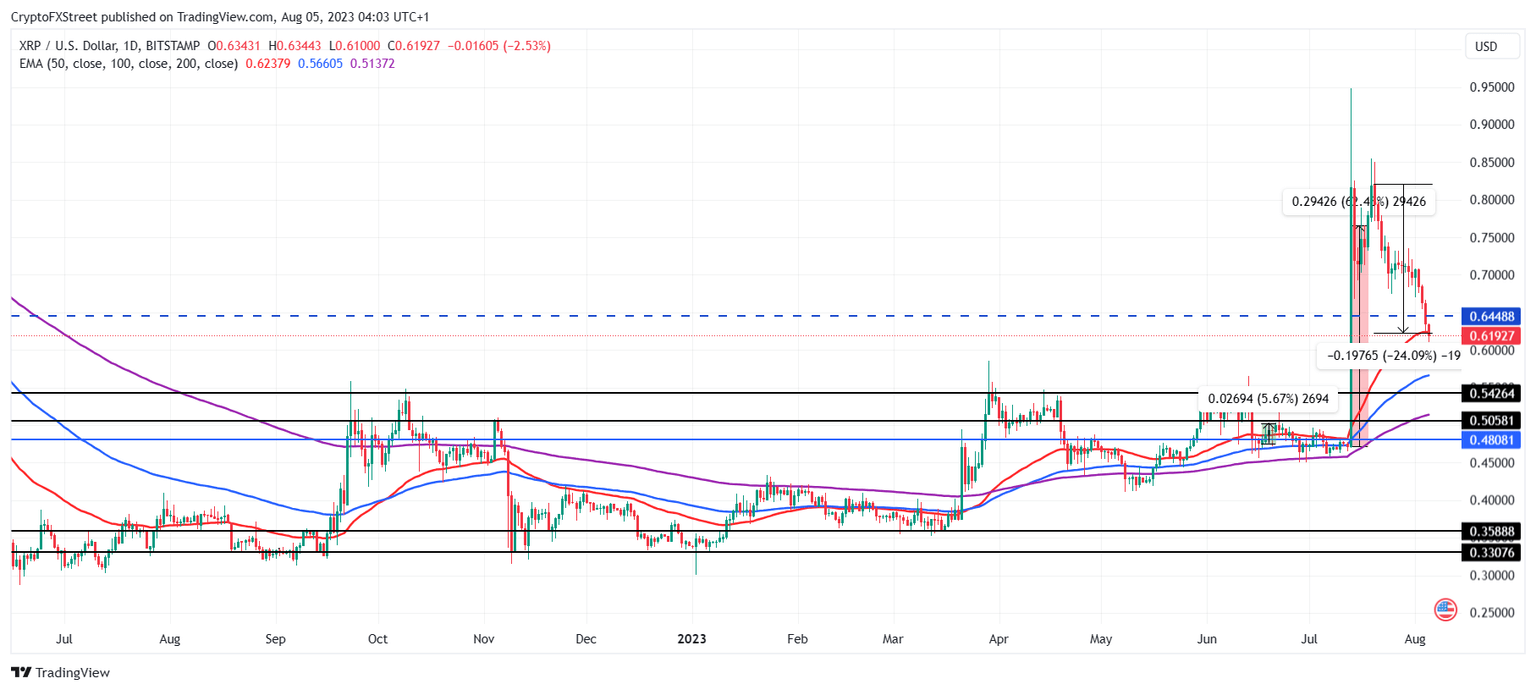

- XRP price has declined by almost 25% in the span of two weeks after marking 2023 highs of $0.85 last month.

- Whale addresses holding 100,000 to 1 million XRP have sold more than 100 million XRP in the same duration to take profits.

- This profit-taking might come to a stop now and reignite accumulation amongst investors as the altcoin is currently in the “opportunity zone” as per the MVRV ratio.

XRP price made a historic rally after securing a partial win last month, but that bullishness now seems to be going away. The cryptocurrency has lost a significant chunk of the recent gains as whales shifted from HODLing to profit-taking. But the altcoin still has a shot to minimize the damage before it loses another key support level.

XRP price loses steam due to profit taking

XRP price is currently trading at $0.619, falling by almost 25% in the span of two weeks after marking 2023 highs of $0.85 in July. The year-to-date high was achieved following a 73% rally in the span of a week after Judge Torres granted Ripple a partial win in the SEC lawsuit.

XRP/USD 1-day chart

This triggered whales and large wallet holders to make the most of the situation finally, and the investors began dumping their holdings to take profits. Between July 19 and the time of writing, the supply of addresses holding 100,000 XRP to 1 million XRP declined from 6.85 billion XRP to 6.75 billion XRP.

XRP whale holding

This 100 million XRP is worth about $61.8 million and could have been a catalyst in the decline observed recently. Furthermore, the ruling that propelled XRP price last month is also feared to be reversed since Judge Torres only granted XRP the label of “not a security” in the case of public sales and not institutional sales.

Regardless, the concern surrounding the same could lead to some pullback from investors in the market which would prove to be good for XRP price. The Market Value to Realized Value (MVRV) ratio can be seen lurking around -12% below the threshold for the opportunity zone.

XRP MVRV ratio

MVRV is a measure of the overall profit/loss of investors, and the opportunity zone represents a shift from selling to potential accumulation from investors. In the case of XRP, this area lies below the -10% mark and suggests a recovery in XRP price provided it still stands above the key support level of the 50-day Exponential Moving Average (EMA).

SEC vs Ripple lawsuit FAQs

Is XRP a security?

It depends on the transaction, according to a court ruling released on July 14:

For institutional investors or over-the-counter sales, XRP is a security.

For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

How does the ruling affect Ripple in its legal battle against the SEC?

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token.

While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and will need to keep litigating over the around $729 million it received under written contracts.

What are the implications of the ruling for the overall crypto industry?

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at.

Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say.

Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales are likely to persist.

Is the SEC stance toward crypto assets likely to change after the ruling?

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation.

While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

Can the court ruling be overturned?

The court decision is a partial summary judgment. The ruling can be appealed once a final judgment is issued or if the judge allows it before then. The case is in a pretrial phase, in which both Ripple and the SEC still have the chance to settle.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B08.28.25%2C%252005%2520Aug%2C%25202023%5D-638268035375836688.png&w=1536&q=95)

%2520%5B08.24.37%2C%252005%2520Aug%2C%25202023%5D-638268035567141833.png&w=1536&q=95)